The U.S. stock market is having an identity crisis, torn between the promise of blockbuster earnings and the panic over an artificial intelligence (AI) bubble.

The Gravity of the Grift

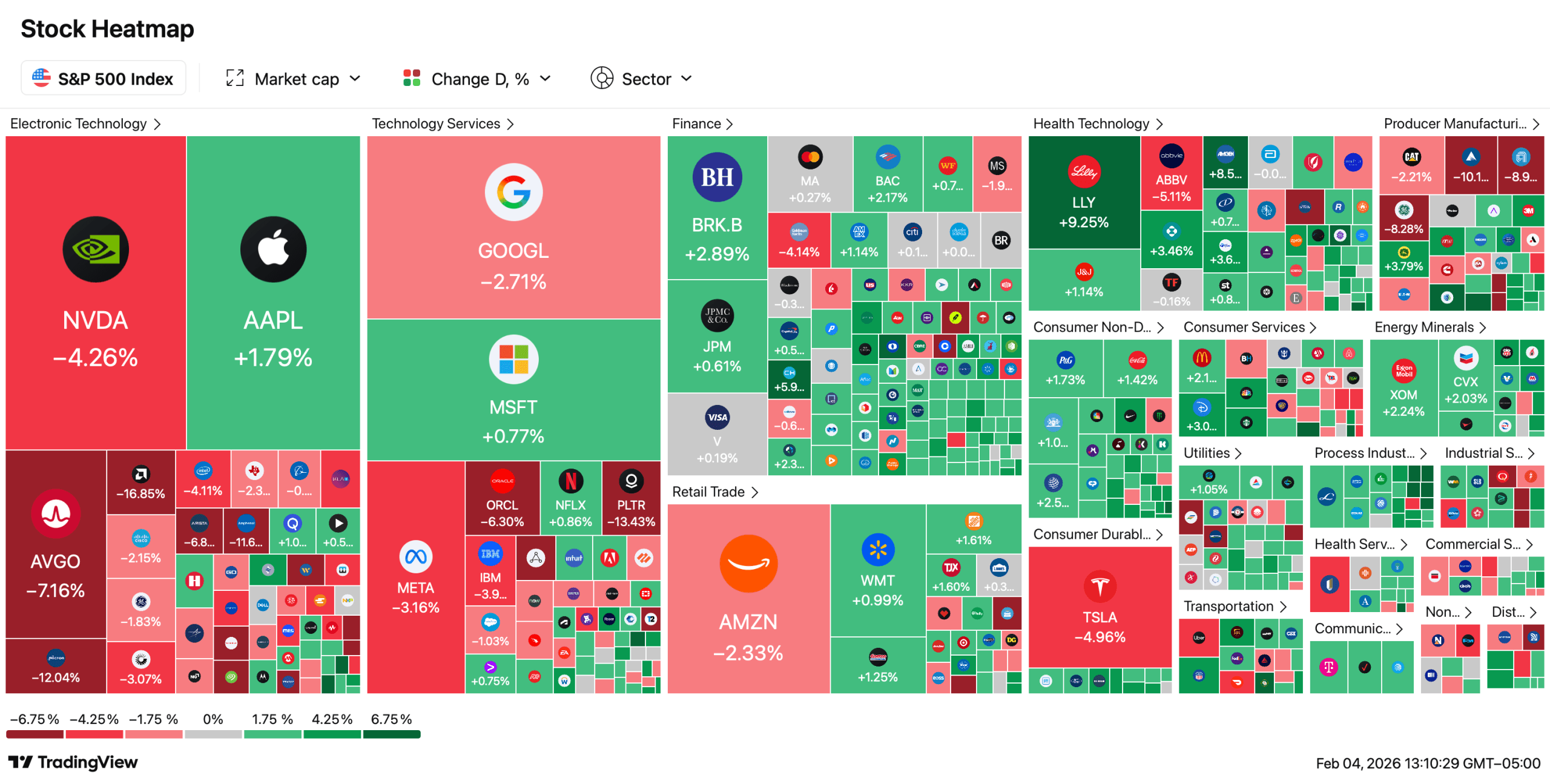

Wednesday’s mixed trading session is more than just a squiggle on a chart; it’s a stark Rorschach test for investor sentiment. With the Dow Jones Industrial Average climbing over 280 points while the Nasdaq Composite slumped, the market is literally moving in two opposite directions.

