Nu, the Latam-focused neobank, has reached a milestone by receiving a conditional approval to establish a national bank in the U.S., Nubank N.A. The organization, which serves over 127 million customers, says its new challenge will be to prove that digital-first services are the future of the financial services industry.

Nu Receives OCC Approval To Launch A National Bank in the US

São Paulo-based Nu, one of the largest Latam-focused digital neobanks, is ready to jump north.

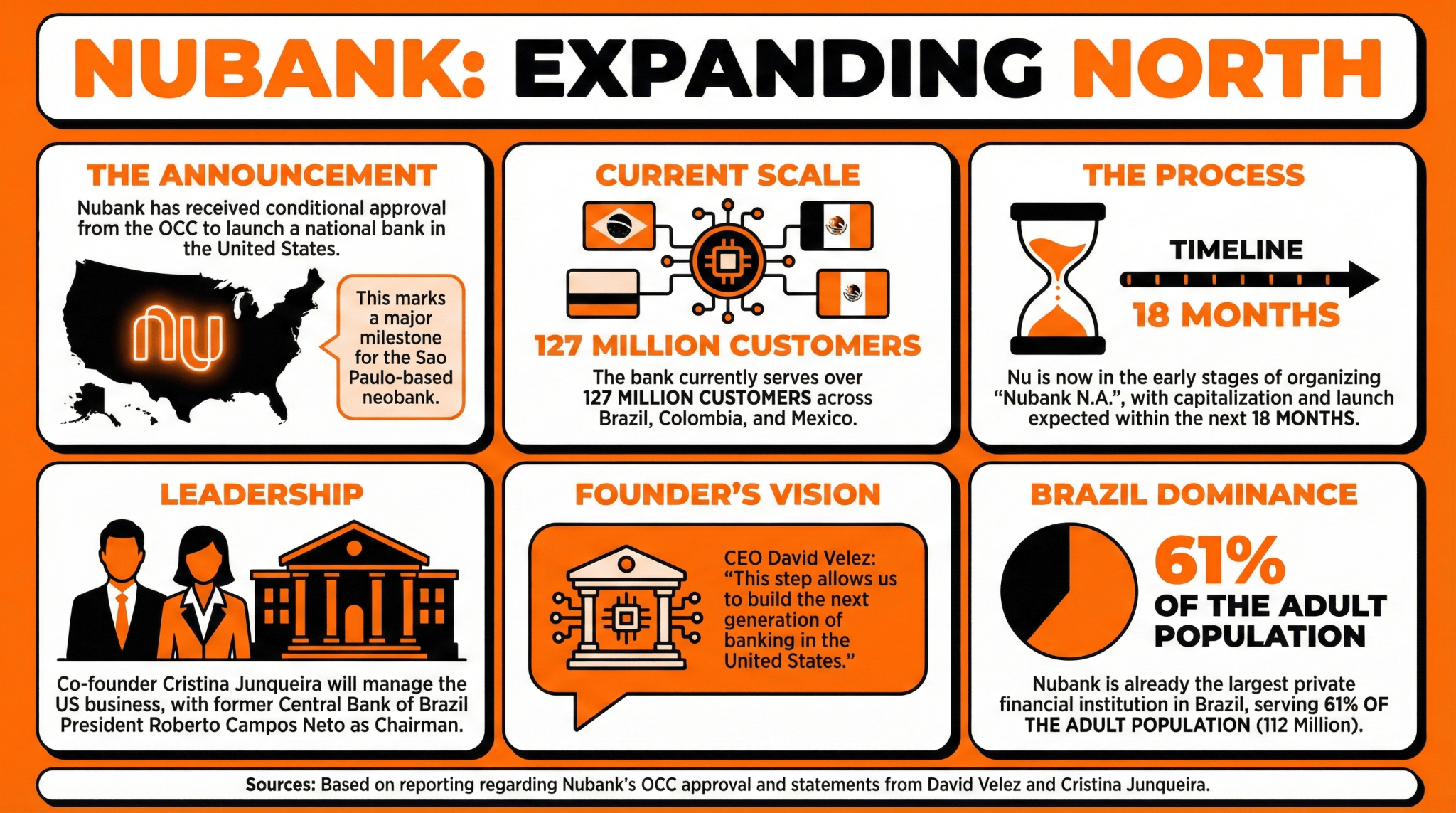

With over 127 million customers across Brazil, Colombia, and Mexico, Nu is now expanding to the U.S. after reaching a significant milestone. Nu has received conditional approval from the Office of the Comptroller of the Currency (OCC) of the United States to take the first steps toward launching a national bank, Nubank N.A.

With this approval, Nu, which operates the Nubank platform, is now in the first stages of organizing the bank, dealing with satisfying the requirements specified by the OCC. This includes the capitalization and launch of Nubank N.A. during the next 18 months.

Nu Holdings founder and CEO David Velez identifies this new opportunity as a challenge to demonstrate that digital-first banking alternatives, such as Nubank, are poised to become the future of finance, both in Latam and the world.

“While we remain fully focused on our core markets in Brazil, Mexico, and Colombia, this step allows us to build the next generation of banking in the United States,” Velez explained.

The new banking business will be managed by Nu’s co-founder Cristina Junqueira, with former Central Bank of Brazil President Roberto Campos Neto as Chairman of the board of directors. “We look forward to delivering the transparent, efficient financial experiences already trusted by more than 127 million customers around the world to our future customers in the U.S.,” Junqueira assessed.

With this move, Nubank strives to keep growing with a full digital bank service offering even in already crowded markets. The institution is already the largest private financial institution in Brazil, registering over 61% of the country’s adult population – 112 million- as customers.

Read more: Nubank Seeks to Acquire Traditional Bank to Satisfy Brazilian Regulatory Requirements

FAQ ❓

-

What major expansion is São Paulo-based Nubank undertaking?

Nubank is expanding to the U.S. after receiving conditional approval from the Office of the Comptroller of the Currency (OCC) to launch Nubank N.A. -

How many customers does Nubank currently serve?

Nubank serves over 127 million customers across Brazil, Colombia, and Mexico. -

What are the next steps for Nubank in the U.S. market?

The company is working on satisfying OCC requirements to capitalize and launch Nubank N.A. within the next 18 months. -

Who will lead Nubank’s new banking venture in the U.S.?

The bank will be managed by Nubank’s co-founder Cristina Junqueira, with former Central Bank of Brazil President Roberto Campos Neto serving as Chairman.

cryptopolitan.com

cryptopolitan.com

coinfomania.com

coinfomania.com

cointelegraph.com

cointelegraph.com