Bitcoin (BTC) has been trading sideways in the $65,000-$70,000 range in recent days.

However, the risk of a decline for Bitcoin is still not over, and analysts generally predict that further drops are possible.

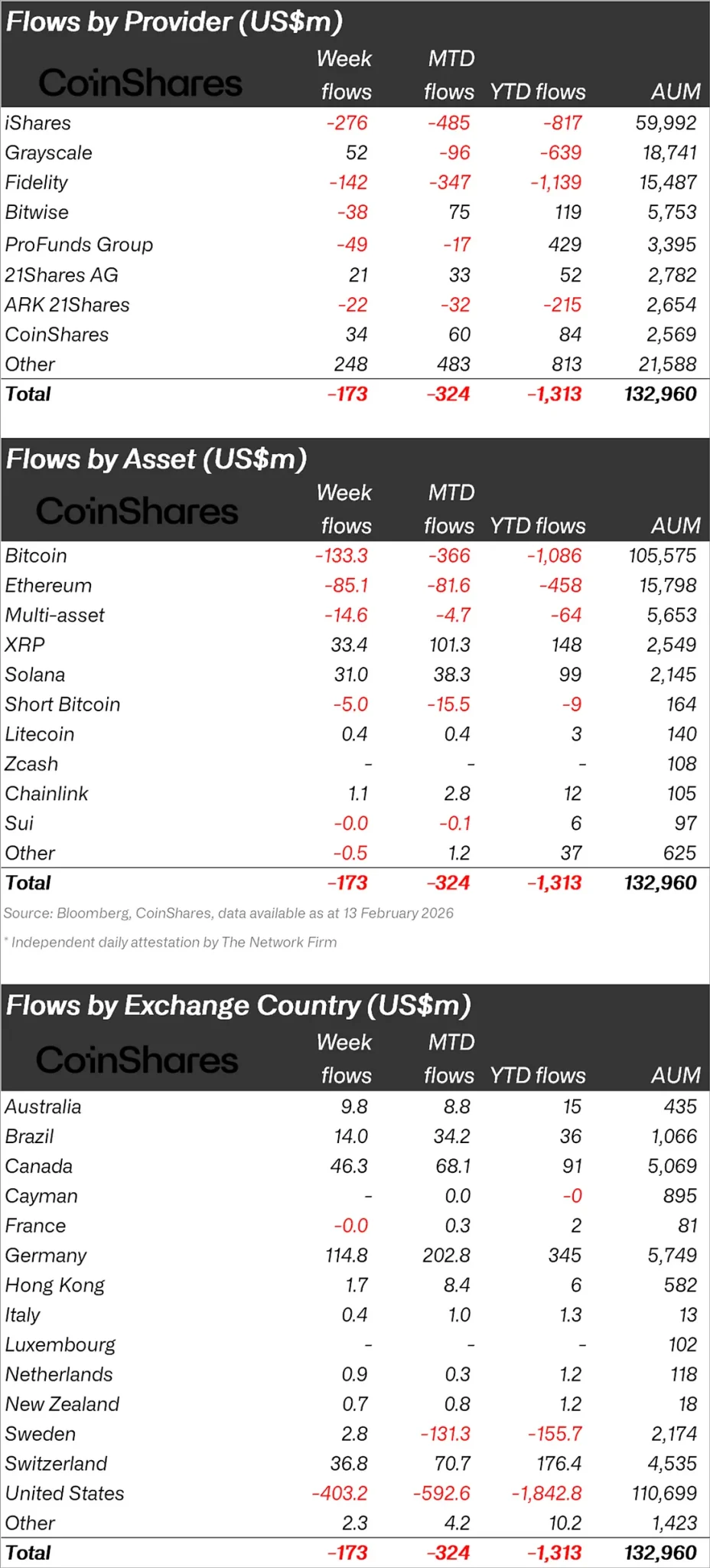

At this point, while some analysts predict Bitcoin could fall to the $50,000 level, Coinshares published its cryptocurrency report stating that only $173 million in outflows occurred last week.

“Crypto investment products experienced outflows for the fourth consecutive week, with a total of $173 million withdrawn.”

“In the last four weeks, there has been an outflow of $3.74 billion.”

Bitcoin Leads the Exodus!

Looking at crypto funds individually, outflows were observed to be in Bitcoin.

Bitcoin experienced outflows worth $133.3 million, while Ethereum (ETH) saw outflows of $85.1 million.

Looking at other altcoins, $XRP saw inflows of $33.4 million, Solana (SOL) $31 million, and Chainlink (LINK) $1.1 million, while Hyperliquid (HYPE) saw inflows of $1 million.

“Bitcoin showed its weakest market sentiment with outflows totaling $133 million. However, short positions in Bitcoin investment products also saw outflows totaling $15.4 million in the last two weeks. This is a common occurrence near market bottoms.”

Ethereum saw outflows of $85.1 million, while Hyperliquid experienced outflows of $1 million.

In contrast, $XRP, Solana, and Chainlink saw inflows of $33.4 million, $31 million, and $1.1 million respectively, and the positive sentiment in altcoins continued.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $403 million.

The US was the only country to experience outflows, while Germany saw inflows of $114.8 million, Canada $46.3 million, and Switzerland $36.8 million.

*This is not investment advice.

cryptopolitan.com

cryptopolitan.com

cryptobriefing.com

cryptobriefing.com

coinfomania.com

coinfomania.com