As the United States enters day four of a partial federal government shutdown tied to unresolved funding for Homeland Security, prediction markets are signaling that traders expect disruption—but not a prolonged Washington standoff.

Shutdown Backdrop Traders Are Pricing In

The partial shutdown began at 12:01 a.m. EST on Jan. 31, after Congress failed to pass funding for six remaining appropriations bills, most notably Homeland Security, amid disagreements over immigration enforcement (ICE) reforms and broader spending levels.

The lapse followed a record 43-day shutdown in late 2025, leaving lawmakers with little political appetite for another extended closure. While essential services such as border security, national defense operations, and Social Security payments continue, roughly 800,000 federal workers are either furloughed or working without pay, and agencies including the Federal Aviation Administration, Housing and Urban Development, and parts of the State Department are already seeing disruptions.

Against that backdrop, traders on Polymarket and Kalshi are wagering not on political rhetoric, but on how long the dysfunction realistically lasts.

Polymarket: Big Volume, Low Patience

Polymarket’s market tracking shutdown duration has surpassed $18 million in trading volume, making it one of the most active political contracts of the year. Despite that heavy participation, pricing suggests traders expect lawmakers to resolve the standoff quickly.

As of 11:30 a.m. EST on Feb. 3, the highest-probability outcome was a shutdown lasting at least five days, priced near 13%. Odds then fall off sharply: six or more days traded around 3%, 10 or more days near 2%, and 30 or more daysclose to 1% .

Longer scenarios barely register. Contracts pricing a shutdown extending 60 days or more traded below 1%, underscoring a market consensus that a repeat of 2025’s extended closure is unlikely.

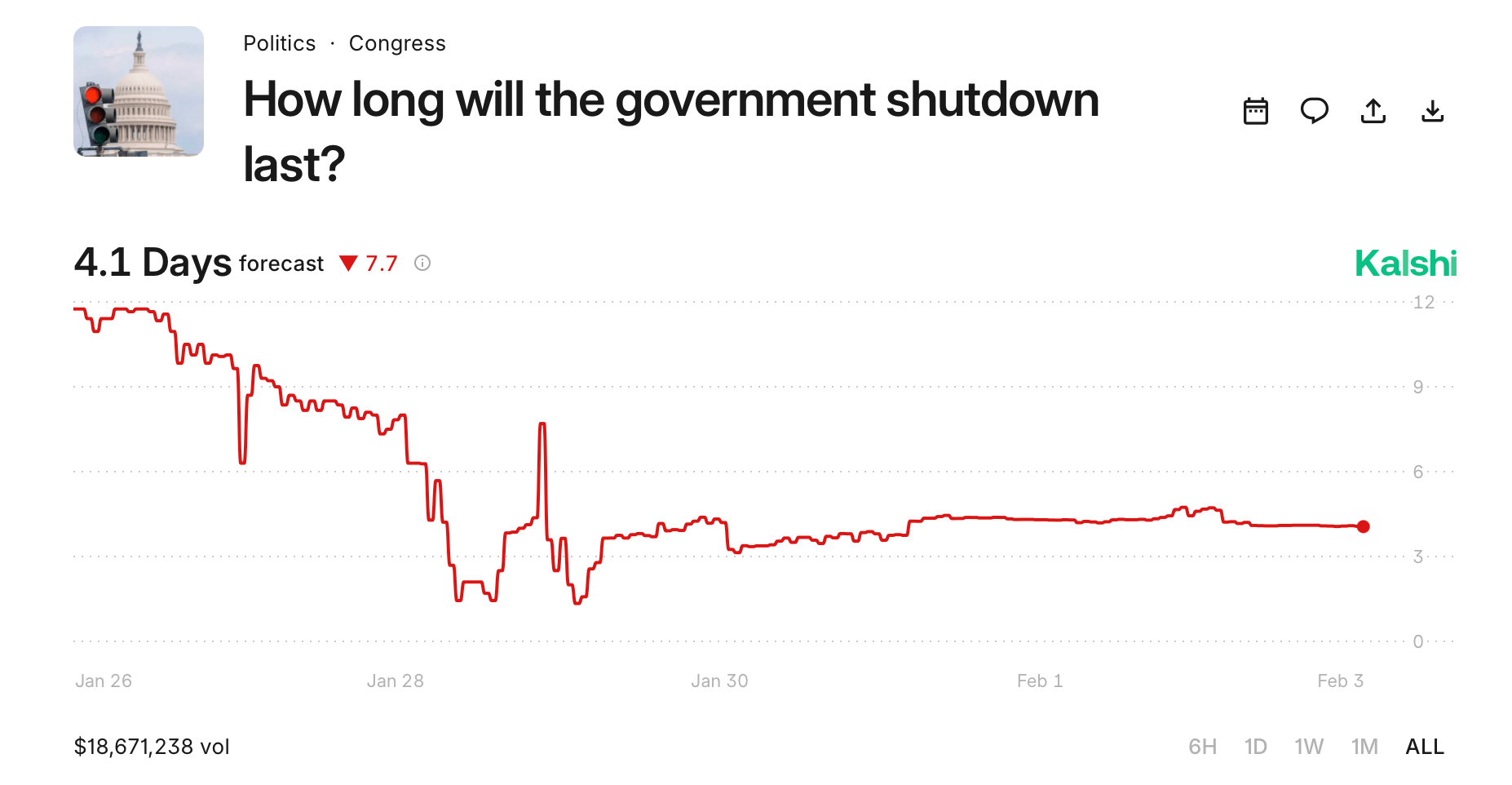

Kalshi Echoes the Same Message

Kalshi’s government shutdown market, which asks whether the shutdown will last more than four days, shows a nearly identical read. Total volume has climbed above $18.4 million, with the “Yes” contract priced around 10 cents and “No” near 91 cents as of late morning Feb. 3.

Because Kalshi resolves based on official Office of Personnel Management determinations at 10 a.m. ET each day, traders are focused tightly on near-term congressional action rather than abstract political risk.

Why Markets Expect a Short Fight

Traders appear to be factoring in several realities: the political damage from the 2025 shutdown, mounting pressure from furloughed workers, looming flight disruptions, and a narrow House majority that leaves little room for procedural failure.

With a key House vote scheduled and leadership signaling confidence in passage, prediction markets are effectively betting that lawmakers will tolerate only limited pain before cutting a deal.

For now, the markets’ verdict is clear: inconvenience is priced in, chaos is not.

FAQ 🏛️🇺🇸

-

Why did the 2026 government shutdown begin?

Congress failed to pass funding for several agencies, including Homeland Security, before the Jan. 31 deadline. -

Which agencies are affected by the shutdown?

Parts of DHS, Transportation, HUD, State, and Defense face furloughs or service disruptions. -

What do prediction markets say about how long it will last?

Polymarket and Kalshi both price low odds for a prolonged shutdown. -

How much money is being wagered on shutdown outcomes?

Each market has recorded more than $18 million in trading volume.

invezz.com

invezz.com

cointelegraph.com

cointelegraph.com

coindoo.com

coindoo.com

coindesk.com

coindesk.com