By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin

is holding its own as the broader crypto market declines in the run-up to today's Federal Reserve monetary policy decision and a slew of data later this week.

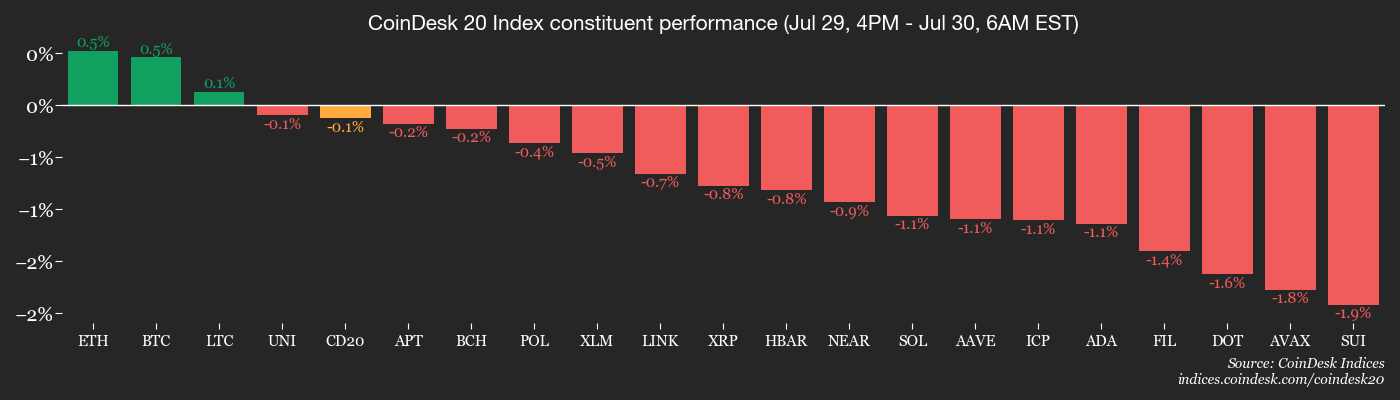

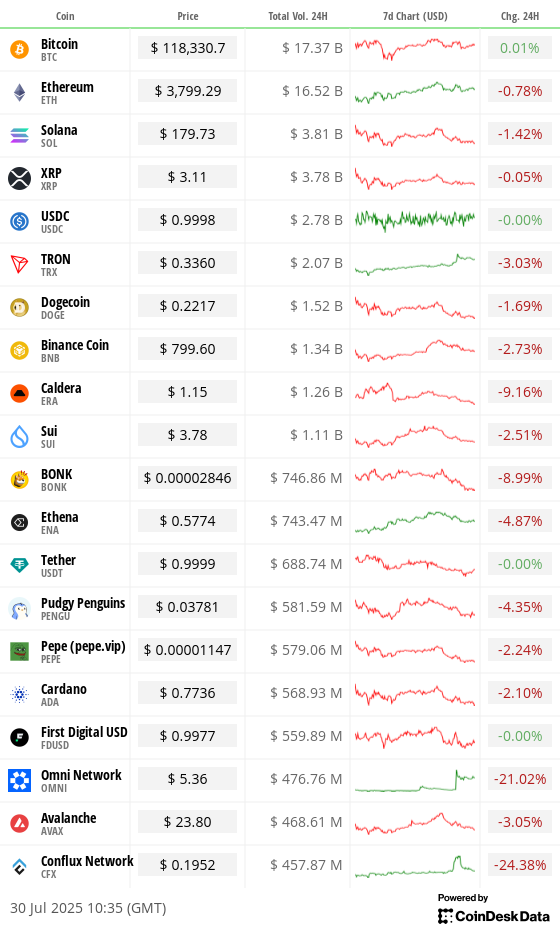

The CoinDesk 20 Index has fallen 1.6% in the past 24 hours, while bitcoin is unchanged around $118,300. Ether, which celebrates its 10th anniversary today, has lost about 0.8%, a sign of growing disillusion with altcoins (See Token Talk).

While the Fed is expected to hold interest rates steady — the CME’s FedWatch tool points to a 98% chance rates remain unchanged and Polymarket shows 97% odds of no change — there's plenty of macroeconomic uncertainty in the pipeline, not least July unemployment data due Friday, which is also the deadline for President Donald Trump’s reciprocal tariffs, expected to affect at least two dozen countries.

Still, the Fed’s decision carries added weight amid political pressure from Trump to cut the rate and signs of dissent within the Fed’s board.

