U.S. stocks opened with a burst of optimism Wednesday, but by mid-afternoon that enthusiasm had faded as stronger-than-expected jobs data pushed Treasury yields higher and trimmed hopes for near-term Federal Reserve rate cuts.

Wall Street’s Early Pop Fizzles as Hot Jobs Data Lifts Yields, Weighs on Stocks

At the time of writing, on Feb. 11, 2026, the Dow Jones Industrial Average was down roughly 120 points, or 0.2%, near 50,068 after briefly climbing more than 300 points earlier in the session. The S&P 500 slipped about 0.2% to around 6,928, while the Nasdaq Composite trailed with a 0.5% drop to roughly 23,000. Markets remain open, and intraday swings continue.

The catalyst was January’s nonfarm payrolls report, delayed by prior government shutdown disruptions, which showed 130,000 jobs added—well above forecasts near 50,000. The unemployment rate ticked down to 4.3% from 4.4%, reinforcing the view that the labor market remains firm.

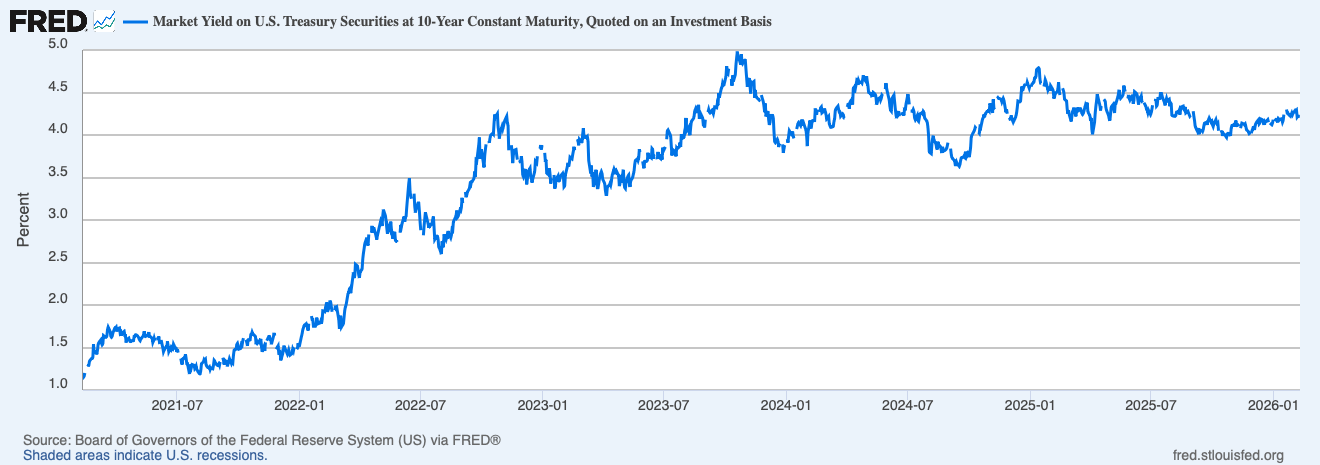

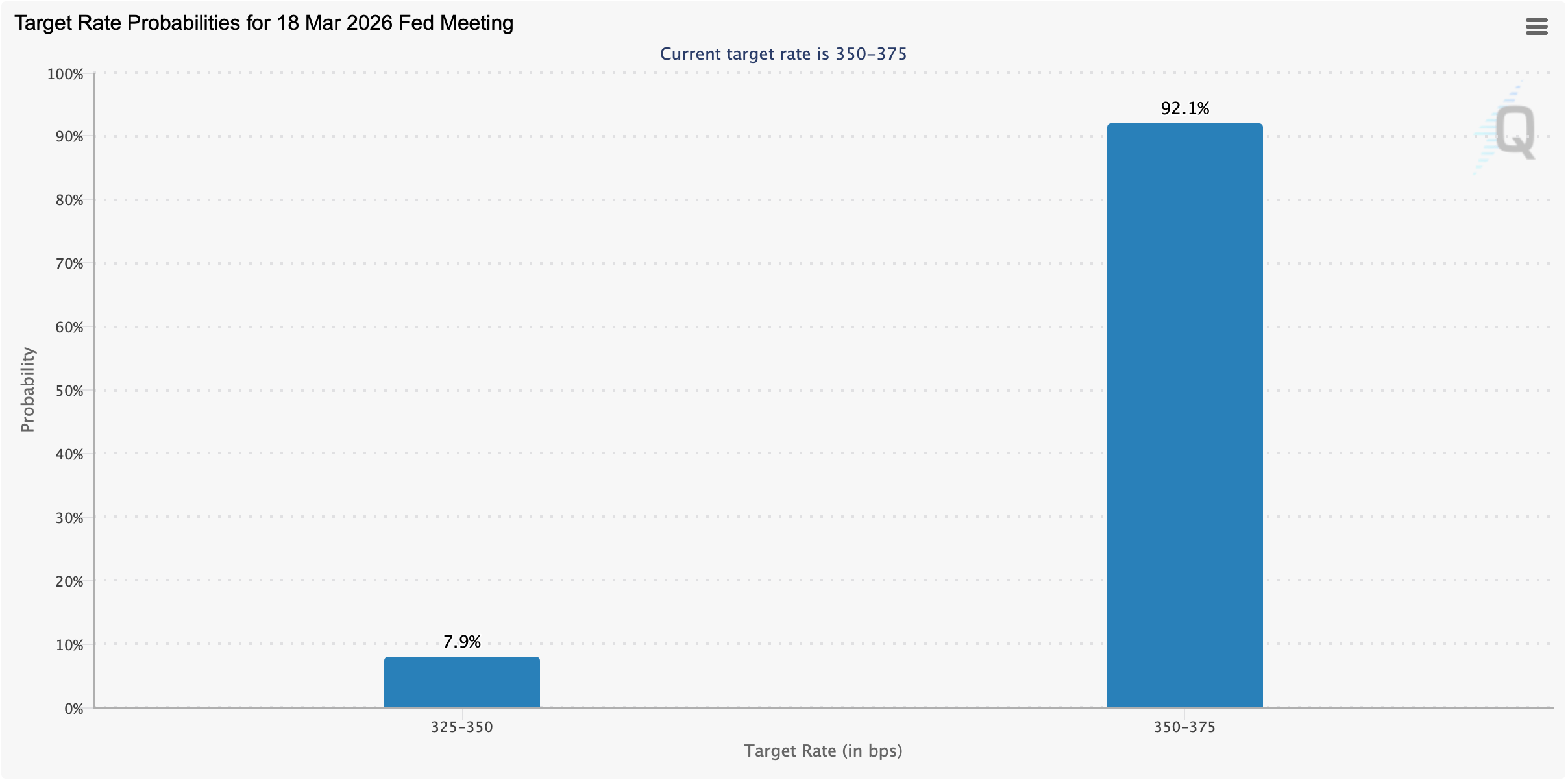

That strength came with a catch. Treasury prices fell, sending the 10-year yield to about 4.22%, up from roughly 4.18% previously. Higher yields often act as gravity for equity valuations, particularly in growth-heavy corners of the market. Traders recalibrated expectations for Federal Reserve easing in 2026, with limited cuts now priced in and most bets shifting toward midyear or later.

The reversal marks a shift from Tuesday’s close, when the Dow notched its third straight record at 50,188.14. The S&P 500 and Nasdaq, however, ended that session lower, reflecting pressure from weaker retail sales data and selective profit-taking in technology shares.

Earnings season added another layer of crosscurrents. Vertiv Holdings rallied sharply after issuing upbeat guidance tied to data center demand, while Lyft, Robinhood, and Mattel declined following softer results and outlooks. Stock-specific reactions have widened sector performance gaps, keeping volatility elevated even as index-level moves appear modest.

