Several US-based Bitcoin (BTC) mining pools have curtailed operations in response to extreme winter weather that strained electricity grids across the country.

The reductions came as an Arctic cold snap brought subfreezing temperatures across large parts of the United States.

Arctic Weather Triggers Sharp Bitcoin Hashrate Pullback

According to TheMinerMag, 2 major Bitcoin mining pools serving North America collectively cut over 110 exahashes per second (EH/s) of hashrate in late January 2026.

Foundry USA, the world’s largest Bitcoin mining pool, saw a sharp drop in hashrate. It fell from nearly 340 EH/s to around 242 EH/s late last week.

Luxor also recorded a decline, with its hashrate sliding from roughly 45 EH/s to 26 EH/s. Smaller pullbacks were observed at Antpool and Binance Pool as well. These figures have since fallen further.

“Bitcoin hashrate on FoundryUSA alone is down by nearly 200 EH/s, or 60%, since Friday amid continued curtailment. Temporary block production has slowed down to 12 minutes,” TheMinerMag wrote.

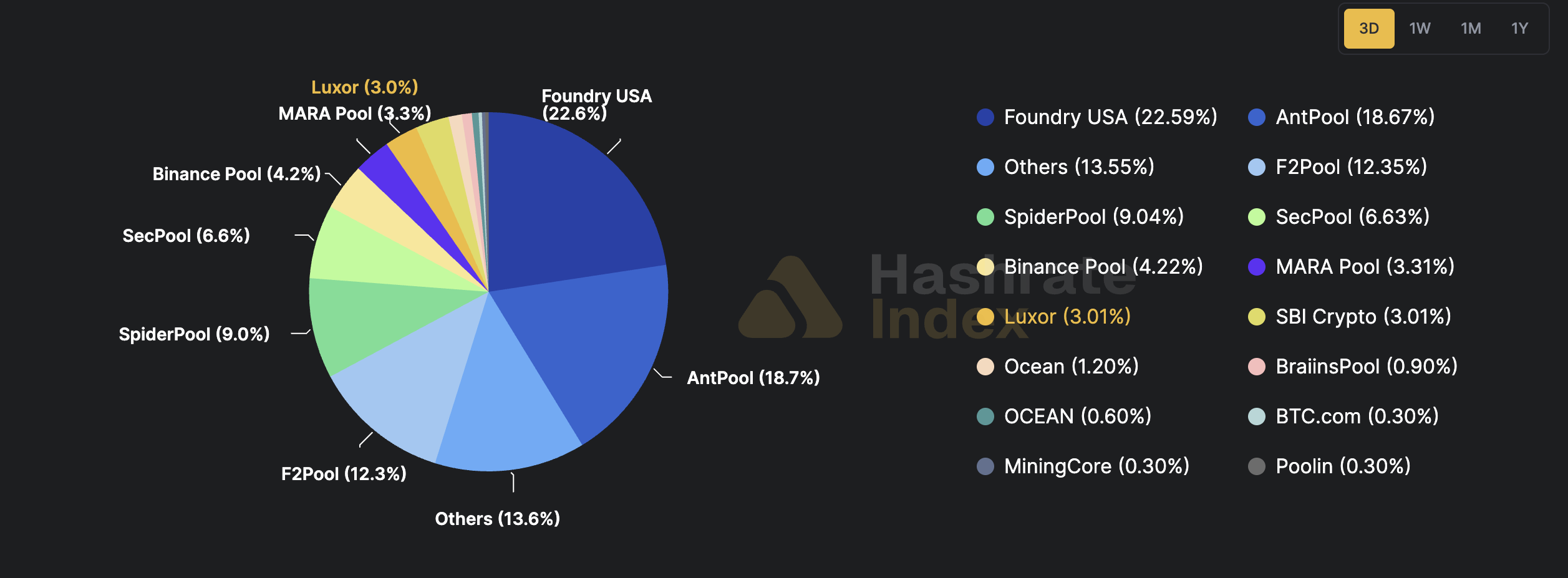

Data from the Hashrate Index shows that Foundry still controls approximately 163.5 EH/s of hashing power. It accounts for about 22.59% of the total Bitcoin network hashrate. Luxor’s share stands at 3.01%, with its hashrate falling to roughly 21.9 EH/s.

The widespread decline in hashrate coincides with a severe Arctic freeze that has brought snow, ice, and extreme cold, sharply increasing heating demand. Power grids in multiple states came under strain, prompting operators to issue conservation requests.

According to the BBC, the winter storm has left at least three people dead and knocked out power to hundreds of thousands of homes. Schools and roads were closed nationwide, and flights were canceled as “life-threatening” conditions stretched from Texas to New England.

In a post on X (formerly Twitter), Matthew Sigel, Head of digital assets research at VanEck, pointed to the role Bitcoin miners can play in easing grid strain during extreme weather events.

“Tragic that 1M+ Americans are without power due to the winter storm impacting the eastern US. Some public bitcoin miners have meaningful capacity in or near affected regions, and several such as CLSK, RIOT, BTDR and others are structurally set up to act as flexible loads via utility demand response programs, including the Tennessee Valley Authority (TVA). We do not yet have confirmation of real time curtailments for this storm, but the model has already proven its value when conditions tighten,” he wrote.

Due to extreme winter storms in the U.S., multiple mining farms across the country have experienced power outages. Bitcoin's total hashrate dropped by approximately 30% in a short period, a decrease of about 260 EH/s. Roughly 1.3 million mining rigs have been shut down as they… pic.twitter.com/75DniLUDh8

— Leon Lyu (@LeonLyuLv) January 26, 2026

The hashrate downturn also comes amid a sustained drawdown in miner reserves. According to CryptoQuant data, Bitcoin miner holdings fell to their lowest level since 2010 in January 2026, highlighting the mounting financial pressure across the sector.

Subdued Bitcoin prices and rising energy costs are squeezing margins, pushing many miners toward unprofitable territory. In response, some operators are reassessing their business models. Bitfarms, for example, has begun reallocating resources toward artificial intelligence and high-performance computing.

Meanwhile, the broader outlook for miners remains challenging. Electricity prices reached a record 18.07 cents per kilowatt-hour in September 2025, up 10.5% since January.

BeInCrypto reported an emergency power auction plan from President Trump’s administration, set to add $15 billion in new generation through tech-backed, long-term contracts.

The plan may offer long-term relief as new capacity comes online, though the benefits will take time to materialize. In the interim, miners must focus on affordable access to power and active participation in demand response to survive.

news.bitcoin.com

news.bitcoin.com

bitcoinworld.co.in

bitcoinworld.co.in