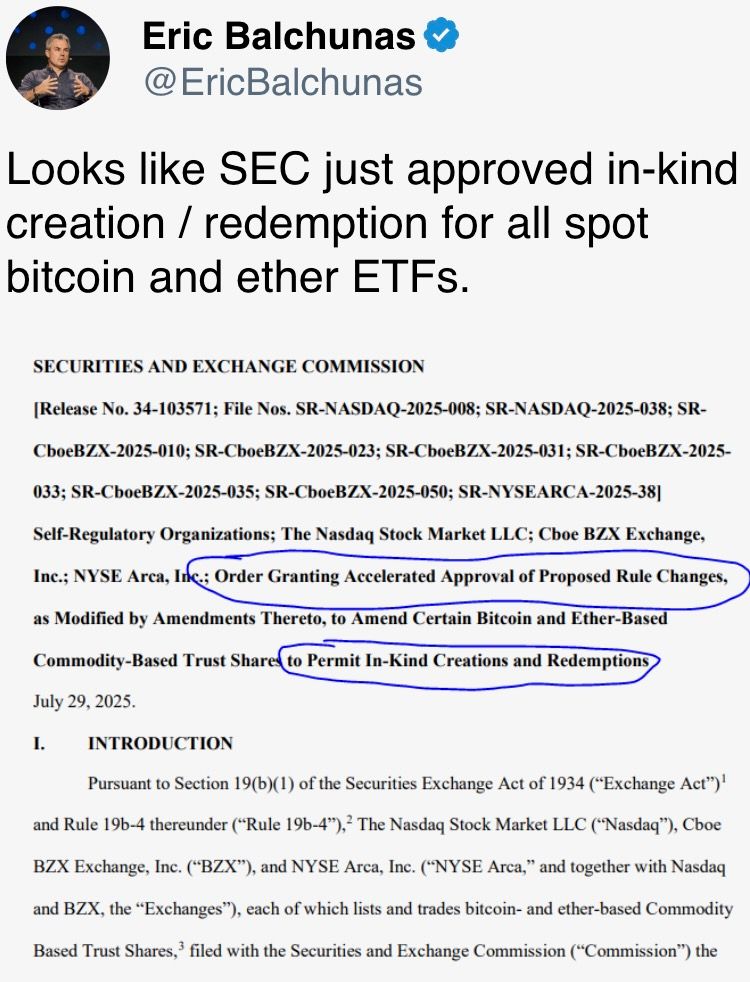

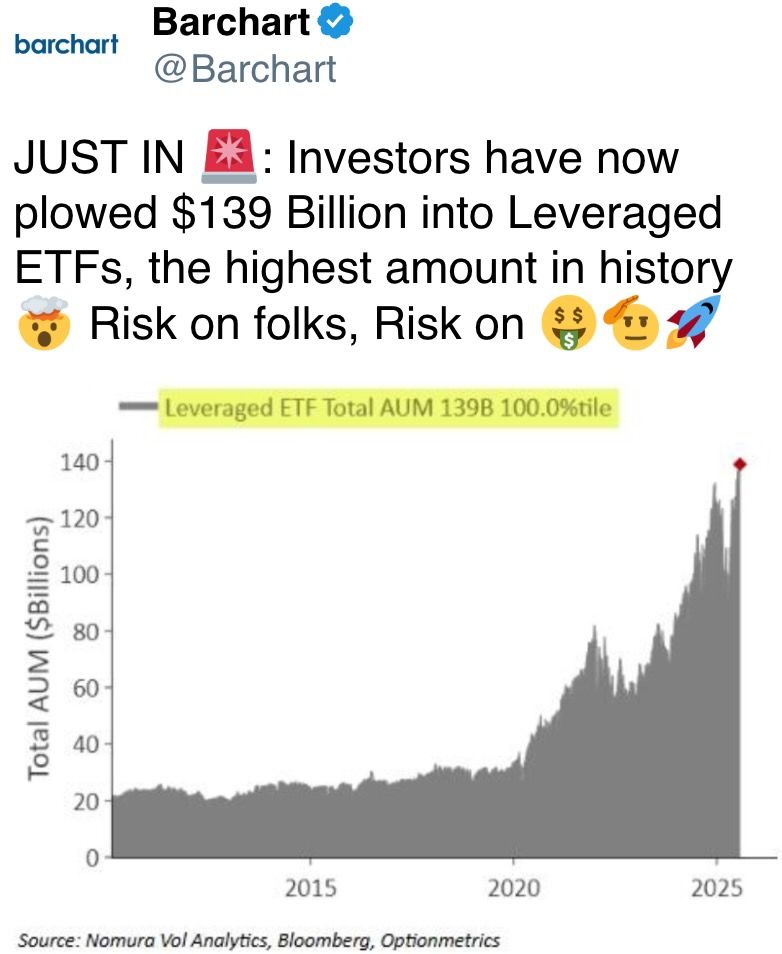

On a positive note for exchange-traded funds, the SEC approved in-kind redemptions for spot bitcoin and ether ETFs. That means authorized participants can swap ETF shares directly for crypto rather than needing to transact via cash, a decision that will ease volatility and smooth the transaction.

The shift comes as spot ETFs are booming. This month, total net inflows into spot bitcoin ETFs has exceeded $6 billion and into ether ETFs $5.4 billion, according to SoSoValue data. Spot ether ETFs are now in an 18-day inflow streak.

The Ethereum blockchain anniversary sees the network enjoying significant adoption as it adapts to innovations in the industry.

“With regulatory clarity, stablecoin rails, DeFi dominance, RWA applications and ETF flows converging, Ethereum isn’t chasing the next narrative — it’s aiming to become the institutional foundation that underwrites it,” Bitwise wrote in a report shared with CoinDesk.

The SEC’s move is the first major crypto-facing decision under its new chair, Paul Atkins, signaling a more open stance toward digital assets. Still, the market is caught between growing structural adoption and short-term macroeconomic jitters. Stay alert!

What to Watch

- Crypto

- July 31, 12 p.m.: A live webinar featuring Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential to become a global reserve currency amid dedollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), now running on Solana, undergoes its halving event, cutting annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing regime to regulate stablecoin activities in the city.

- Aug. 1: New Bretton Woods Labs will launch BTCD, which it says is the first fully bitcoin-backed stablecoin, on the Elastos (ELA) mainnet, a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Foundation.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- July 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q2 GDP growth data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 0.2% vs. Prev. 0.8%

- July 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (Advance Estimate) Q2 GDP data.

