Dollar-pegged tokens edged higher over the past week, pulling in roughly $703 million in fresh capital. Even with that bump, the sector remains down 0.61% month over month, a $1.9 billion dip that keeps the broader tally in check. Among the top ten stablecoin competitors over the last seven days, Blackrock’s BUIDL led the charge, leaping 36.03% higher.

Stablecoin Market Caps Shift as February Closes Out

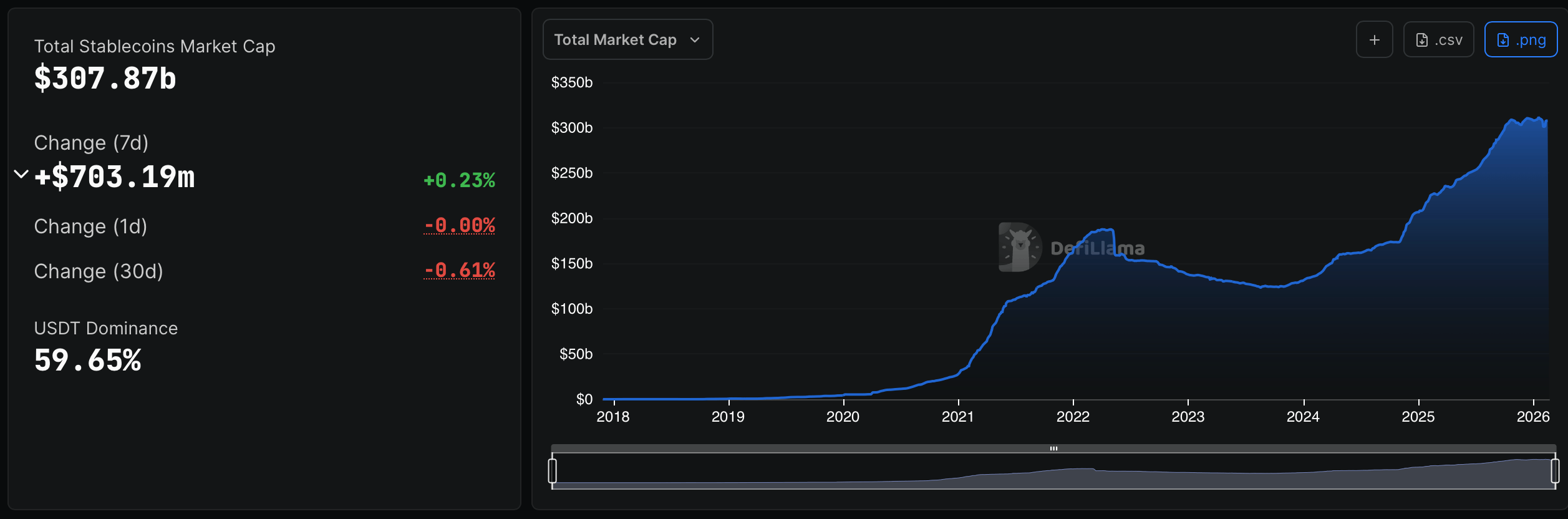

While the stablecoin economy added to its totals this week, it remains lower over the past 30 days. Over that stretch, adjusted transaction volume tracked by Artemis Terminal reached roughly $7.5 trillion. That figure spans 1.8 billion distinct transactions, reflecting activity from institutions and high- volume retail players alike. As the final week of February gets underway, the dollar-pegged economy sits at $307.87 billion, according to defillama.com data.

Of course, the two heavyweights— $USDT and $USDC— still command the lion’s share of the sector, controlling 83.62% of the total. Tether ( $USDT) slipped 0.10% over the week, yet still commands a hefty $183.652 billion market cap. The second-largest contender, Circle’s $USDC, moved in the opposite direction, posting a 0.74% weekly gain and bringing its market cap to $73.794 billion. While $USDT’s dominance out of the $307 billion is 59.65% $USDC’s stands at 23.97%.

Sky dollar (USDS) holds the third position with a $6.852 billion market cap and a solid 3.80% gain over the past seven days. Meanwhile, Ethena’s USDe moved the other way, slipping 1.65% and settling at a $6.229 billion market cap. In fifth place, World Liberty Financial’s USD1 took a 4.36% hit over the past week, trimming its market cap to $5.109 billion. The week’s standout performer among the top ten was BUIDL, the U.S. Treasury-backed stablecoin.

Blackrock’s token BUIDL watched its market cap rocket 36.03% higher, pushing its overall valuation to roughly $2.462 billion. Another Treasury-flavored contender making noise was Circle’s USYC, which added 9.43% and reached a $1.688 billion market cap. The data indicates that while the ‘Big Two’ ( $USDT and $USDC) posted flat or modest gains this past week, Treasury-focused, fund-backed stablecoins are stealing the spotlight with outsized advances.

These tokens sit squarely on the yield-bearing front. Of the $307 billion total, yield-bearing stablecoins account for roughly 6.66%, or about $20.44 billion today. As traditional finance products migrate onchain and tokenized Treasurys continue to gain traction, capital appears increasingly comfortable chasing programmable dollars that pay.

For now, the ‘Big Two’ still rule by sheer size, but the momentum suggests the next chapter of the stablecoin race may be less about stability alone — and more about who can offer it with income attached.

FAQ ⏰

- What is the current size of the stablecoin market? The dollar-pegged stablecoin market stands at approximately $307.87 billion in total value.

- Which stablecoin gained the most this week? Blackrock’s BUIDL led the top ten with a 36.03% increase in market cap over the past seven days.

- How much volume did stablecoins process in the last 30 days? Adjusted transaction volume reached about $7.5 trillion across 1.8 billion transactions.

- What share do $USDT and $USDC control? Tether ( $USDT) and Circle’s $USDC together account for 83.62% of the total stablecoin sector.

cryptobriefing.com

cryptobriefing.com

coindesk.com

coindesk.com

coinfomania.com

coinfomania.com