Under loosened regulations from the Trump administration in the United States, both decentralized finance (DeFi) and centralized platforms are rushing to bring real-world assets (RWAs) onchain, with tokenized stocks being one of this year's breakout products.

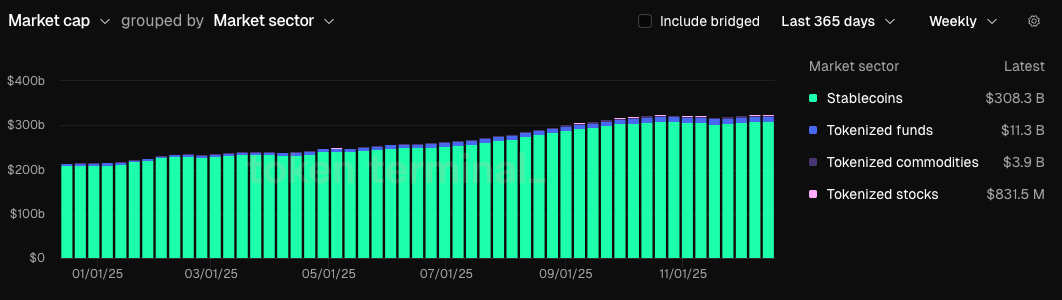

According to TokenTerminal, the market capitalization of tokenized stocks stands at $831 million as of this week, compared to just $32 million at the beginning of 2025, a 2496% increase.

Major traditional finance (TradFi) and DeFi companies are piling in to win the tokenized equity race, with popular retail platforms such as Robinhood diving headfirst into tokenized equity trading. Crypto exchanges Coinbase and Kraken are also competing for their own slice of the pie, while decentralized venues like TradeXYZ and Ostium are working on crypto-native adoption.

Robinhood offers the largest number of tokenized stocks, with nearly 2000 tokenized assets according to Dune Analytics, while TradeXYZ boasts the highest publicly available trading volumes, averaging $4 billion per week over the last month.

Tokenized commodities and funds have also grown, albeit to a lesser extent than tokenized stocks. Over the last year, the tokenized commodity space is up 220% to $3.8 billion, and the tokenized fund sector is up 145% to $11.3 billion. However, it is worth noting that tokenized commodities and funds both began the year with significantly larger valuations of $1.2 billion and $4.3 billion, respectively, compared to the tokenized stock sector’s $32 million.

coindesk.com

coindesk.com

protos.com

protos.com

cryptobriefing.com

cryptobriefing.com

coinfomania.com

coinfomania.com

coingape.com

coingape.com