- GDP Growth Rate QoQ Est. 2.4% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2.2% vs. Prev. 3.8%

- GDP Sales QoQ Prev. -3.1%

- PCE Prices QoQ Est. 2.9% vs. Prev. 3.7%

- Real Consumer Spending QoQ Prev. 0.5%

- July 30, 9:45 a.m.: The Bank of Canada (BoC) announces its monetary policy decision and publishes the quarterly Monetary Policy Report. The press conference follows at 10:30 a.m. Livestream link.

- Policy Interest Rate Est. 2.75% Prev. 2.75%

- July 30, 1:30 p.m.: Uruguay's National Statistics Institute releases June unemployment rate data.

- Unemployment Rate Prev. 7.8%

- July 30, 2 p.m.: The Federal Reserve announces its monetary policy decision. Federal funds rates are expected to remain unchanged at 4.25%-4.50%. Chair Jerome Powell’s press conference follows at 2:30 p.m.

- July 30, 5:30 p.m.: Brazil’s central bank, Banco Central do Brasil, announces its monetary policy decision.

- Selic Rate Est. 15% vs. Prev. 15%

- July 31, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June unemployment rate data.

- Unemployment Rate Est. 6% vs. Prev. 6.2%

- July 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases June consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

- Core PCE Price Index YoY Est. 2.7% vs. Prev. 2.7%

- PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.5% vs. Prev. 2.3%

- Personal Income MoM Est. 0.2% vs. Prev. -0.4%

- Personal Spending MoM Est. 0.4% vs. Prev.-0.1%

- July 31, 11 a.m.: Colombia's National Administrative Department of Statistics (DANE) releases June unemployment rate data.

- Unemployment Rate Est. 9.1% vs. Prev. 9%

- July 31, 2 p.m.: Colombia's central bank, Banco de la República (BanRep), releases its monetary policy decision..

- Policy Rate Est. 9% vs. Prev. 9.25%

- Aug. 1, 12:01 a.m.: New U.S. tariffs take effect on imports from trade partners that failed to reach agreements by this date. For most countries, the baseline tariff will be in the 15-20% range.

- Aug. 1, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 147K

- Unemployment Rate Est. 4.2% vs. Prev. 4.1%

- Government Payrolls Prev. 73K

- Manufacturing Payrolls Est. 0K vs. Prev. -7K

- Aug. 1, 9 a.m.: S&P Global releases July manufacturing and services data for Brazil.

