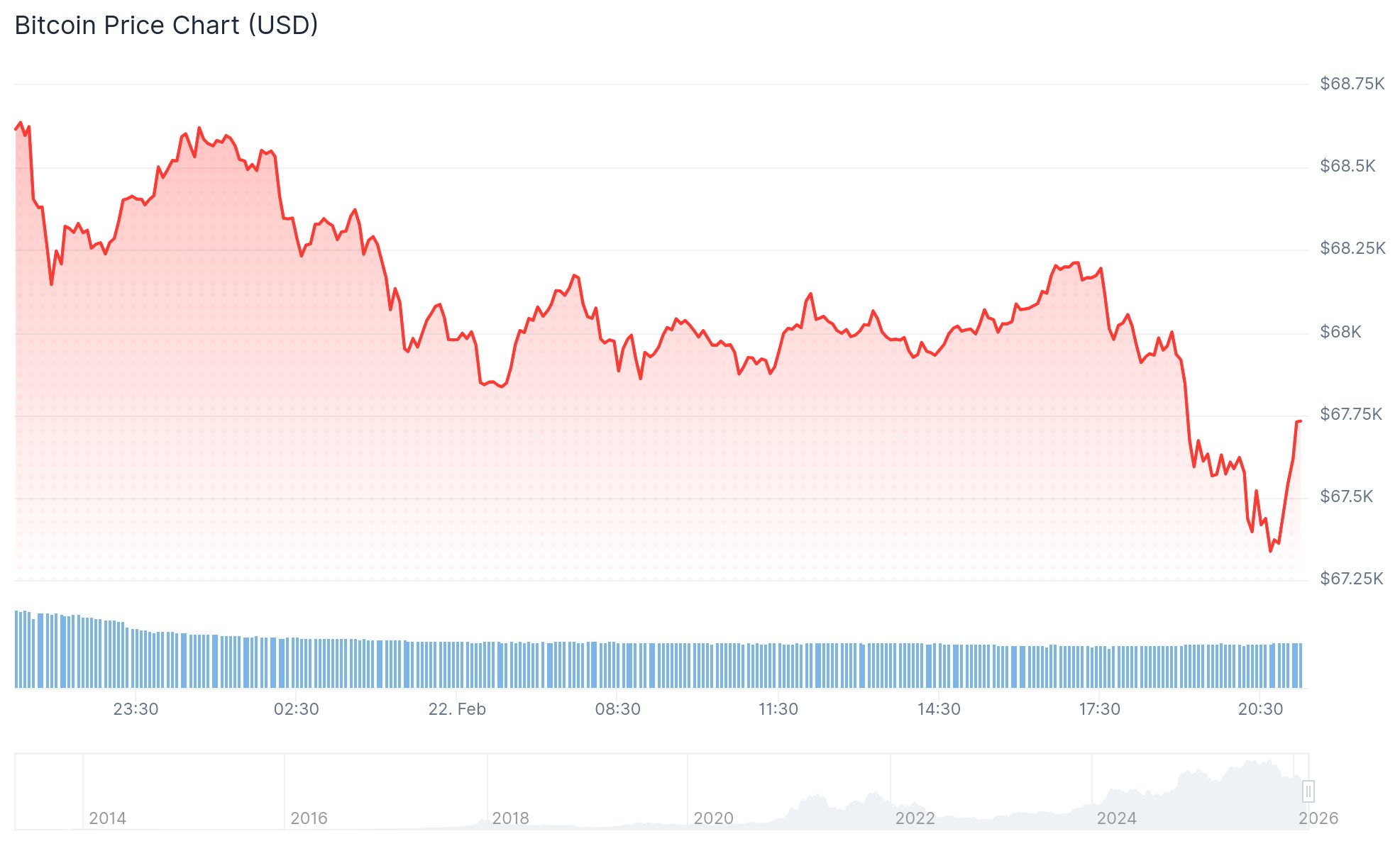

Bitcoin slid back toward $67,000 in Sunday trading as trade uncertainty resurfaced, with investors weighing fresh tariff escalation against a shifting legal backdrop in the U.S.

BTC was trading around $67,526, down about 1.4% over the past 24 hours and roughly 2.1% on the week. The move follows President Donald Trump’s decision to raise the worldwide tariff rate to 15% from 10%, despite a recent Supreme Court ruling that invalidated earlier emergency trade measures.

The court’s decision had briefly appeared to limit Washington’s ability to deploy sweeping tariffs ahead of Trump’s planned March 31 visit to Beijing. Instead, the administration responded by lifting the global rate, keeping pressure on trade partners even as the legal footing remains contested.

China now faces the same 15% levy applied to U.S. allies, with that rate set against a 150-day window. Markets are left navigating both escalation and ambiguity, a combination that tends to dampen appetite for risk.

Losses were broad acorss crypto majors. Ether slipped 1.8% to $1,951 and is down 2.5% over the past week. XRP fell 4.4% on the day and 8.4% across seven days to $1.39. Solana dropped 3.8% in 24 hours to $83.25, while Dogecoin shed nearly 5% on the day and more than 11% on the week. Cardano declined 4.3%, and BNB eased 2.3%.

Trade friction is not confined to Asia. European lawmakers are signaling hesitation over advancing the so-called Turnberry Agreement, saying they want clearer commitments from Washington on trade policy before moving forward.

For now, crypto remains tightly linked to macro headlines. Until tariff policy finds firmer footing, digital assets are likely to move with broader risk sentiment rather than on purely crypto-native catalysts.

cryptobriefing.com

cryptobriefing.com