This split personality highlights a fundamental debate: is the economy still resilient, or are the long-awaited consequences of an expensive AI arms race and a cooling labor market finally here? The divergence tells us that money isn’t fleeing the market—it’s frantically rotating, searching for a safe story to believe in.

Wall Street’s Whisper Network

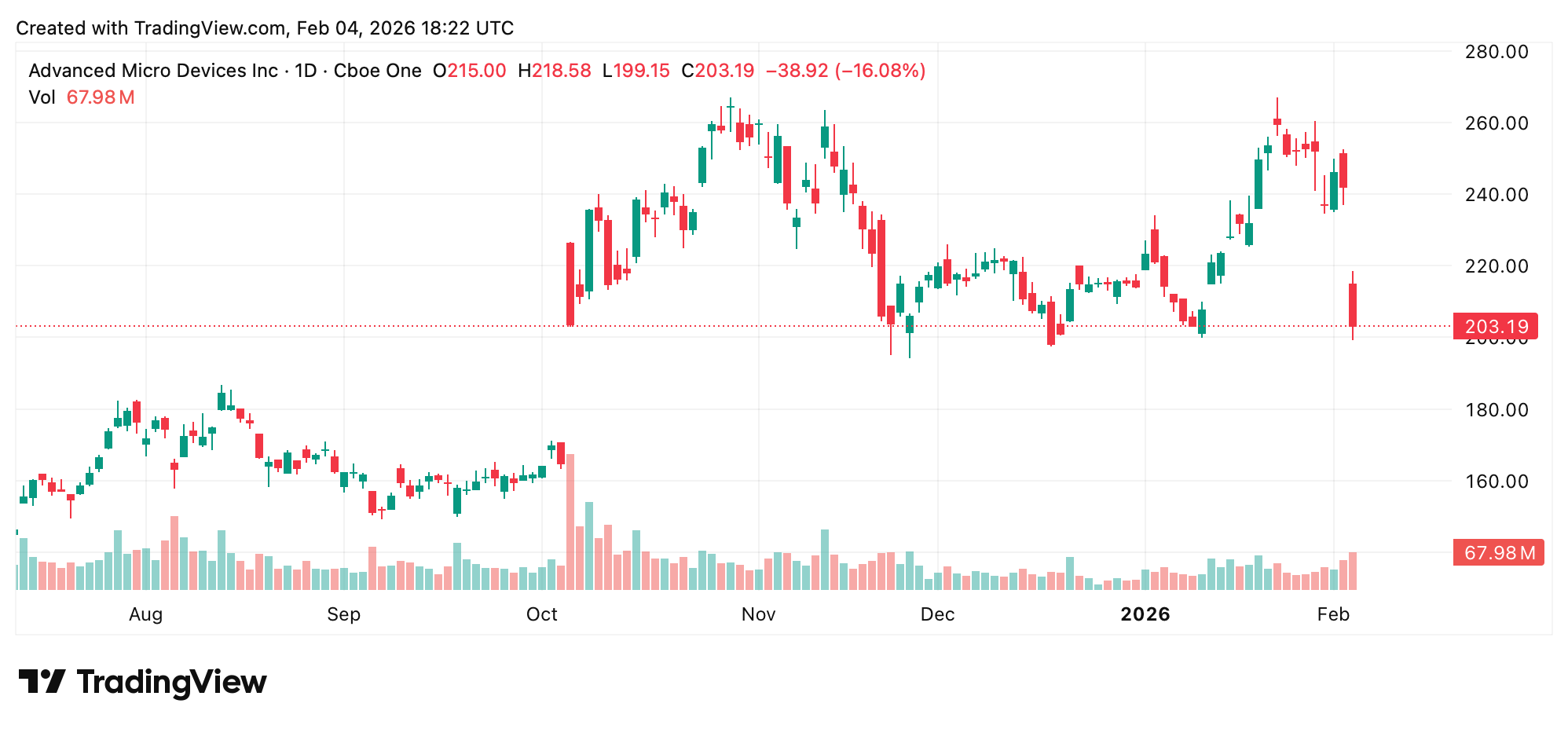

The chatter on the floor isn’t optimistic. John Praveen, managing director and Co-CIO, Paleo Leon in Princeton, New Jersey, told Reuters, “there are some genuine concerns that AI investments will eat the software companies’ lunches,” cutting to the heart of the tech sell-off. The fear is that massive capital expenditures are becoming a black hole. The worry is that the “AI theme may not be as immediately lucrative as hoped,” Fawad Razaqzada at Forex.com explained to Bloomberg. Even stellar profits aren’t enough to calm nerves, with stocks like AMD plunging over 12% despite beating expectations, a classic sign that valuations had simply flown too close to the sun.

