Digital asset treasuries (DAT) were touted as a major unlock in 2025, with struggling companies being acquired and repurposed as crypto allocation vehicles; however, just one month into 2026, the new class of DATs are almost $20 billion in the hole.

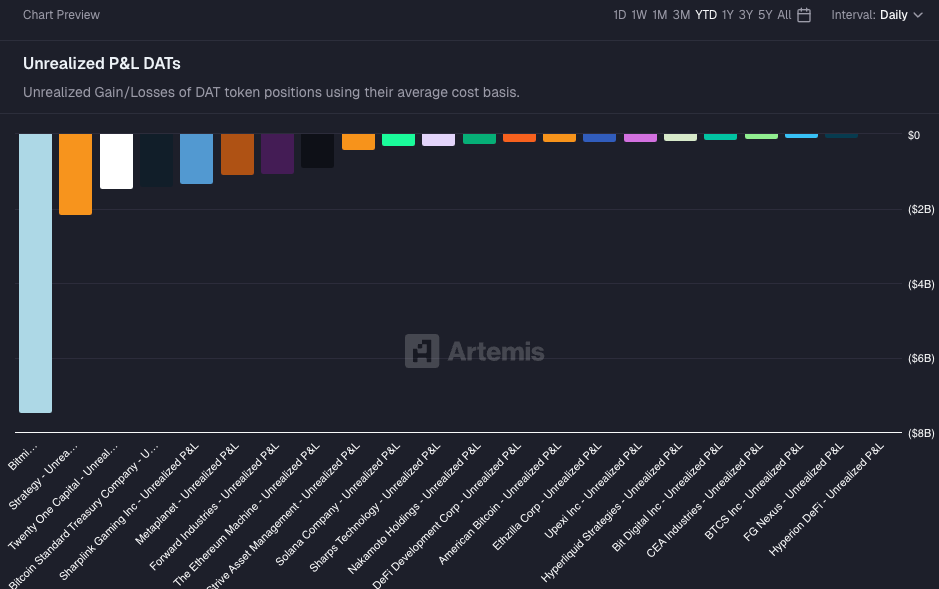

According to Artemis Terminal, the 20 largest DATs are down a cumulative $17 billion as the crypto market continues to fall.

Tom Lee’s Bitmine Immersion stands out, accounting for almost 44% of that figure with $7.5 billion in unrealized losses on its $ETH holdings, purchased at an average price of $3,900.

Michael Saylor’s Strategy is next in line due to its massive $BTC holdings, and the company is down $2.2 billion despite Bitcoin only trading 2.8% below his $76,000 average acquisition price.

The mounting losses are a result of the crypto market’s continued downtrend, with $BTC and $ETH falling below $73,000 and $2,100, respectively, earlier this morning.

While the top 20 DATs account for the majority of losses, there are more than 140 companies with crypto treasuries, 76 of which were formed between January and November 2025, according to a report from CoinGecko in Q4 2025.

Many of these companies have not disclosed their exact exposure and leverage, but industry experts have warned that the DAT structure could pose significant risks to crypto markets.

As the DAT model began to really take off in July 2025, Galaxy Digital’s Mike Novogratz warned that it could create a “structurally fragile” market environment.

coindesk.com

coindesk.com

theblock.co

theblock.co