By Omkar Godbole (All times ET unless indicated otherwise)

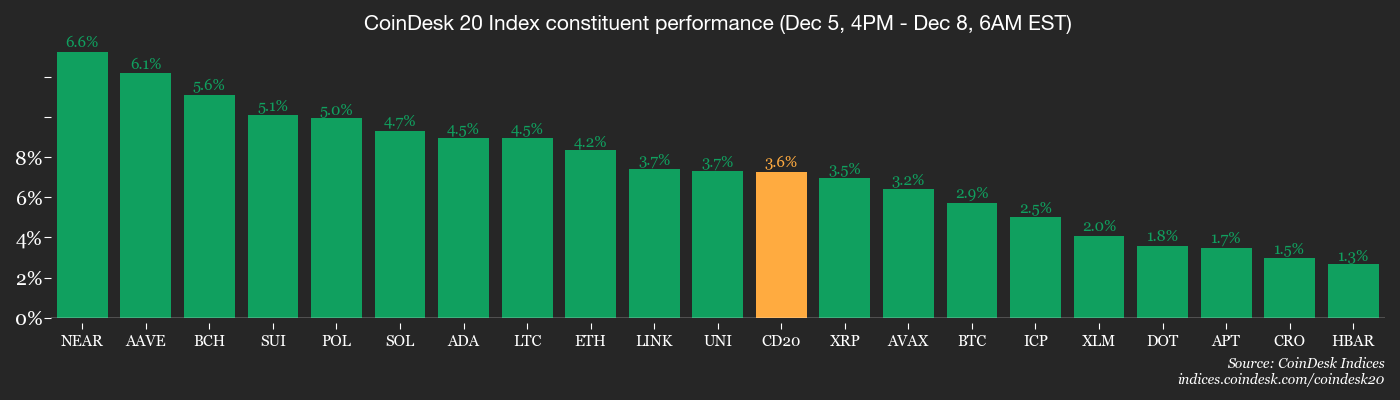

The crypto market perked up Monday on expectations of a Federal Reserve rate cut that are juicing the appetite for risk across the board. Bitcoin $BTC$91,854.83 rose to nearly $92,000, up 3% over the last 24 hours, while the CoinDesk 20 and CoinDesk 80 indexes added in the region of 3.5%.

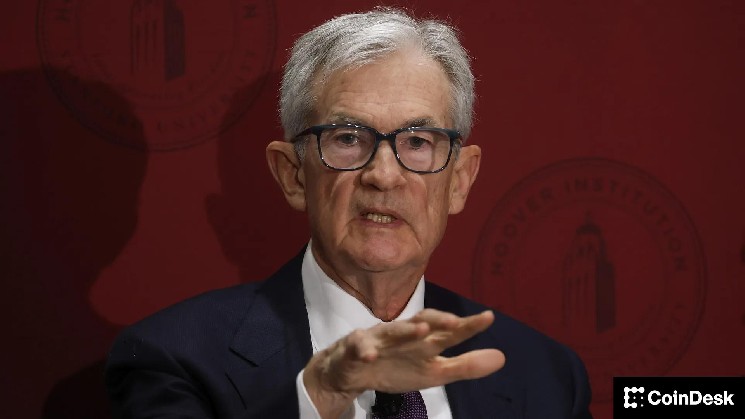

That said, bulls might want to exercise caution because there are least three yellow flags waving. First off, this rate cut is basically a done deal, so all eyes are on Fed Chair Jerome Powell's forward guidance and whether he'll signal more cuts in 2026. Some market watchers are betting against aggressive easing. Case in point: The 10-year yield is climbing in the lead-up to the meeting, hinting bond traders smell a hawkish vibe.

Momentum's leaning bearish too. The CoinDesk Bitcoin Trend Index screams strong downtrend, and the ether equivalent isn't far behind. These flipped bearish in mid-November, nailing the timing on the price slide that followed.

Flows aren't screaming "buy" either. The U.S.-listed spot bitcoin ETFs leaked a net $87.77 million last week, with spot ether ETFs bleeding $65.59 million, according to SoSoValue.

"The tape is constructive beneath the surface, as big wallets are accumulating and exchange supply is historically low, but the market is politically and macro-sensitive this week," said Timothy Misir, a research analyst at BRN.

Misir added that a hawkish Fed cut, large-scale ETF outflows or re-acceleration of exchange inflows and data that dents rate-cut bets, could play spoilsport.

Watch for volatility in the broader market too, as token unlocks for CONX, APT, STRK, CHEEL, LINEA, and BB, each worth over $5 million, are scheduled for the next seven days, as noted by newsletter service LondonCryptoClub.

Over in traditional markets, gold's rally has hit pause around $4,200 per ounce. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Dec. 8: EstateX (ESX) platform goes live for Unicorn Club members (1M ESX required) and NFT holders; first property put up for sale.

- Dec. 8 (market open): ProCap Financial Inc. (BRR), formed by the merger of Columbus Circle Capital Corp. I and ProCap $BTC, LLC, begins trading on the Nasdaq Global Market.

- Dec. 8, 11:30 a.m.: Enjin (ENJ) activates the Senotsa upgrade on the mainnet of both Relaychain and Matrixchain.

- Dec. 8, 1:30 p.m.: Hivemapper (HONEY) AMA on X Spaces.

- Macro

- Nothing major scheduled.

