Bitcoin (BTC) and altcoins have entered the FOMC week, where the final interest rate decision of 2025 will be announced, with a recovery.

BTC, which fell below $90,000 over the weekend, rose above $92,000 with the new week.

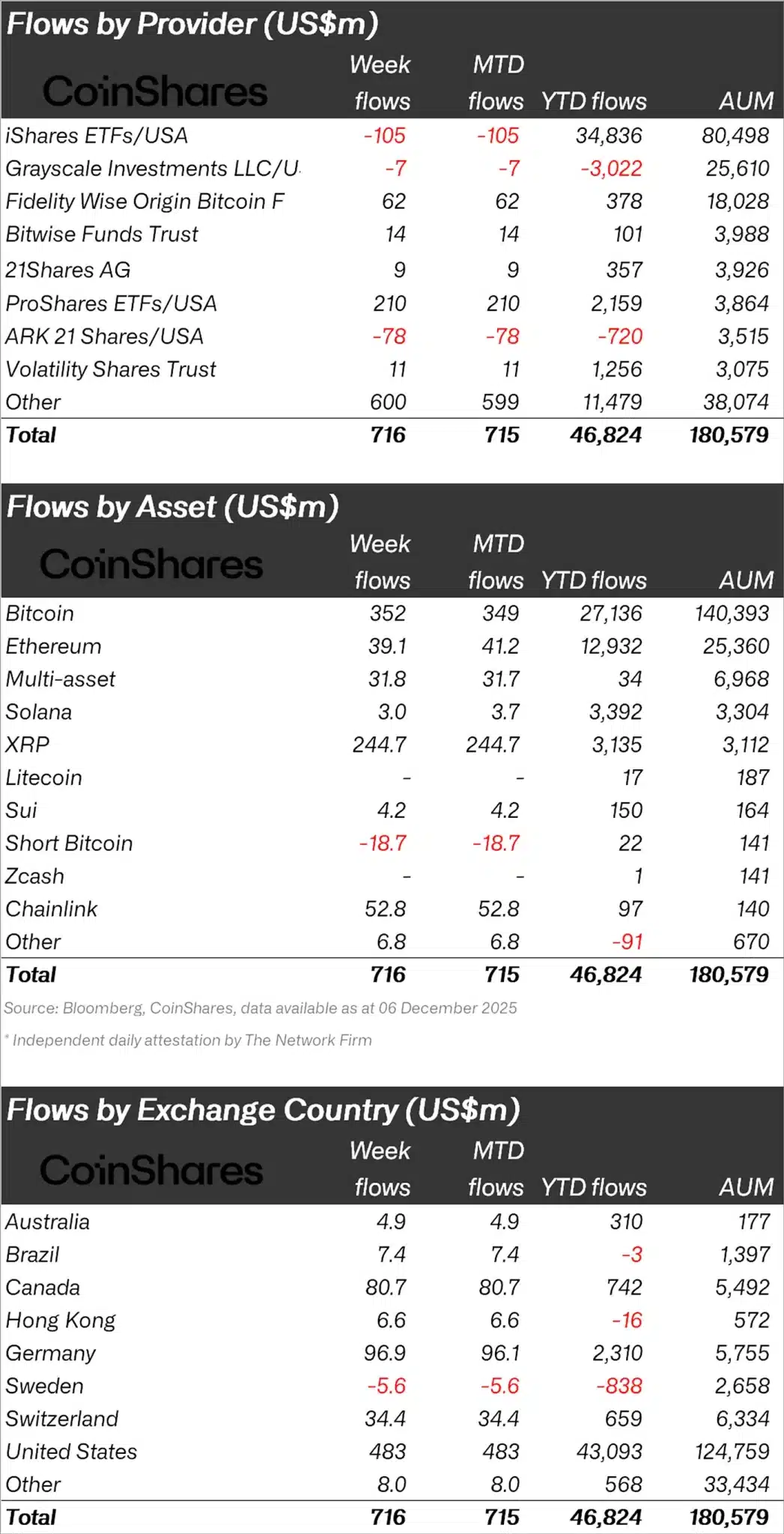

While the Fed is expected to make another 25 basis point cut this week, Coinshares released its weekly cryptocurrency report and said that $716 million in inflows occurred last week.

“Last week, $716 million in inflows into cryptocurrency investment products increased, bringing total assets under management to $180 billion, but this figure is still well below the all-time high of $264 billion.”

XRP and Chainlink Make a Big Attack!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $352 million, Ethereum (ETH) experienced an inflow of $39.1 million.

Looking at other altcoins, XRP saw an inflow of $244.7 million, Solana (SOL) $3 million, Sui (SUI) $4.2 million, and Chainlink (LINK) $52.8 million.

“Bitcoin has been the biggest beneficiary, recording inflows of $352 million and bringing year-to-date (YTD) inflows to $27.1 billion.

XRP continued to see strong inflows, reaching a total of $245 million last week, bringing year-to-date inflows to $3.1 billion, vastly outpacing the $608 million inflow seen in 2024.

Chainlink also saw relatively large inflows last week, totaling $52.8 million.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $483 million.

Following the USA, Germany had an inflow of $96.9 million and Canada $80.7 million.

Against these inflows, only Sweden experienced a small outflow of $5.6 million.

*This is not investment advice.