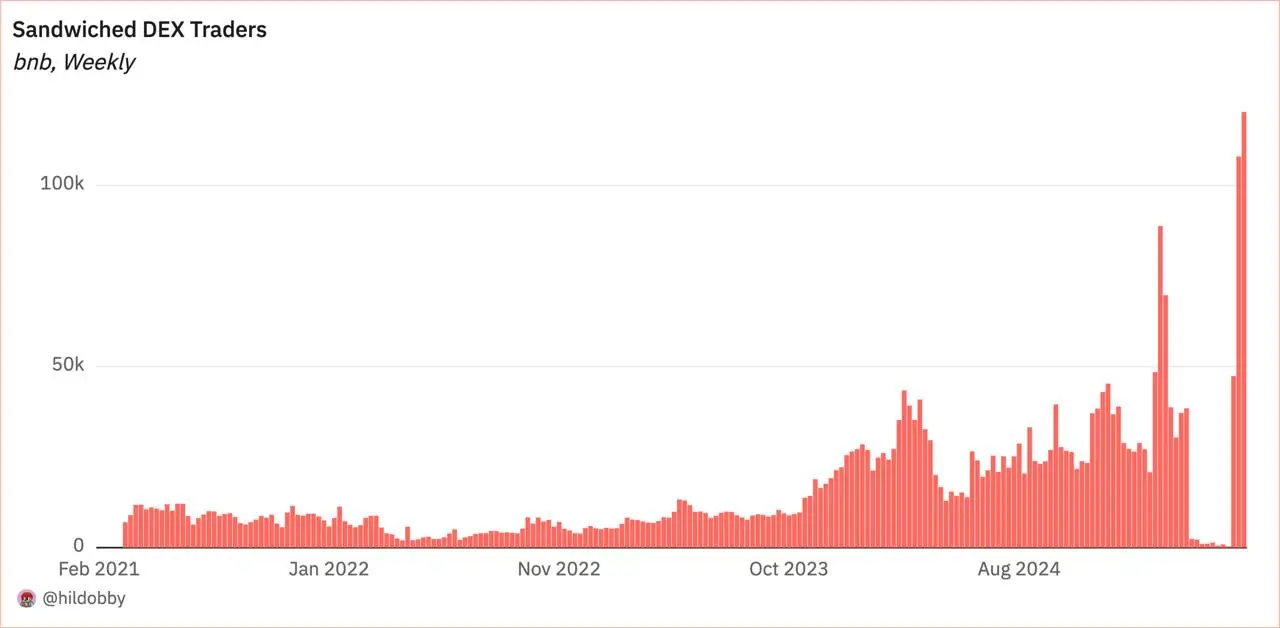

BNB Smart Chain (BSC) has seen a rise in sandwich attacks, with over 120,000 decentralized exchange (DEX) traders affected this week alone. The resurgence coincides with the rise in activity on the network.

According to Dragonfly data analyst Hildobby on X, the network first saw a surge in sandwich attacks around mid-May, and the number has continued to trend upward, particularly over the last week of May and the first week of June. The data shows that the number of sandwich DEX traders has exceeded 100,000 for two consecutive weeks, with trading volume exceeding $1 billion.

Sandwich attacks are a form of on-chain market manipulation where the attackers front-run the victim’s trades by inserting their trades before and after to extract value from the victim’s transaction. The attacker artificially increases the price of a token by placing a buy order before the victim’s trade and then profits from the inflated value by placing a sell order right after the trade.

This issue has long been a major problem for decentralized exchanges, with attackers automating the process using Maximum Extracted Value (MEV) bots. Interestingly, the attack happens due to the inherent nature of the DEX infrastructure.

All submitted transactions go to the memory pool (mempool), which is visible to the public before miners select which transactions to execute. Attackers can manipulate transactions from here by offering higher fees to ensure miners reorder transactions to their advantage.

The issue has long been an issue for BSC, with over a third of blocks on the network containing transactions impacted by the sandwich attacks on December 1, 2024. However, it is not peculiar to BSC, as other networks, such as Ethereum and Solana, also have to deal with it. One address in 2024, Jaredfromsubway.eth, made over $40 million in revenue with $6.3 million in profits in less than three months from sandwich attacks.

BNB Chain tackled sandwich attacks before

However, BNB Chain previously addressed the issue by introducing MEV protection for several wallets earlier this year. At the time, the network said there were three solutions: allowing users to have automatic or manual MEV protection, or even customizing the protection for advanced users.

