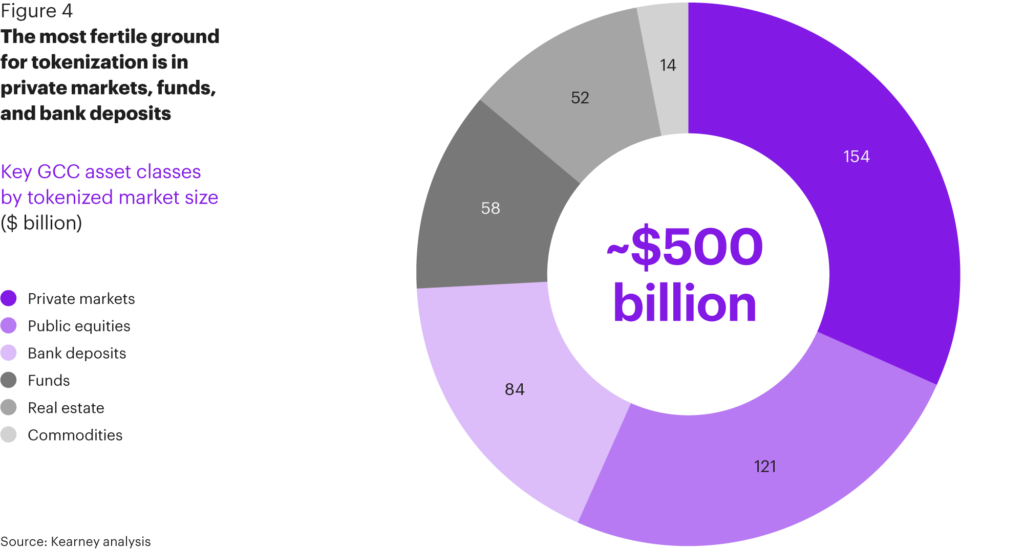

Kearney, a global management consulting firm, in its recent report, confirms that the projected growth for tokenization uptake in the GCC (Gulf Cooperation Council) countries is close to $500 billion worth of assets. The fertile sectors for tokenization are private markets, funds, and bank deposits, while the primary catalysts are financial institutions, asset managers, and sovereign wealth funds.

As per the report, private markets represent the largest tokenization opportunity for the GCC. This is due to the high and clear demand from investors seeking transparent ways to participate. Private markets are also projected to grow from $4.5 trillion in 2024 to $6 trillion in 2030. Private companies with tokenization can cost-effectively open up ways for investors to build and manage their private market portfolios.

This is especially important in Dubai and Riyadh, where there is a strong pipeline of high-growth start-ups and unicorns.

On-chain RWAs (excluding stablecoins) have grown from approximately $1.1 billion in early 2023 to nearly $20 billion by January 2026.

Additionally, Kearney also sees that tokenization will be quite strong in GCC stock markets, such as KSA’s Tadawul and Dubai Financial Market. By tokenizing listed securities, this could simplify cross-border access and reduce intermediary layers while opening up fractional ownership for easier participation. Aramco, with a market cap of $1.5 trillion, could utilize this by allowing investors to take part in smaller ticket sizes.

Kearney also discusses how bank deposits can adopt tokenization, enabling them to offer real-time institutional settlement, optimized treasury operations, and more. The report notes that already, banks in KSA, Qatar, and UAE are exploring tokenized bank deposits as an alternative to stablecoins.

As for Funds, Kearney notes that progress has been stalled in the GCC due to regulatory approvals or a lack thereof. If massive sovereign wealth funds such as Saudi Arabia’s Public Investment Fund, which has $913 billion in AUM, do tokenize, it will create a more efficient structure for their fund, enhanced liquidity options, streamline operations, and greater visibility.

When it comes to real estate, Kearney sees this as a compelling asset class for governments and the public. There are two advantages: the fractional ownership and the enhanced liquidity with potential for secondary trading. Kearney mentions the Prypco, Ctrl Alt tokenization project in Dubai, UAE, under the VARA-regulated ecosystem.

It also mentions the Saudi Arabian launch of the national real estate tokenization infrastructure project, which has been enabled by SettleMint as the tokenization platform and implementor.

The Kearney report touches on commodity tokenization, mentioning gold in particular, as well as gem tokenization, mentioning diamonds, and then oil and gas. Interestingly, for oil and gas, they see investors accessing the market beyond traditional equities and ETFs, such as tokenized futures and direct commodity exposure.

