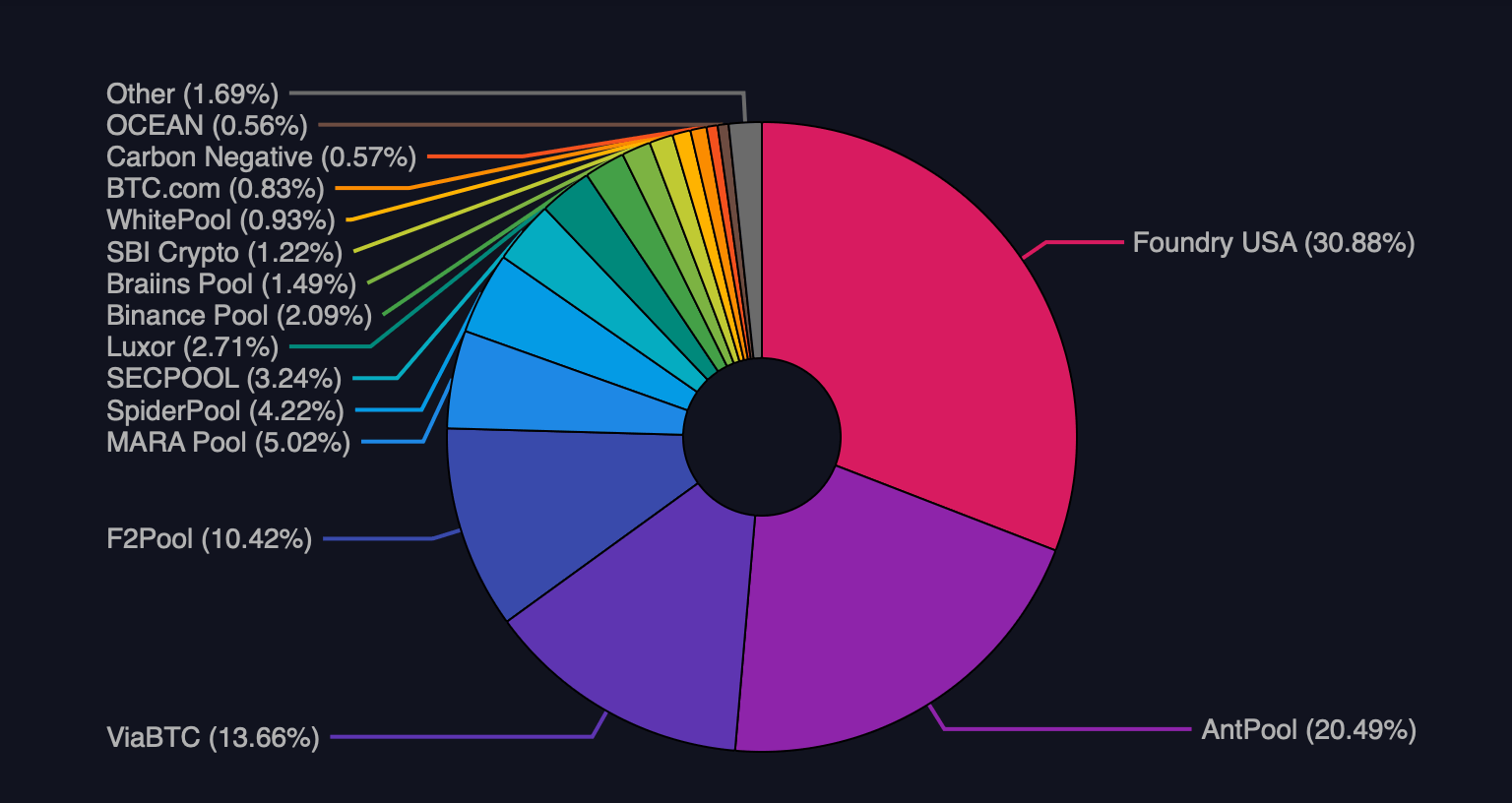

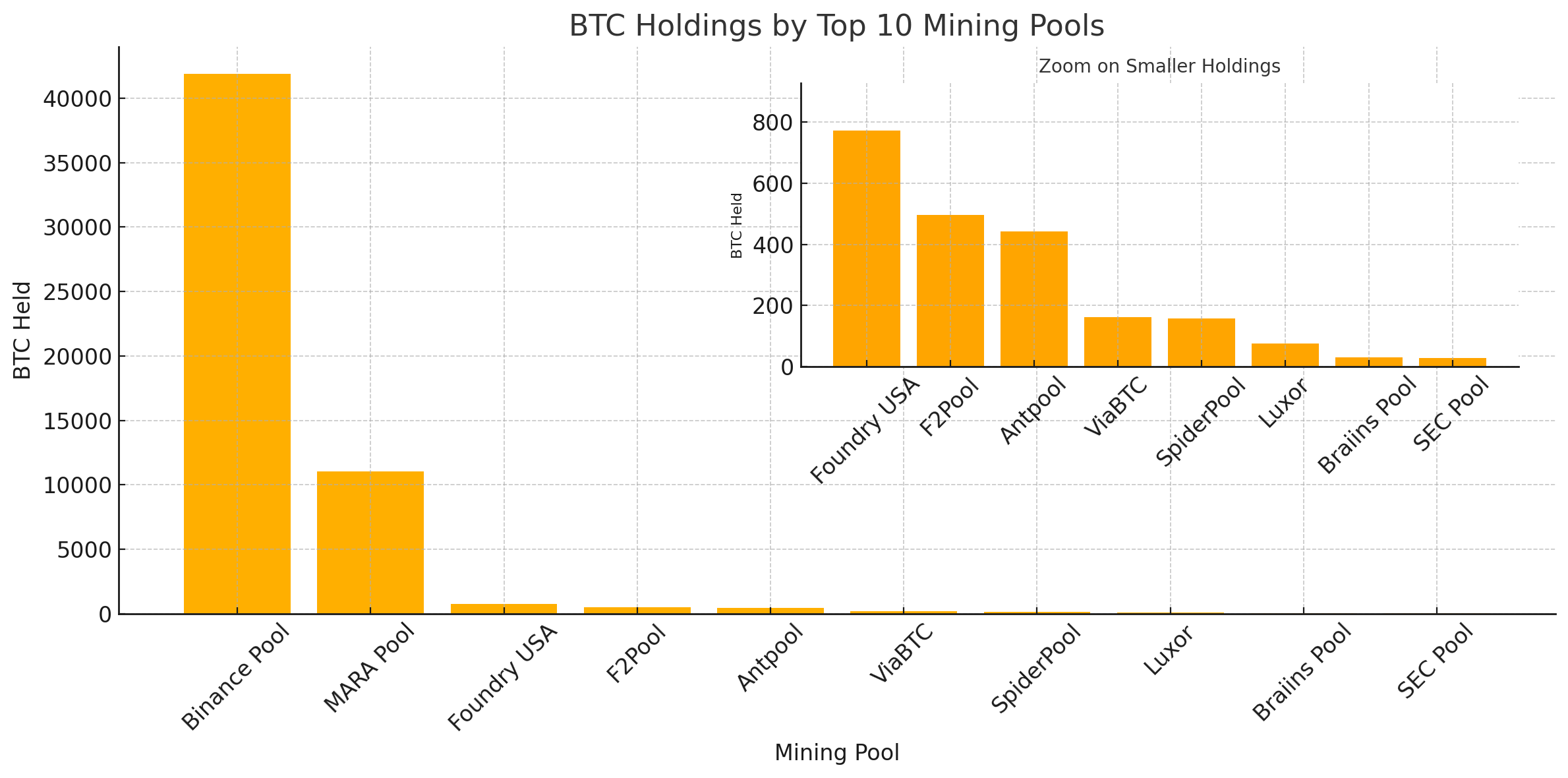

According to the latest onchain stats, Bitcoin’s top ten mining pools currently control a hefty 94.2% of the global hashrate — and they collectively hold $6.52 billion in bitcoin across their wallets.

Inside the Secret Stashes of Bitcoin’s Biggest Mining Pools and Their Counterparties

As of today, the ten biggest mining pools by block production are Foundry, Antpool, ViaBTC, F2pool, MARA Pool, Spider Pool, SEC Pool, Luxor, Binance Pool, and Braiins Pool. Foundry leads the pack with 30.88% of the global hashrate. Onchain data from Arkham Intelligence shows Foundry’s wallets now contain 772.652 BTC valued at $91.2 million — a noticeable dip from the more than 2,000 BTC it held in mid-March 2024.

When it comes to counterparties, Foundry frequently transacts with Coinbase. Antpool ranks second in hashpower, currently managing 20.49% of the global total. As of July 30, Antpool holds 441.839 BTC valued at $52.15 million, with Coinbase also serving as its primary counterparty. ViaBTC comes in third with 13.65% of the global hashrate according to mempool.space stats and the entity maintains 162.086 BTC worth $19.13 million at the time of writing.

ViaBTC works closely with Coinex, which it owns and supports — the two are tightly linked through shared infrastructure and services. On Wednesday, F2pool held 10.42% of the total hashrate, and its wallets contained 495.322 BTC worth $58.46 million. F2pool works with two key counterparties: Coinbase and the custody firm Cobo.

MARA Pool accounts for 5.01% of Bitcoin’s total computing power. The company also functions as a bitcoin treasury, with a sizable 50,000 BTC on its books. MARA’s mining wallets alone hold 11,034 BTC valued at $1.3 billion. Most of this stash is likely safeguarded by NYDIG Custody, and onchain patterns suggest MARA also transacts with Foundry regularly. Spider Pool controls 4.22% of Bitcoin’s total hashpower and holds 157.994 BTC valued at $18.65 million.