The Hard Numbers: A Tale of Two Economies

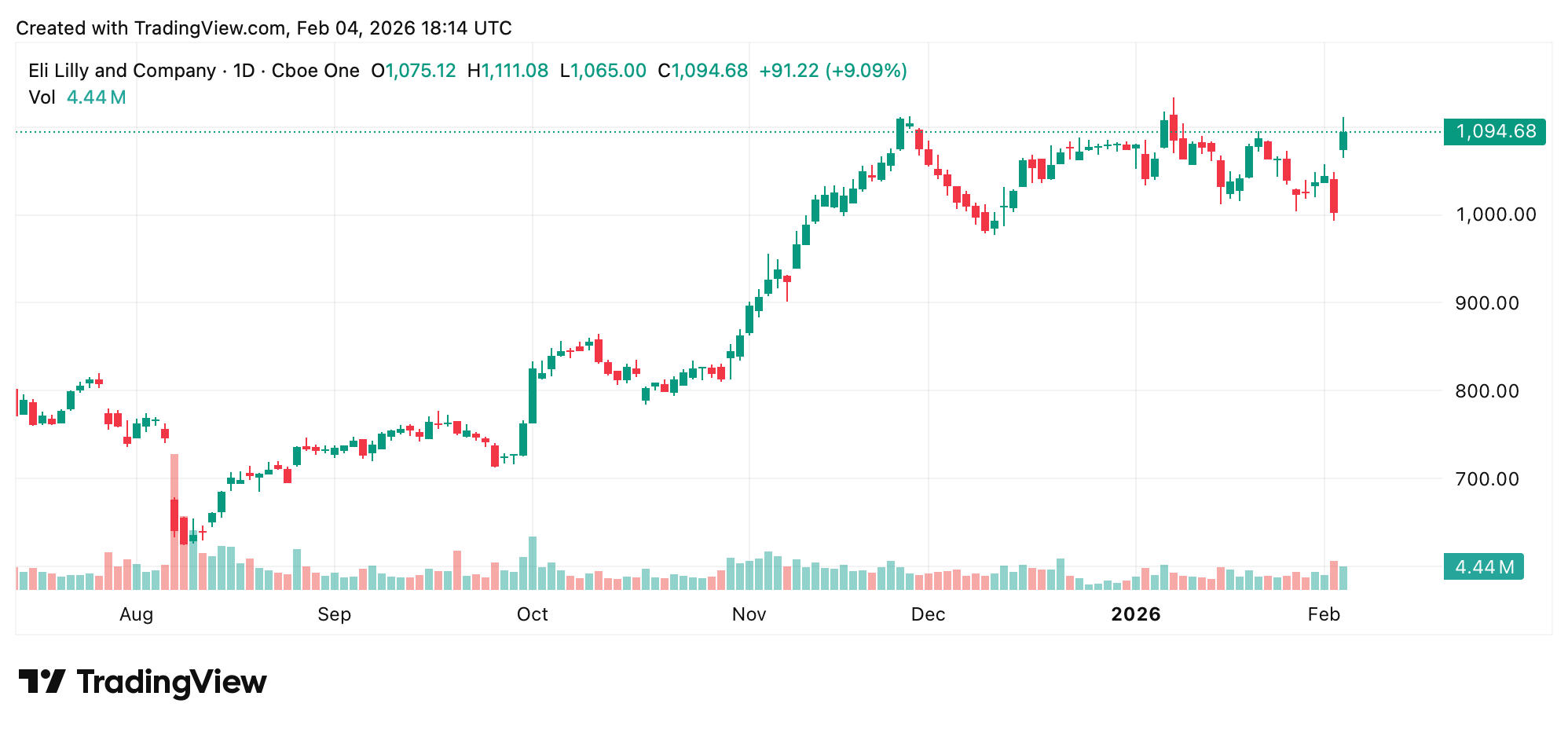

The data paints a contradictory picture. In one corner, corporate America shows muscle. Eli Lilly surged over 7% after crushing earnings expectations, and Super Micro Computer jumped 12%, proving there are still winning trades. In the other corner, the macroeconomic engine is sputtering. The ADP report showed private employers added a meager 22,000 jobs in January, a fraction of the expected 48,000 and a clear signal of a slowdown. Notably, professional and business services bled 57,000 jobs, while manufacturing continued its long retreat.

AI Anxiety: The Hangover After the Party

The technology sector is ground zero for the panic. It’s not just about spending; it’s about existential spending. Investors are suddenly questioning if the trillion-dollar bets on artificial intelligence will ever generate commensurate returns. Microsoft’s recent cloud slowdown sparked a 10% plunge, serving as a wake-up call that even the mightiest can disappoint. The sell-off has been brutal and broad, engulfing software giants from Salesforce to Adobe. The anxiety is that AI itself might disrupt the very software models these companies are built on, turning them from disruptors into the disrupted.

Also read: XRP Derivatives Paint a Cautious Picture as Price Stalls Under $1.65

Safe Haven Samba

As tech trembles, a classic rotation is underway. Money is dancing toward perceived safety. Healthcare stocks, buoyed by Lilly, are up. Consumer staples and industrials are attracting flows. Even gold, after a violent pullback, is clawing its way back near $5,000 an ounce as investors seek a hedge against uncertainty. Meanwhile, the yield on the 10-year Treasury held steady around 4.27%, suggesting bond markets are in a “wait-and-see” mode, caught between weak jobs data and persistent inflation concerns in the services sector.