The automatic protection was available for select wallets, including Trust Wallet, Binance Wallet, OKX Wallet, TokenPocket Wallet, and SafePal, while other wallets could set up the feature manually. This solution appeared to have worked earlier, with sandwich attacks dropping significantly between late March and early May 2025. However, it appeared to have picked up again.

Interestingly, the resurgence coincides with the increase in DEX transactions on BSC, with the network recording massive transaction volume. Dune data shows that the network recorded 69 million transactions in the first week of June, while the last week of May saw 58.45 million transactions.

Interestingly, the impact of recent sandwich attacks is minimal, as they have affected only a small percentage of transactions within these two weeks. In the first week of June, over 776,000 transactions were sandwiched, while around 207,000 transactions were sandwich attacks. In the week before, total sandwich-related transactions were only around 1 million.

Even more surprisingly, the number of sandwich bots on BSC has declined to less than 300 on average weekly since early April. This represents a major drop from the almost 9,000 sandwich bots in mid-February.

BSC sees soaring transaction volume driven

Meanwhile, the surge in BSC transaction volume is due to the Binance Alpha program introduced on May 20. The initiative, which spotlights early-stage Web3 projects for users to access tokens and airdrops, has driven tons of new users to the network, causing its DEX volume to soar.

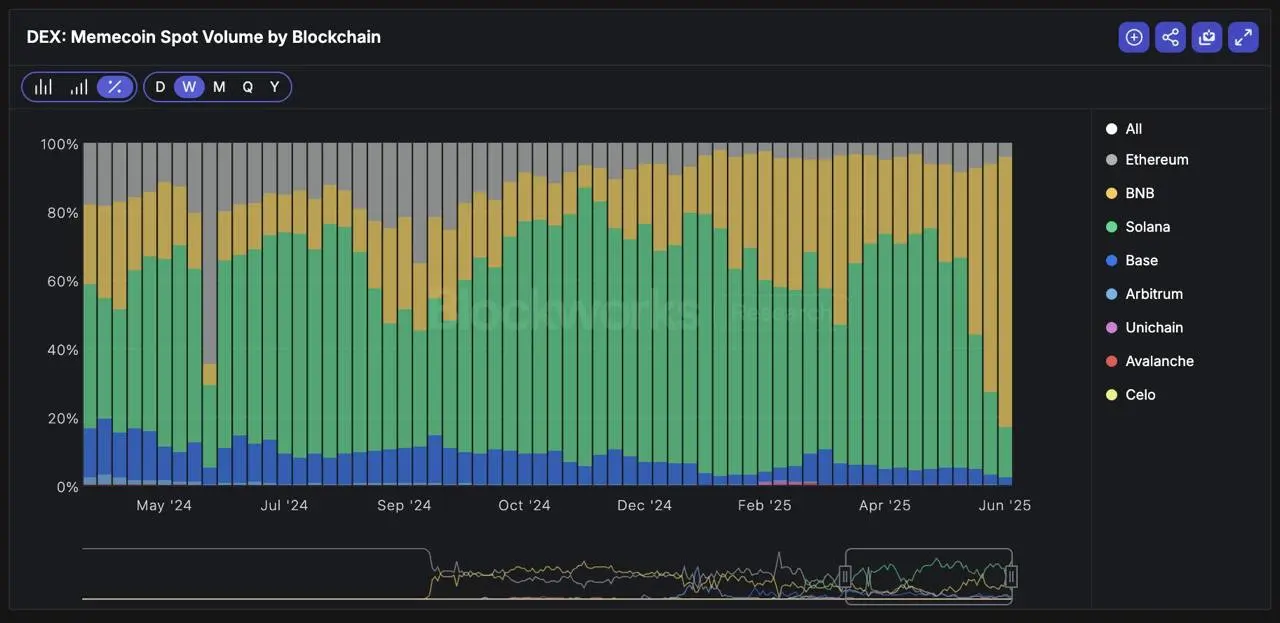

According to Defillama, BSC has been the leading network for DEX volume over the last 30 days, with $147.18 billion, far above Solana, which is in second place with $79.31 billion. The network is also leading in daily volume with $3.63 billion.

Interestingly, it has also flipped Solana in memecoin trading volume, showing how massively impactful the program has been. However, many observers believe the trading volume is inflated due to wash trading as users try to farm points through the Binance Alpha initiative.

cryptopolitan.com

cryptopolitan.com