Several local mining experts agree that there is sufficient gas in the country to establish a mobile fleet of bitcoin miners directly adjacent to oil extraction operations. Estimates set the gas lost to flaring operations in the country at 13,000 cubic meters, which could be used to power bitcoin mining farms.

Venezuela Might Become a Bitcoin Gas Mining Powerhouse

With the recent opening of Venezuela’s oil industry, speculation has surged about the use of flared gas to power bitcoin mining facilities in the country.

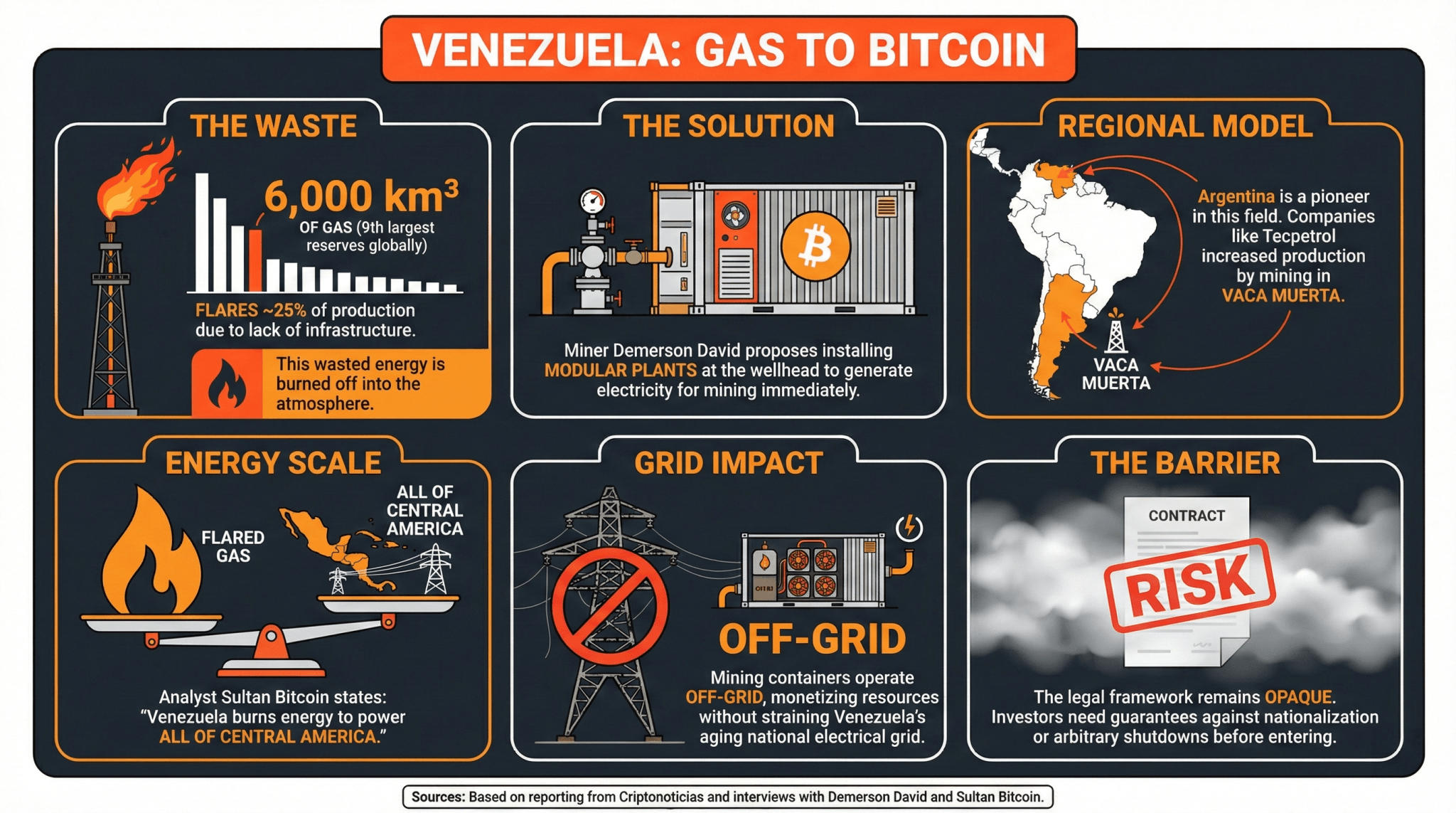

While the country has 6,000 cubic kilometers of gas, the ninth nation with the most proven reserves in the world has to flare much of it to the atmosphere due to the unfeasibility of exploiting it. Estimates put this number at nearly to 25% of Venezuela’s gas production.

Demerson David, a local bitcoin miner, told Criptonoticias that using this gas to mine bitcoin was not only possible but a strategic opportunity for the nation to take advantage of resources that would be wasted otherwise.

He stated:

“Following models like those in Argentina, we could install modular plants at the wellhead to generate electricity immediately, injecting direct capital into the national economy.”

Argentina has been a pioneer in this field in Latam, with companies like Tecpetrol reporting production increases after implementing crypto mining operations in oil fields located in Vaca Muerta, a formation with over 126 million tonnes of crude.

Sultan Bitcoin, a Venezuelan bitcoin analyst, stated that Venezuela burns energy to power all of Central America, and that bitcoin mining might provide a way to monetize these resources while infrastructure to process and transport this gas is built.

He assessed:

“The great thing about Bitcoin mining is that it allows us to install containers with the mining equipment right there in the industrial zone, without the need to build very long transmission lines immediately.”

This would bring these activities off-grid, avoiding straining the aging local grid and affecting Venezuelans directly. Nonetheless, he acknowledges that conditions must evolve to allow this kind of investment.

“The current legal framework is opaque. An international investor needs guarantees that their equipment will not be nationalized or shut down arbitrarily,” he concluded.

Read more: Tecpetrol Raises Crude Oil Production Fivefold With Crypto Mining In Argentina

FAQ

-

What recent developments are driving speculation about bitcoin mining in Venezuela?

The opening of Venezuela’s oil industry has sparked interest in utilizing flared gas for bitcoin mining facilities, given the country’s substantial gas reserves. -

How much gas is being flared in Venezuela, and what does this imply?

Venezuela flares nearly 25% of its gas production due to logistical challenges, indicating a significant resource that could be harnessed for energy. -

What opportunities do local miners see in utilizing flared gas for bitcoin mining?

Local miners believe utilizing flared gas for bitcoin mining could create a strategic economic opportunity by generating electricity directly at the wellhead. -

What challenges must be addressed for bitcoin mining to succeed in Venezuela?

Analysts emphasize that a clearer legal framework is necessary to ensure international investors are protected from the risk of equipment nationalization or arbitrary shutdowns.

cryptonews.net

cryptonews.net

bitcoinworld.co.in

bitcoinworld.co.in

coindesk.com

coindesk.com

coinedition.com

coinedition.com