Technology and communication services stocks, which led recent advances in artificial intelligence (AI) enthusiasm, faced renewed scrutiny. Financials showed relative resilience as rising yields support net interest margins, while energy stocks found support from firmer oil prices amid geopolitical tensions.

Precious metals like gold and silver logged gains on Wednesday, with gold rising 0.66% above the $5,000 range. Silver is trading for $83 per ounce, up 2.43% over the last day. The crypto economy, like U.S. equities, is down, as the sector has shed 3.2% to drop to $2.28 trillion by mid-day. Bitcoin has lost 3.8% against the greenback over the last seven days.

Looking ahead, Friday’s consumer price index (CPI) report is the week’s marquee event. Inflation data could either reinforce the “higher for longer” narrative or reopen the door to earlier rate relief. Analysts estimate blended fourth-quarter earnings growth near 12% for the S&P 500, with 2026 projections in the mid-teens, though those assumptions hinge on stable inflation and steady demand.

For now, the market’s message is clear: strong economic data is welcome—but not if it complicates the Fed’s path. With CPI on deck and earnings still rolling in, Wall Street appears poised for more intraday whiplash before the week is done.

FAQ 📉

- Why did U.S. stocks turn lower midday on Feb. 11, 2026?Stronger-than-expected January jobs data pushed Treasury yields higher and reduced expectations for near-term Fed rate cuts.

- How are Treasury yields affecting the stock market?Higher yields increase borrowing costs and weigh on equity valuations, particularly for growth-oriented stocks.

- Which index is underperforming today?The Nasdaq Composite is lagging with a larger percentage decline compared to the Dow and S&P 500.

- What’s the next major catalyst for markets this week?Friday’s CPI report could shape expectations for inflation and Federal Reserve policy.

theblock.co

theblock.co

coindesk.com

coindesk.com