Spider pool routinely transacts with Coinbase. Next up is SEC Pool, contributing 3.24% to the network’s hashrate. As of today, SEC Pool’s wallets hold about 28.616 BTC worth $3.38 million. Onchain activity shows SEC Pool interacts with both Cobo and Coinbase — though Coinbase appears to be the more frequent partner. Ranking eighth by hashrate, Luxor Technology operates 2.71% of the network’s power. Currently, Luxor Tech holds 75.278 BTC valued at $8.91 million. Like several others, Luxor also has a regular transaction flow with Coinbase.

Ninth on the list is Binance Pool with a relatively small 2.09% slice of global hashpower. Still, the Binance Pool wallets tracked by Arkham show a staggering 41,919 BTC under management, worth $4.96 billion. Rounding out the top ten is Braiins Pool — the pool formerly known as Slush — with 1.49% of the global hashrate. Braiins’ wallets contain 30.983 BTC, valued at $3.67 million at today’s rates. The top ten bitcoin mining pools collectively hold 55,117.77 BTC as of today, with an estimated total value of $6.52 billion.

The sheer volume of bitcoin held by these top miners highlights their dual role as both infrastructure providers and long-term stakeholders. Their collective stash, worth billions, places them among the protocol’s most influential economic actors beyond just securing the network.

Such concentrated holdings suggest these pools are not merely selling block rewards but accumulating for strategic purposes. Some overtly and some covertly. Whether as treasury reserves, collateral, or institutional leverage, this growing pile of BTC positions miners as powerful players in Bitcoin’s evolving financial ecosystem.

news.bitcoin.com

news.bitcoin.com