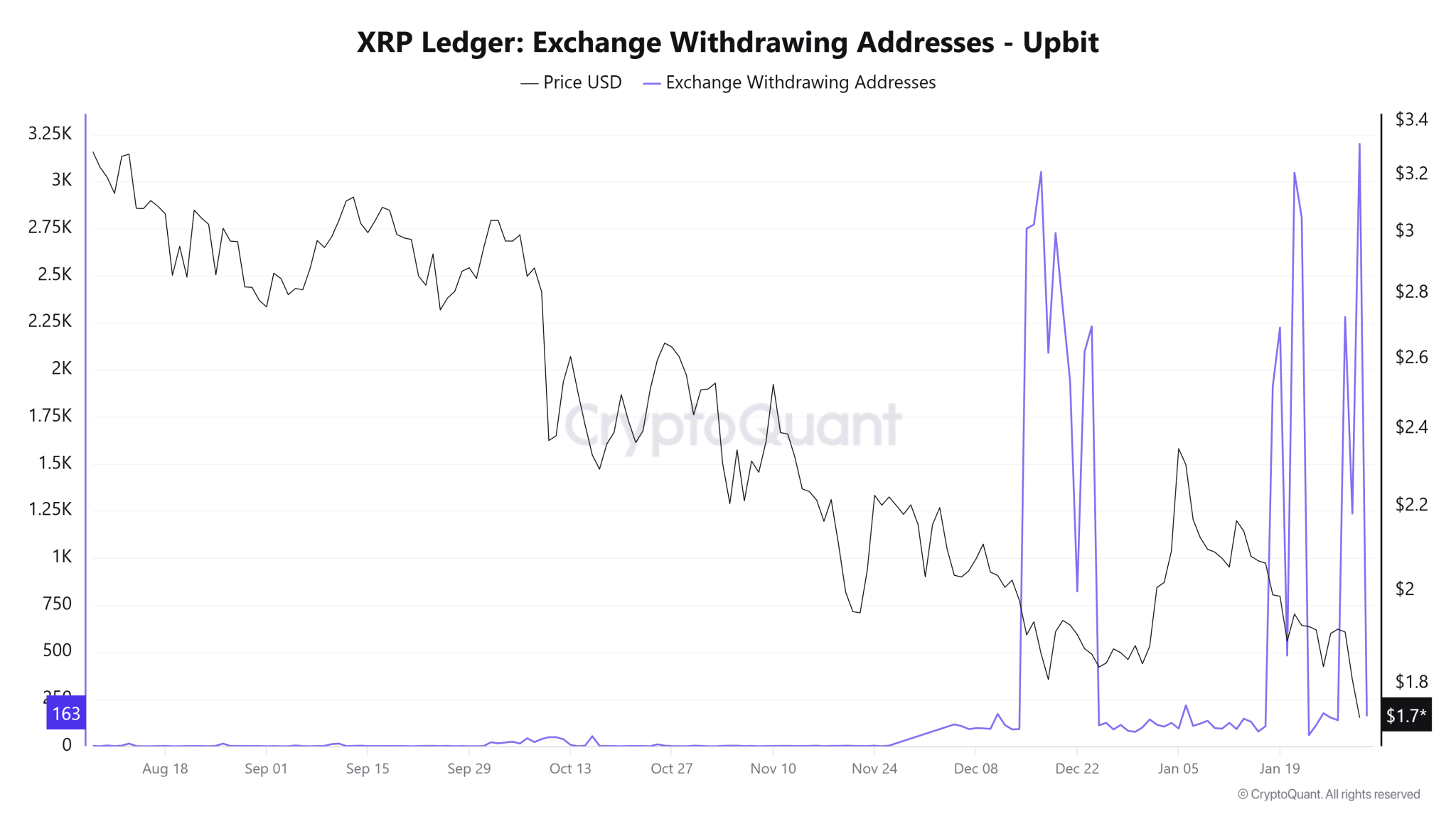

Addresses withdrawing $XRP from the Upbit exchange recently spiked to a new all-time high, indicating that investors are increasingly pulling their assets from exchanges.

This recent pattern comes despite $XRP’s latest price struggles, as it relinquishes the $1.8 and support level amid a broader market risk-off environment. For context, $XRP has continued to witness declines since Jan. 14, when it recovered to $2.2 and met a roadblock. Currently trading for $1.7, $XRP is down 22.7% from the $2.2 high.

While the downturn has persisted, South Korean investors remain unfazed, as evidenced by their increased exchange withdrawals. Specifically, exchange withdrawing addresses on Upbit, Korea’s largest exchange, recently spiked to 3,200, the highest recorded figure.

Key Points

- The $XRP price has continued to struggle since the Jan. 14 high of $2.2, currently down 22.7% to $1.7.

- Despite these struggles, South Korean investors remain unfazed, continuously withdrawing their tokens to cold wallets.

- Recently, exchange withdrawing addresses on Upbit, Korea’s largest exchange, spiked to a new all-time peak of 3,200.

- Investors typically withdraw their tokens from exchanges when they plan to HODL them for long, but this isn’t a definitive signal.

Upbit Exchange Withdrawing Addresses Hit 3,200

Kriptomessi, a pseudonymous market commentator, called the investing public’s attention to this trend in a recent post. Citing the bullish development, the analyst teased a possible “massive $XRP move,” pointing to the potential impact of such withdrawals on the $XRP price.

Notably, data from the accompanying CryptoQuant chart shows that exchange withdrawing addresses in Q4 2025 ranged between 1 and 53 daily amid the downtrend that dominated the market at the time. While withdrawing addresses observed occasional spikes, the daily peak during this period stood at 171.

However, in December, despite the downturn persisting, withdrawing addresses from Upbit saw rapid spikes. The first spike occurred on Dec. 15, 2025, hitting a high of 2,750. By Dec. 17, another spike resulted in a peak of 3,051, a new all-time high at the time.

While more spikes occurred in January 2026, they remained lower than the 3,051 peak until Jan. 30. Specifically, on this day, withdrawing addresses on Upbit hit a new all-time high of 3,200 despite $XRP collapsing below the $1.8 support.

How Could This Impact $XRP?

Kriptomessi called the recent trend a sign that “whales are stacking hard offline.” The market watcher believes $XRP could react with a “massive” move. He charged investors to expect the unexpected.

Daily spikes in $XRP withdrawals suggest that large holders and active traders continue to move tokens off the exchange despite the price struggles. Investors often withdraw assets to hold them in private wallets, which can point to long-term confidence and accumulation during the dip.

Others may move funds to decentralized platforms for staking, liquidity pools, or arbitrage opportunities across exchanges. Whatever the reason, when fewer tokens sit on exchanges, immediate selling pressure can ease, which sometimes helps stabilize the price or set the stage for a rebound.

However, these withdrawals do not always signal bullish intent. Some traders move $XRP to sell on other platforms with better liquidity or to manage risk during volatile periods. In addition, institutions may also reshuffle wallets for security or operational reasons without any plan to hold long-term.

coindesk.com + 2 more

coindesk.com + 2 more

cryptopolitan.com

cryptopolitan.com

protos.com

protos.com