A recent New York Times piece misleadingly suggests that stablecoins facilitate money laundering by criminal actors. However, the article reveals that crypto-to-cash conversion services and inadequate compliance measures by financial companies are the primary mechanisms enabling such activities.

Stablecoins are Not Aiding Money Launderers, Weak Compliance Is

The Facts

A recent article published by The New York Times, which warns about the advantages of stablecoins for money laundering, might seem correct at first, but it highlights problems that have little to do with stablecoins.

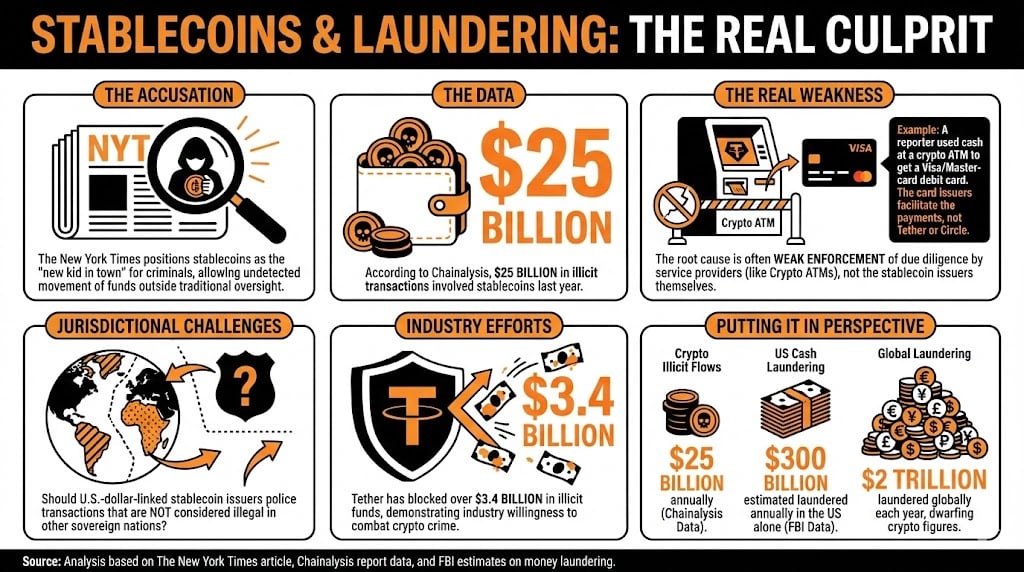

The piece points to stablecoins as the “new kid in town,” opening the doors to criminals to act undetected, allowing them to move funds quietly while avoiding traditional financial oversight.

According to blockchain research firm Chainalysis, $25 billion in illicit transactions included stablecoins last year. Nonetheless, New York Times reporter Aaron Krolik veers from its path to evidence the real culprit behind these numbers: weak enforcement of due diligence measures from service providers, which can also leverage other funding sources.

For example, the author relates that he used a crypto ATM to purchase stablecoins using cash, and subsequently issued a debit card as evidence of his point. However, Visa and Mastercard are ultimately the companies that issue these cards and facilitate further payments, not Tether or Circle, issuers of the two largest stablecoins in the crypto world.

The stablecoin industry has made efforts to combat onchain illicit activity, and Tether has blocked over $3.4 billion in illicit funds, a testament to the sector’s willingness to aid in this battle against crypto crime.

Read more: GENIUS Act Triggers Treasury Request for Anti-Money Laundering Tech Feedback

Why It Is Relevant

While the figures linked to money laundering ($25 billion) are relevant, and measures must be taken to reduce it, they pale in comparison to the use of the U.S. dollar for this purpose.

For example, the FBI estimates that each year, $300 billion is laundered in the U.S., a number that dwarves crypto figures. Globally, money laundering reaches up to $2 trillion, dwarfing the $25 billion in crypto flows reported.

Analysts have criticized the timing of the piece, as the U.S. Senate is currently discussing its version of a crypto market structure bill, and stablecoins are one of the issues being vigorously debated.

Read more: State of Senate’s Crypto Market Bill: Stablecoins, Trump’s Involvement and DeFi Pain Points Examined

Coincenter’s Neeraj K. Agrawal agreed that the article exposed “issues caused by a network of credit card issuing companies rather than stablecoins,” while Haun Ventures’ Rachael Horwitz accused the banking lobby of planting these stories to put stablecoins in a bad position.

Looking Forward

As stablecoins have become a critical element of U.S. government policy to extend the global hegemony of the U.S. dollar, more rigorous compliance measures must be implemented to regulate these financial flows.

Exposing stablecoins as money laundering tools while simultaneously overlooking the systemic weaknesses in financial service platform compliance is fundamentally disingenuous and undermines genuine efforts to combat criminal activities.

coindesk.com

coindesk.com

decrypt.co

decrypt.co

theblock.co

theblock.co