In Conclusion, Kearney notes that all these asset classes, which can be tokenized, represent a close to $500 billion opportunity by 2030. It explains, ” This suggests a fundamental shift in market dynamics, and explains why governments, financial institutions, and asset managers are beefing up their digital asset strategies.”

Is GCC ready for tokenization?

According to the report, the most important question is how ready the GCC is to support tokenization, discussing the three major challenges as well.

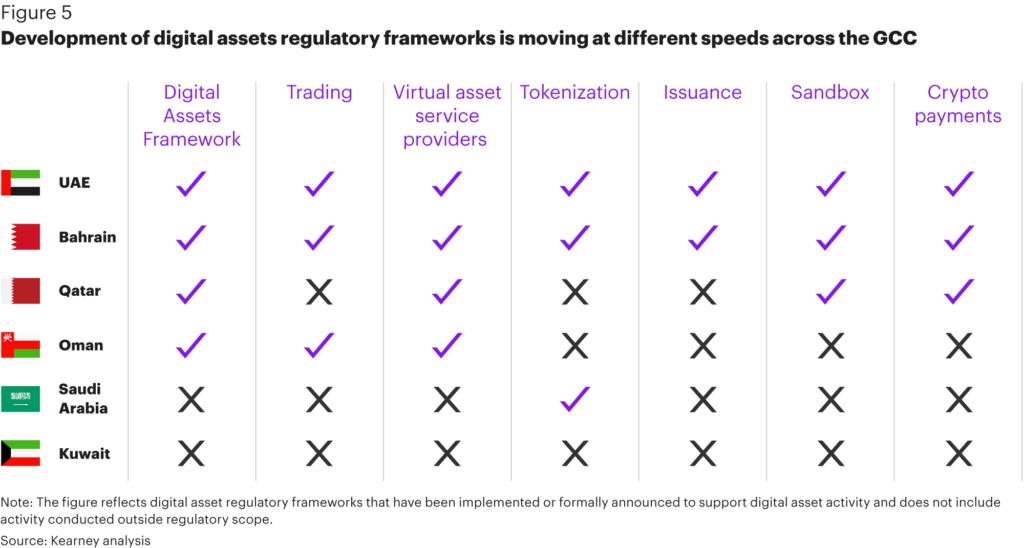

Firstly, in terms of the regulatory landscape, while there are moves to build regulatory frameworks that support tokenization and digital financial and trading systems, the countries that are leading in this respect are the UAE and Bahrain, with Kuwait currently not doing anything in this sector.

Jereon Gillekens, Principal Digital and Analytics Practice, at Kearney Middle East and Africa, believes that tokenization will scale where market infrastructure and regulations evolve in step. He explains, “Issuance, custody, settlement, and secondary trading must function as an integrated system, with digital asset capabilities embedded into core operating models. That alignment is what enables durable, institutional-grade markets.”

Another challenge facing the GCC is how to utilize and integrate the technology, blockchain, DLT, and digital assets. Kearney research notes that for tokenization to be viable at an institutional level, enterprise-grade infrastructure will need to align with existing operational and regulatory processes.

This includes support for issuance structures, custody, settlement, payments, regulatory integration, on- and off-ramps, cap table management, and valuation processes, alongside analytics and reporting tools that provide visibility and auditability, both vital to maintain stakeholder trust.

Adam Popet, CEO of SettleMint, commenting to Cryptopolitan on the report states, “When it comes to tokenization and the adoption of blockchain technology in production and at real scale, you need technologies that are robust, proven, and able to easily integrate with institutions’ existing core operating systems. Anything else will be a non-starter.”

Also important is market infrastructure. What is meant by that is there should be reliable mechanisms for issuance, trading, settlement, and asset servicing, or else tokenized assets will struggle to move beyond isolated pilots. This fragmentation creates friction, limiting liquidity and restricting cross-border distribution.

Who will lead tokenization in the GCC?

According to the report, financial institutions, asset managers, and sovereign investors are likely to be the primary catalysts for tokenization projects within the GCC. They will shape both supply and demand for tokenized instruments.

Andrew Forson, President of DeFi Technologies, commenting on this statement to Cryptopolitan states, “Absolutely, Financial institutions will be the catalyst because they stand at the intersection of availability of capital and the need for capital, and their lifeblood is to execute transactions amongst providers of capital and consumers of capital.”

He adds, “Tokenized assets represent the advancement of technology that enables anybody, anywhere, to participate in capital markets any time. This means an automatic increase of TAM (Total addressable market) for the innovative financial institution.”

cryptobriefing.com

cryptobriefing.com

coindesk.com

coindesk.com