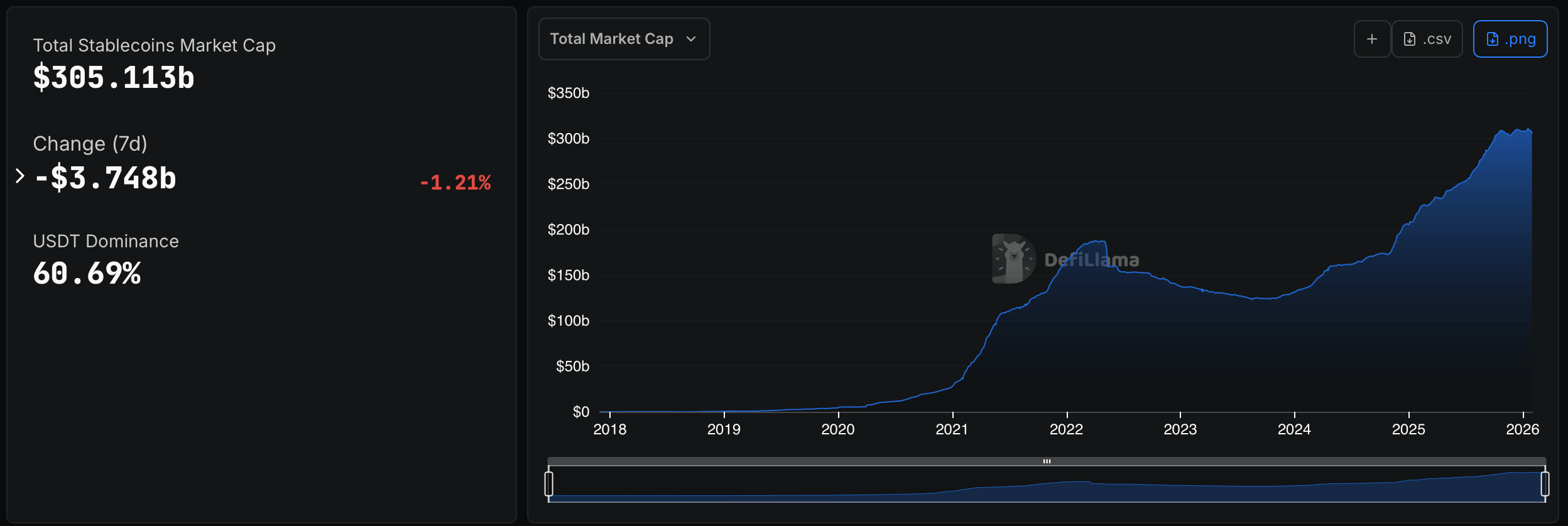

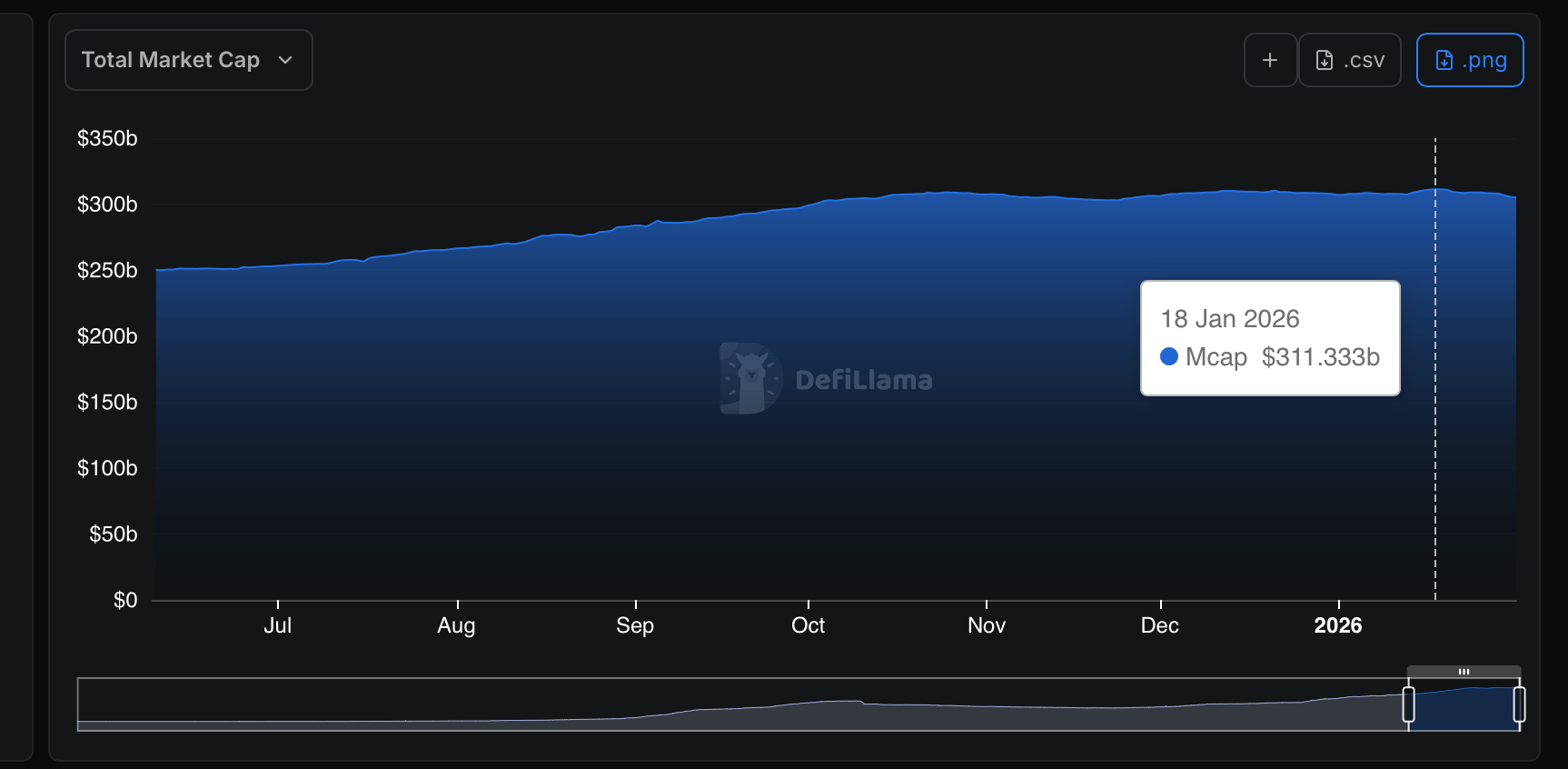

Over the past two weeks, the stablecoin economy trimmed $6.22 billion after topping out at an all-time high of $311.333 billion. Just this past week, the sector edged lower by 1.21%, shaving off another $3.748 billion.

Stablecoin Sector Trims Billions

The stablecoin, or fiat-pegged token economy, according to defillama.com stats, is in the red this week, logging a full two-week pullback since crossing the $311 billion mark. Out of the top 12 stables, Tether’s $USDT still dominates with a commanding $185.18 billion market cap, brushing off a modest 0.81% dip over the last week.

Circle’s USDC follows at $70.07 billion but looks shakier, down 3.40% in seven days. That equates to a loss of $5.05 billion during that timeframe. Ethena’s USDe holds third place with a $6.51 billion cap and a 0.92% weekly dip. Sky’s USDS barely budged, inching up 0.17% to $6.22 billion.

World Liberty Financial’s (WLF) stablecoin $USD1 showed the biggest muscle, climbing 7.37% to a $5.07 billion valuation. It marks the first time $USD1 has pushed past the $5 billion milestone. Sky’s DAI eased a hair by losing just 0.54% to $4.6 billion. Paypal’s PYUSD took a bruising, sliding 3.98% to $3.60 billion.

Meanwhile, Falcon Finance’s USDf edged down 0.27% and now stands at $2.05 billion. Circle’s U.S. Treasury-backed stablecoin USYC slid 2.3% to $1.62 billion. Global dollar (USDG) trimmed 1.22% and holds at $1.49 billion. Ondo’s yield-bearing dollar $USDY grabbed attention with a 10.10% weekly jump to $1.39 billion. Ripple USD trails the top 12, off 4.12% with a $1.36 billion market cap.