The Friction Point: A Reality Check

The core tension is a collision between micro-optimism and macro-pessimism. Company-specific good news is being overshadowed by systemic doubts. Can the stellar performance of a few healthcare or industrial giants offset the gravitational pull of a softening job market and a deflating tech bubble? The market’s verdict, so far, is a hesitant “maybe,” resulting in this frustrating stalemate. The delayed official government jobs report, now due Feb. 11, is only amplifying the uncertainty.

The Crossroads: What Comes Next

All eyes are on the next catalyst. The market is trapped in a waiting game, caught between earnings from mega-caps like Alphabet and Amazon and the upcoming labor data. The path forward depends on which narrative gains the upper hand: a soft economic landing supported by strong corporate health, or a deeper slowdown exacerbated by a tech-led correction. The wild swings in assets like gold, silver and crypto show a market that is desperately seeking direction but finding only volatility.

FAQ ❓

- What’s causing the stock market split today? Strong earnings from companies like Eli Lilly are boosting the Dow, while fears over AI spending and profitability are crushing tech stocks, dragging down the Nasdaq.

- Why are tech stocks falling even with good earnings? Investors fear that huge AI investments won’t pay off soon enough and that AI could disrupt traditional software business models, making even strong current results look less valuable.

- What did the latest jobs report show? Private sector job growth was weak, with only 22,000 jobs added in January, missing forecasts and signaling a cooling labor market.

- Where are investors putting their money instead of tech? Money is rotating into “safer” sectors like healthcare and consumer staples, and some are moving into gold, which rose back near the $5,000 an ounce range.

cryptobriefing.com

cryptobriefing.com