Coinbase is reportedly negotiating to acquire CoinDCX, one of India’s leading cryptocurrency exchanges, according to Wublockchain, citing local Indian media.

CoinDCX previously suffered a $44 million hack but has since recovered. This incident may be one of the reasons the exchange’s valuation has dropped significantly—from its previous peak of $2.2 billion to below $1 billion today.

Coinbase Could Acquire CoinDCX as Valuation Falls Below $1B

This potential acquisition follows CoinDCX’s recovery from a recent hacking incident. According to CoinDCX’s disclosure, CoinDCX suffered a security breach involving unauthorized access to its operational hot wallet. The attack resulted in approximately $44 million in losses from trade liquidity funds. The company immediately contained the incident and delayed the public announcement for 17 hours.

Blockchain sleuth ZachXBT traced the attacker who received 1 ETH via Tornado Cash. Security firm Cyvers detected suspicious withdrawals as funds moved across multiple blockchain addresses.

During CoinDCX’s peak period, the exchange achieved a $2.15 billion valuation after raising $135 million in Series D funding. The company had amassed over 10 million users and was aggressively expanding its workforce from 400 to 1,000 employees. However, the exchange’s valuation has since fallen to below $1 billion following the recent security breach.

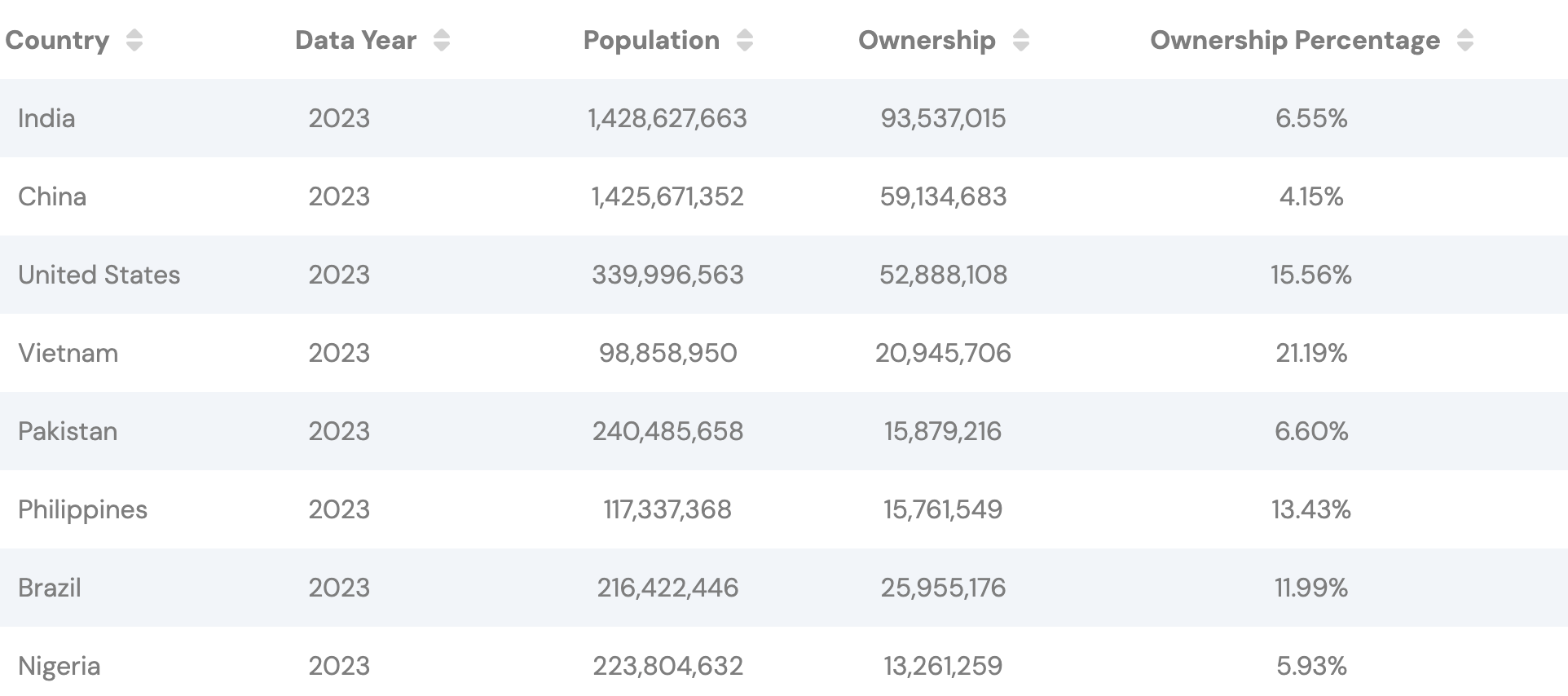

Coinbase’s role as a potential buyer signals its strong interest in the Indian market—one of the fastest-growing regions globally for cryptocurrency adoption. According to data from Triple-A, India ranks among the top countries worldwide, with over 93 million crypto holders.

In March, the leading US exchange secured a license from India’s Financial Intelligence Unit. This move signals its aim to re-enter the market after regulatory hurdles cut short its brief 2022 launch.

CoinDCX ranks 397th among centralized exchanges on CoinMarketCap at the time of reporting. The Indian cryptocurrency exchange recorded a 24-hour spot trading volume of $14 million (equivalent to 119 BTC), while maintaining total assets valued at $160 million.

beincrypto.com

beincrypto.com