The stablecoin economy’s pullback arrives in step with the wider crypto slump, as heavyweights like bitcoin and ethereum see billions wiped from their market caps. Even as $3.748 billion vanished from select fiat-pegged tokens, names like WLF’s $USD1 and Ondo’s $USDY chose to buck the mood and swim upstream.

With the dust settled across the top 12 this week, as of Feb. 1, 2026, the stablecoin economy’s net value stands at $305.113 billion, making up 11.74% of the crypto economy’s total valuation of $2.6 trillion.

Also read: OSL Group Raises $200 Million to Accelerate Stablecoin and Payments Expansion

Over the last week and since Jan. 18, the numbers paint a market catching its breath rather than losing its nerve. While the stablecoin economy has cooled in tandem with broader crypto weakness, dominance remains concentrated and selective winners still emerge. For instance, out of the $305.113 billion today, $USDT dominates by 60.69%.

Capital is rotating, and the $305 billion base shows sticky demand for dollar-linked liquidity—even when risk appetite thins and valuations across digital assets tighten.

FAQ ❓

- What is the current size of the stablecoin market? As of Feb. 1, 2026, the stablecoin economy totals $305.113 billion, representing 11.74% of the broader crypto market.

- Why has the stablecoin market declined recently? The pullback reflects reduced crypto market activity as bitcoin and ethereum prices weaken and capital rotates defensively.

- Which stablecoin remains dominant today? Tether’s $USDT leads the market with a 60.69% share, holding roughly $185 billion in circulation.

- Are any stablecoins still growing despite the slowdown? Yes, $USD1 and $USDY expanded over the past week, defying the broader contraction.

cointelegraph.com

cointelegraph.com

coindesk.com

coindesk.com