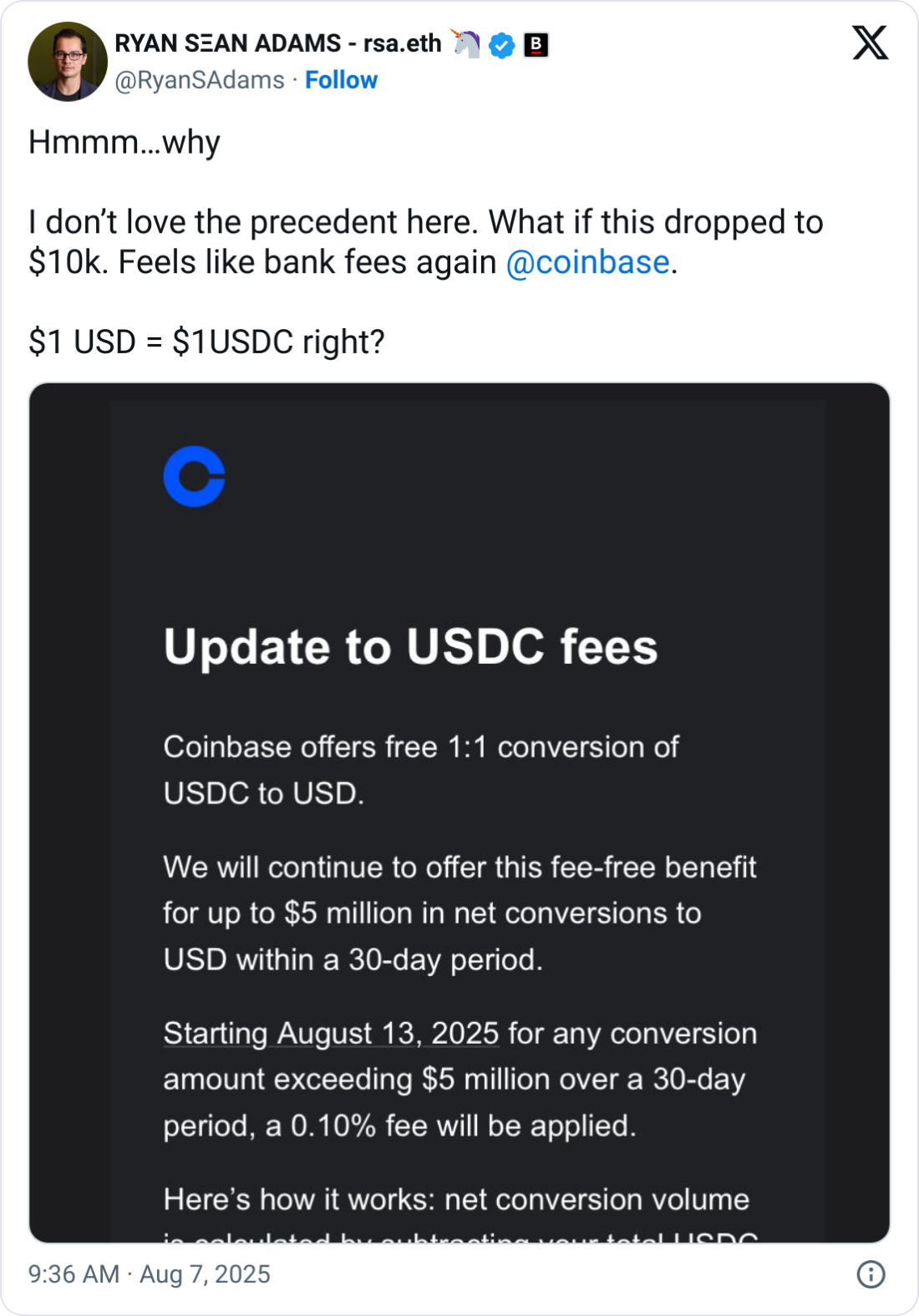

Coinbase will start levying a 0.1% fee for conversions of the stablecoin $USDC to US dollars for net conversions above $5 million within 30 days, as the crypto exchange has recently struggled with its earnings.

Starting Aug. 13, Coinbase will charge the fee on $USDC ($USDC) to US dollar conversions exceeding a net of $5 million on a 30-day rolling period — with the net calculated by deducting $USDC purchases from $USDC sales, according to a notice shared online.

It comes after Coinbase’s second-quarter results, shared last week, missed on revenue and earnings, sending its shares tumbling. However, its stablecoin-related revenue rose 12% year-on-year to $332 million.

It marks two quarters in a row that the company has missed analyst expectations, as its Q1 revenue also came in lower than expected.

Coinbase “running an experiment”

“I don’t love the precedent here,” Bankless co-founder Ryan Sean Adams said in an X post sharing Coinbase’s update. “What if this dropped to $10k. Feels like bank fees again.”

Coinbase’s senior product manager for stablecoins, Will McComb, responded to the post, saying that the exchange is experimenting to understand how fees will impact $USDC conversions.

“We’re running an experiment to better understand how fees impact $USDC off-ramping, especially as some competitors charge higher fees to off-ramp back to fiat,” McComb said.

“Your point about this being a core feature is heard and we’re carefully monitoring all feedback. We’re committed to making sure Coinbase is the best place to use stablecoins.”

Currently, Coinbase does not charge a fee for net conversions of $USDC to USD up to $40 million in a 30-day period. Fees then kick in at 0.05% for net conversions from $40 million to $100 million and scale up to a maximum of 0.2% for conversions over $200 million.

Fees to stamp out Tether to $USDC conversions

Some commentators speculated that the move is likely to cover the costs incurred by the company in managing $USDC, the second-largest stablecoin by volume.

Others, such as crypto influencer Jordan Fish who goes by “Cobie,” said the fee could be to stop the arbitrage of users converting Tether ($USDT) to $USDC to off-ramp into dollars for free, which is reducing the $USDC’s supply.

“Tether has an exit fee, which means the cheapest practical route was to swap $USDT to $USDC and then off-ramp $USDC to USD, which shrinks $USDC supply and maintains $USDT supply. If I were to guess,” he said.

Coinbase CEO Brian Armstrong agreed with Fish’s comment, replying with a simple “yep.”

Tether charges a fee of 0.1% or $1,000, whichever is higher, for converting $USDT with a minimum redemption value of $100,000.

$USDT’s market capitalization is up 20% from the start of the year, while $USDC’s market capitalization is up 47% during the same period, according to DefiLlama.

Bloomberg ETF analyst James Seyffart said that Coinbase is likely incurring a cost, which the company is now passing on.

Related: KakaoBank plans to ‘actively participate’ in stablecoin market: Report

“This feels similar to a create/redeem fees for an ETF. If they actually have to facilitate creating and redeeming $USDC based on one way flow from someone they are [probably] incurring some sort of cost to do that,” Seyffart said.

“My guess is they’re offloading that cost … and then some,” he added.

Coinbase’s earnings miss

The new fees come as Coinbase missed analysts’ revenue estimates for the quarter ended June. The company reported a revenue of $1.5 billion, while analysts were expecting the revenue to range between $1.56 billion and $1.59 billion.

The company’s stock sank 8% after it reported its second-quarter earnings report.

In its report for Q1, Coinbase saw its total revenue drop by 10%, while its net income dropped 95% due to unrealized losses the company reported on its crypto holdings.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

decrypt.co

decrypt.co

coindesk.com + 1 more

coindesk.com + 1 more

protos.com

protos.com