Bitcoin and altcoins continue to show weakness as the end of 2025 approaches. At this point, Bitcoin is expected to finish the year below $100,000, and Coinshares has released its weekly cryptocurrency report, stating that there was a $952 million outflow last week.

“In cryptocurrency investment products, outflows of $952 million were recorded for the first time in four weeks, due to delays in the US Clarity Act, prolonged regulatory uncertainty, and concerns about large investor sell-offs.”

Coinshares attributed the massive outflow from Bitcoin and altcoin funds to the US Clarity Act not being passed by the end of the year, leading to increased uncertainty. As is known, the Clarity Act was expected to bring significant clarity to cryptocurrencies in the US.

Outflows Concentrated in Bitcoin, Ethereum and the US!

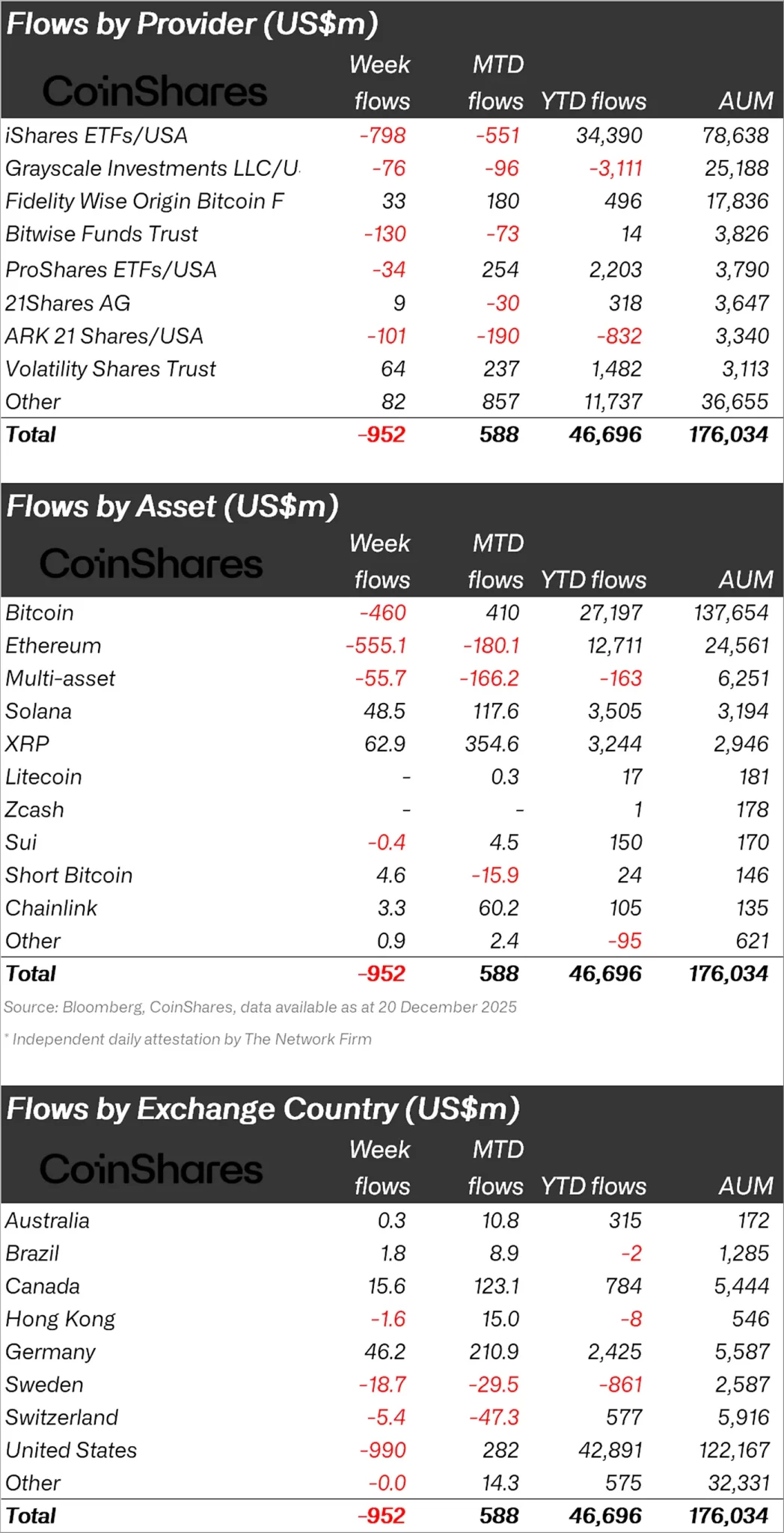

Looking at crypto funds individually, the majority of outflows this week were seen in Ethereum.

Ethereum (ETH) experienced an outflow of $555.1 million, while Bitcoin saw an outflow of $460 million.

Looking at other altcoins, Solana (SOL) saw inflows of $48.5 million, XRP $62.9 million, and Chainlink (LINK) $3.3 million.

“Ethereum experienced the largest outflow of funds, at $555 million USD. This is understandable, considering it’s the cryptocurrency that will most likely gain or lose from the Transparency Act.”

Bitcoin came in second with $460 million. In contrast, Solana and XRP continued to see fund inflows, indicating selective investor support.

Solana and XRP continued to receive support with inflows of $48.5 million and $62.9 million, respectively.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $990 million.

After the US, Sweden experienced an outflow of $18.7 million.

In response to these outflows, Germany experienced inflows of $46.2 million, while Canada saw inflows of $15.6 million.

*This is not investment advice.

coindesk.com

coindesk.com

cryptobriefing.com

cryptobriefing.com

u.today

u.today