Stephen Gandel believes that stablecoins rewards will not endanger the banking system and that estimates of deposit flight are excessive. Nonetheless, he acknowledged that the equity returns of banking institutions might be affected, as banks will be forced to pay higher interest rates.

Analyst: Bank’s Stablecoin Reward-Tied Deposit Flight Numbers Are Flawed

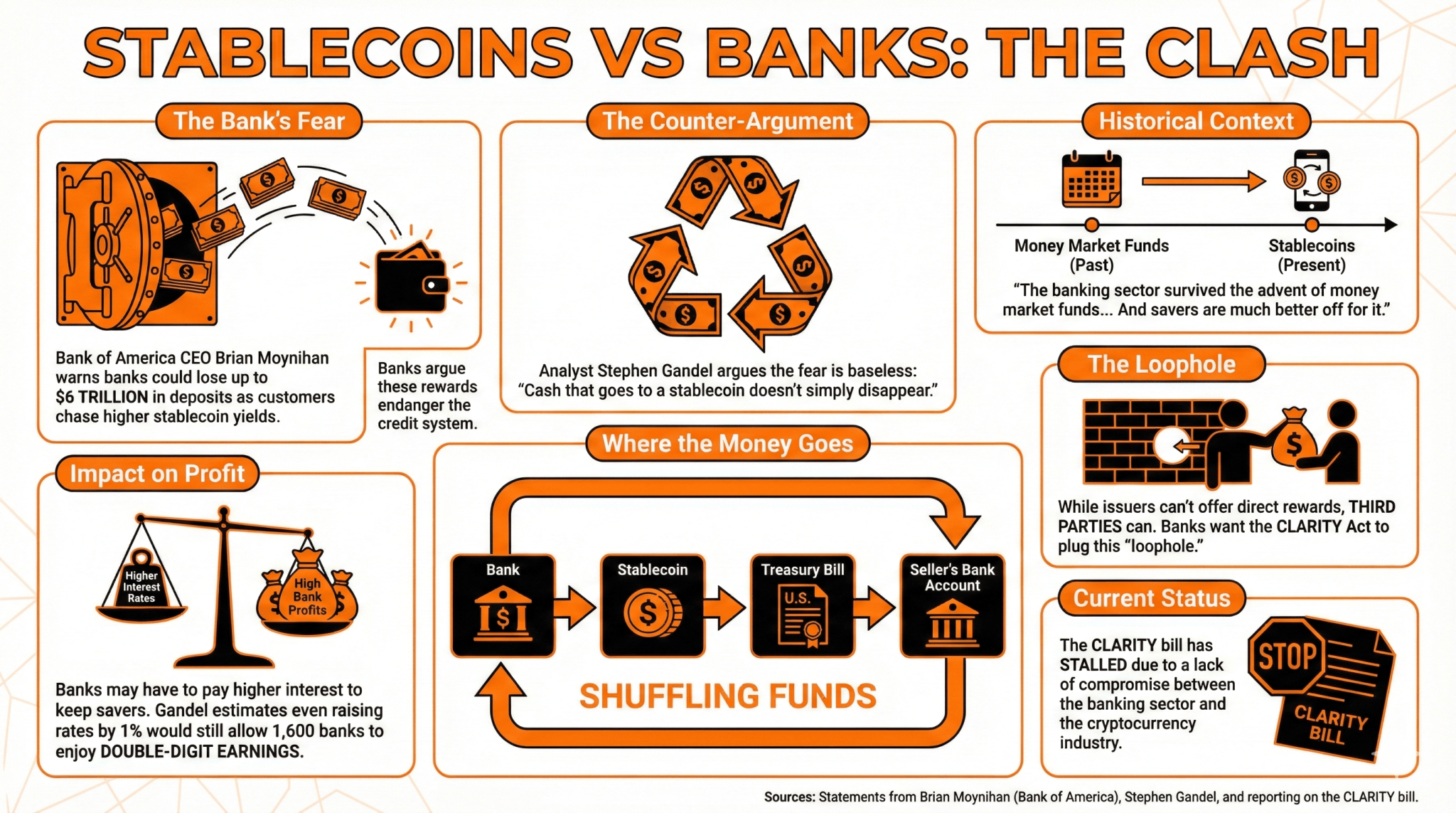

The discussion of stablecoin rewards in the CLARITY bill has prompted concerns from banks, which claim these rewards might endanger the credit system.

According to Bank of America’s CEO Brian Moynihan, banks could lose up to $6 trillion in deposits, as customers seek higher yields by holding stablecoins under the custody of cryptocurrency exchanges.

Stephen Gandel, a seasoned financial analyst and journalist, claims that the banks’ arguments are baseless, as there is no way to pull deposits from the system completely.

He explained:

“Cash that goes to a stablecoin doesn’t simply disappear – it goes into the reserve assets like Treasury bills or bank accounts.”

This means that whenever stablecoin issuers buy U.S. Treasuries to support their issuance, the party selling the debt instruments would have extra cash in their account. In this way, funds would just be shuffled around.

Gandel acknowledges that individual banks will have to pay more to keep savers’ cash under their control, potentially affecting their business model profitability. He alleges that raising interest levels by 1% would still allow 1,600 national banks to enjoy double-digit earnings, with the U.S. remaining the nation with the most banks even after this shift.

“The banking sector survived the advent of money market funds, even if many smaller regional lenders didn’t. And savers are much better off for it. The same may be true if stablecoins take off,” he concluded.

While stablecoins issuers have been banned from offering direct rewards to holders, third parties can still do it. Banks have qualified this as a loophole and are actively trying to plug it by including this consideration in the CLARITY Act.

Nonetheless, the bill has stalled due to a lack of compromise on this subject from both banks and the cryptocurrency industry.

FAQ

-

What concerns have banks raised regarding stablecoin rewards in the CLARITY bill?

Banks argue that allowing stablecoin rewards could lead to a loss of up to $6 trillion in deposits as customers seek higher yields from cryptocurrency exchanges. -

How does financial analyst Stephen Gandel view the banks’ concerns?

Gandel claims the banks’ fears are unfounded, noting that cash moving to stablecoins does not disappear but is reallocated into assets like Treasury bills or bank accounts. -

What impact might the shift to stablecoins have on individual banks?

While banks may need to increase interest rates to retain customers, Gandel believes many national banks can still thrive, even with a 1% increase in rates. -

What is the current status of the CLARITY Act concerning stablecoin rewards?

The bill has stalled due to disagreements between banks and the cryptocurrency industry over how to manage stablecoin rewards and related loopholes.

thecryptobasic.com

thecryptobasic.com

coinedition.com

coinedition.com

coinfomania.com

coinfomania.com