- Manufacturing PMI Prev. 48.3

- Aug. 1, 9:30 a.m.: S&P Global releases July manufacturing and services data for Canada.

- Manufacturing PMI Prev. 45.6

- Aug. 1, 9:45 a.m.: S&P Global releases (final) July manufacturing and services data for U.S.

- Manufacturing PMI Est. 49.5 vs. Prev. 52.9

- Aug. 1, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

- Manufacturing PMI Est. Est. 49.5 vs. Prev. 49

- Aug. 1, 10 a.m.: The University of Michigan releases (final) July U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 61.8 vs. Prev. 60.7

- Aug. 1, 11 a.m.: S&P Global releases July manufacturing and services data for Mexico.

- Manufacturing PMI Prev. 46.3

- Aug. 1 p.m.: Peru’s National Institute of Statistics and Informatics releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.13%

- Inflation Rate YoY Prev. 1.69%

- July 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q2 GDP growth data.

-

Earnings (Estimates based on FactSet data)

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Strategy (MSTR), post-market, -$0.10

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Euler DAO is voting to activate currently disabled fees in the Euler Lending protocol. Voting ends July 30.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators must approve the proposal for it to pass, and if so it could be implemented by late Q3. Voting ends Aug. 1.

- Compound DAO is voting to select its next Security Service Provider (SSP). Delegates are choosing between ChainSecurity & Certora, and Cyfrin. Voting ends Aug. 5.

- Unlocks

- July 31: Optimism

to unlock 1.79% of its circulating supply worth $22.1 million.OP$0.6868

- Aug. 1: Sui

to unlock 1.27% of its circulating supply worth $166.3 million.SUI$3.7138

- Aug. 2: Ethena

to unlock 0.64% of its circulating supply worth $23.35 million.ENA$0.5600

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $13.51 million.

- Aug. 12: Aptos

to unlock 1.73% of its circulating supply worth $51.12 million.APT$4.4305

- July 31: Optimism

- Token Launches

- July 31: PlaysOut (PLAY) to be listed on Binance Alpha, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Oliver Knight

- The crypto market went through the long-awaited "altcoin season" last week, with bitcoin's consolidation leading to capital rotation into the more speculative altcoin market.

- In previous cycles these periods of dramatic upside for altcoins lasted weeks, even months. This time, though, it seems to have lasted just a few days before the market shed its newfound gains.

- In the past seven days the likes of FLOKI, FAR and WIF have all lost more than 20% and double digit declines are present across the board.

- CoinMarketCap's altcoin season indicator has returned back to levels seen during the first half of the year, indicating that the outlook for altcoins is bleak because much of the institutional attention is on bitcoin.

- However, if BTC can break out of its current range and form a new record high above, say, $130,000, before entering a period of consolidation, that changes the narrative. Such a movement lays the groundworks for a repeat of last week's short, but exciting, altcoin season.

Derivatives Positioning

- BTC, SOl, ETH and XRP futures open interest has dropped in the past 24 hours with the crypto market witnessing some $300 million of liquidations.

- Annualized funding rates in BTC and DOGE remain elevated relative to other major coins near 10%, pointing to pronounced bullish sentiment in these markets.

- The top 25 tokens by market value have seen net selling pressure, as evidenced by the negative open interest-adjusted cumulative volume deltas.

- On Deribit, BTC short-term puts traded at a slight premium while ETH options showed call bias across all tenors.

- Block flows over Paradigm featured butterfly strategies and risk reversals in BTC.

Market Movements

- BTC is up 0.23% from 4 p.m. ET Tuesday at $117,740.73 (24hrs: +0.00%)

- ETH is up 0.28% at $3,774.875 (24hrs: -0.89%)

- CoinDesk 20 is up 0.28% at 3,961.08 (24hrs: -1.38%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.93%

- BTC funding rate is at 0.002% (2.19% annualized) on KuCoin

- DXY is unchanged at 98.82

- Gold futures are up 0.12% at $3,385.20

- Silver futures are down 0.26% at $38.19

- Nikkei 225 closed unchanged at 40,654.70

- Hang Seng closed down 1.36% at 25,176.93

- FTSE is down 0.21% at 9,117.40

- Euro Stoxx 50 is up 0.22% at 5,391.08

- DJIA closed on Tuesday down 0.46% at 44,632.99

- S&P 500 closed down 0.30% at 6,370.86

- