-

OpenSea, a leading $NFT marketplace, is advocating for clear regulatory definitions, asserting that platforms like theirs should not be categorized as securities exchanges.

-

The request follows the recent decision by the SEC to halt investigations into OpenSea, indicating a potential shift in regulatory attitudes towards digital asset marketplaces.

-

OpenSea’s general counsel emphasized that categorizing $NFT marketplaces as securities exchanges would constitute “regulatory overreach,” disrupting the unique nature of digital transactions.

OpenSea urges U.S. regulators to clarify $NFT marketplace classifications, asserting they don’t qualify as securities exchanges, amidst changing regulatory landscapes.

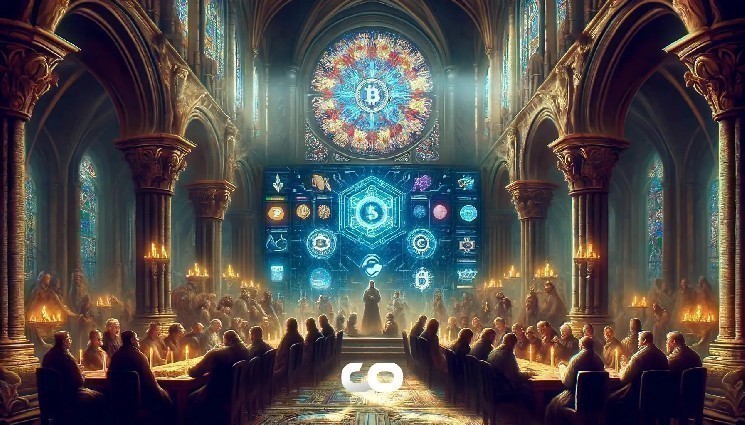

OpenSea Advocates for Regulatory Clarity in $NFT Marketplaces

OpenSea, often termed a digital bazaar, is taking proactive measures to delineate the regulatory boundaries that govern non-fungible token ($NFT) marketplaces. In a formal letter to SEC Commissioner Hester Peirce, OpenSea’s legal team argues that their platform—and others like it—should be expressly recognized as distinct from securities exchanges or brokers.

The desire for clarity comes in the wake of the SEC’s decision to abandon investigations into potential violations of federal securities laws associated with OpenSea. The general counsel, Adele Faure, alongside deputy counsel Laura Brookover, highlighted that narrating $NFT platforms within typical exchange regulations would disrupt the burgeoning and dynamic nature of the cryptocurrency landscape.

Understanding OpenSea’s Operational Model

One of the core arguments presented by OpenSea revolves around its operational framework. The company insists it does not conduct transactions nor operate as an intermediary in the traditional sense. Rather, it facilitates a marketplace where users can freely exchange NFTs, describing itself as a “digital bazaar”. This classification stands in contrast to how exchanges are defined under current U.S. securities regulations.

In their letter to regulators, Faure and Brookover elaborated that OpenSea does not provide investment advice, negotiate on behalf of users, or even manage customer assets. By positioning itself outside the bounds of traditional finance, OpenSea aims to reinforce the notion that $NFT transactions should not be subjected to the same scrutiny as those on conventional trading platforms.

theblock.co

theblock.co

cointelegraph.com

cointelegraph.com

decrypt.co

decrypt.co