- Earnings(Estimates based on FactSet data)

- None scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Dec. 8: MINA$0.09677 to host community call for an update on the Mesa upgrade at 11 a.m.

- Celo Public Goods is voting on the December allocation for "Support Streams Season 1," distributing CELO and OP to projects based on stCELO votes. Voting ends Dec. 8.

- Aave DAO is voting to onboard the Paxos-issued USDG stablecoin to the Aave V3 Core instance. Voting ends Dec. 8.

- Unlocks

- No major unlocks.

- Token Launches

- Stable (STABLE) lists on various exchanges including Bitfinex and KuCoin.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 1 of 2: Bitcoin MENA 2025 (Abu Dhabi)

- Day 1 of 2: Blockchain Association’s Policy Summit 2025 (Washington)

- Day 1 of 4: Abu Dhabi Finance Week 2025 (Abu Dhabi)

Market Movements

- $BTC is up 3.32% from 4 p.m. ET Friday at $92,192.06 (24hrs: +3.27%)

- $ETH is up 4.63% at $3,160.68 (24hrs: +3.98%)

- CoinDesk 20 is up 3.75% at 2,945.01 (24hrs: +3.59%)

- Ether CESR Composite Staking Rate is up 1 bps at 2.85%

- $BTC funding rate is at 0.0039% (4.242% annualized) on Binance

- DXY is unchanged at 98.95

- Gold futures are down 0.17% at $4,235.70

- Silver futures are down 0.29% at $58.88

- Nikkei 225 closed up 0.18% at 50,581.94

- Hang Seng closed down 1.23% at 25,765.36

- FTSE is unchanged at 9,664.29

- Euro Stoxx 50 is unchanged at 5,725.95

- DJIA closed on Friday up 0.22% at 47,954.99

- S&P 500 closed up 0.19% at 6,870.40

- Nasdaq Composite closed up 0.31% at 23,578.13

- S&P/TSX Composite closed down 0.53% at 31,311.41

- S&P 40 Latin America closed down 3.98% at 3,126.05

- U.S. 10-Year Treasury rate is up 1.2 bps at 4.151%

- E-mini S&P 500 futures are up 0.11% at 6,886.00

- E-mini Nasdaq-100 futures are up 0.2% at 25,784.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 47,991.00

Bitcoin Stats

- $BTC Dominance: 59.38% (-0.12%)

- Ether-bitcoin ratio: 0.03434 (1.41%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $38.75

- Total fees: 1.99 $BTC / $178,769

- CME Futures Open Interest: 121,060 $BTC

- $BTC priced in gold: 21.8 oz.

- $BTC vs gold market cap: 6.16%

Technical Analysis

- The chart shows daily swings in the 10-year U.S. Treasury yield.

- The benchmark yield continues to rise despite the impending Fed rate cut and has carved out a bullish inverse head-and-shoulders pattern.

- A breakout above the pattern's resistance (yellow) line could accelerate the uptrend, potentially adding volatility to traditional and digital asset markets.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $269.73 (-1.58%), +2.11% at $275.42 in pre-market

- Circle (CRCL): closed at $85.62 (-2.1%), +0.15% at $130.04

- Galaxy Digital (GLXY): closed at $25.51 (-7.47%), +1.92% at $26

- Bullish (BLSH): closed at $46.45 (-4.07%), +1.42% at $47.11

- MARA Holdings (MARA): closed at $12.47 (+4.7%), +2.56% at $12.04

- Riot Platforms (RIOT): closed at $14.94 (-4.17%), +2.01% at $15.24

- Core Scientific (CORZ): closed at $17.11 (+0.18%)

- CleanSpark (CLSK): closed at $13.72 (-8.75%), +2.59% at $14.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.53 (-3.72%)

- Exodus Movement (EXOD): closed at $14.61 (-5.25%), +2.94% at $15.04

Crypto Treasury Companies

- Strategy (MSTR): closed at $178.99 (-3.77%), +2.23% at $182.98

- Semler Scientific (SMLR): closed at $17.11 (+0.18%)

- SharpLink Gaming (SBET): closed at $10.72 (-3.94%), +3.26% at $11.07

- Upexi (UPXI): closed at $2.66 (-6.67%), +2.63% at $2.73

- Lite Strategy (LITS: closed at $1.67 (-4.57%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: $54.8 million

- Cumulative net flows: $57.6 billion

- Total $BTC holdings ~1.31 million

Spot $ETH ETFs

- Daily net flows: -$75.2 million

- Cumulative net flows: $12.9 billion

- Total $ETH holdings ~6.25 million

Source: Farside Investors

While You Were Sleeping

- Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations (CoinDesk): Abu Dhabi’s regulator is making the platform split its trading, post-trade infrastructure and brokerage work into three locally incorporated entities so each regulatory category can be supervised separately.

- Robinhood to Enter Indonesia With Brokerage, Crypto Trader Acquisition (Reuters): Buying two licensed firms gives the U.S. platform a fast regulatory pathway into a market with tens of millions of equity and crypto participants, setting up its planned 2026 roll-out.

- Coinbase Reopens India Signups, Targets Fiat On-Ramp in 2026 After Two-Year Freeze (CoinDesk): The exchange returns to the market after securing registration with India’s financial-intelligence unit and reviving crypto-only trading through a clean-slate strategy while preparing to restore local currency access next year.

cryptobriefing.com

cryptobriefing.com