Key Highlights

- Crypto.com has formally raised objections to a rule that would exclude companies with over 50% digital asset holdings from major global stock indexes

- This objection has raised support from the industry leaders and supporters

- The largest corporate Bitcoin holders warn that the rule is “discriminatory, arbitrary, and unworkable”

A leading cryptocurrency exchange, Crypto.com has formally raised objections to a proposal from Morgan Stanley Capital International (MSCI). The proposal from MSCI wants to exclude certain companies from its major stock indexes based on how much cryptocurrency they hold.

Justin Wales, Head of Legal for the Americas at Crypto.com, argues that this new rule unfairly singles out digital assets as a treasury holding in a way it does not for other asset types.

Index methodologies should be neutral, consistent, and grounded in economic reality. Proposals that single out one asset class or rely on blunt balance-sheet thresholds risk misclassifying operating companies and weakening index accuracy and comparability. Global indexes should… https://t.co/KTUtRmrMGE

— Blockchain Association (@BlockchainAssn) December 23, 2025

This proposal also got support from the cryptocurrency industry.

MSCI’s New Rule for Digital Asset Treasury Sparks Controversy

This controversy started in October 2025 when MSCI introduced a new guideline. According to the new rule, the firm is considering removing companies from its flagship Global Investable Market Indexes if digital assets make up to 50% or more of their total assets and their main activity is seen as managing that “digital asset treasury.”

MSCI states that these companies are starting to look more like investment funds, which are not included in its stock indexes, rather than traditional operating businesses.

The review came from the questions from MSCI’s clients, which include massive investment funds that track these indexes and want clear guidelines.

However, digital asset companies have raised objections on this matter. They affirmed that this proposal creates a bias by focusing on the type of asset instead of what the company actually does. An initial list from MSCI shows that 39 companies could be affected, with a total market value exceeding $113 billion.

Crypto.com and Corporate Bitcoin Treasuries Fight Back Against the MSCI’s Proposal

The company that is most directly on the target is Strategy, which is the world’s biggest corporate holder of Bitcoin. At the time of writing, the company is holding 671,268 BTC. This easily places it above the proposed 50% threshold, which makes it a major company for exclusion. Being removed from MSCI’s indexes could force index-tracking funds to sell billions of dollars worth of Strategy’s stock.

The company’s executive chairman, Michael Saylor, has presented strong arguments against this proposal. In a detailed letter co-signed with CEO Phong Le in December 2025, Strategy called the 50% rule “Discriminatory, Arbitrary, and Unworkable.”

“The proposal’s 50% rule arbitrarily singles out digital asset businesses for uniquely unfavorable treatment, while leaving untouched businesses in other industries(such as oil, timber, gold, media and entertainment, and real estate) that have similarly concentrated holdings in a single asset type. And there is no way to implement the proposed 50% rule consistently or fairly,” stated in the letter.

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

“Funds and trusts passively hold assets. Holding companies sit on investments. We create, structure, issue, and operate. Our team is building a new kind of enterprise—a Bitcoin-backed structured finance company with the ability to innovate in both capital markets and software,” Michael Saylor stated in the post on X.

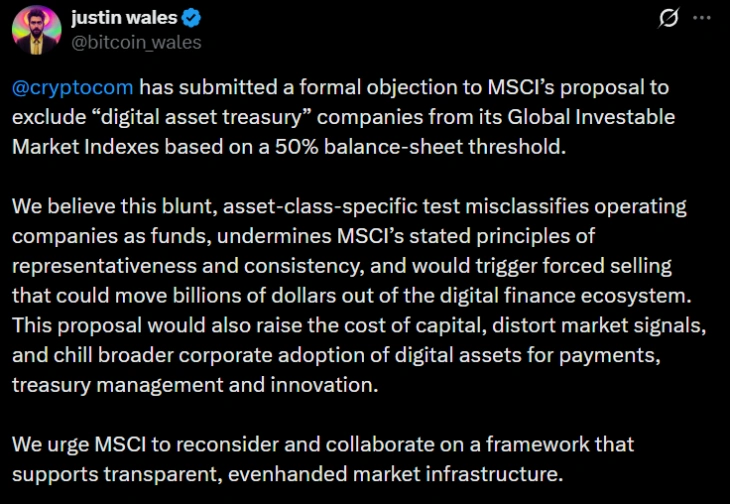

(Source: Justin Wales on X)

Justin Wales stated that the new rule “misclassifies operating companies as funds, undermines MSCI’s stated principles of representativeness and consistency, and would trigger forced selling that could move billions of dollars out of the digital finance ecosystem.”

“This proposal would also raise the cost of capital, distort market signals, and chill broader corporate adoption of digital assets for payments, treasury management, and innovation,” he added further.

Experts Warn of Consequences of MSCI Index Exclusions

Many financial analysts are raising warnings about the potential impacts of the MSCI’s new rule. BitcoinForCorporations, an advocacy group, revealed that forceful exclusions could trigger between $10 billion and $15 billion in selling pressure across all affected firms.

Analysis from banking giant JPMorgan suggests that Strategy alone could face $2.8 billion in sales from passive funds.

Also Read: US Q3 GDP Surges 4.3%, Bitcoin Dips Amid Profit-Taking

cryptopolitan.com

cryptopolitan.com

cointelegraph.com

cointelegraph.com

news.bitcoin.com

news.bitcoin.com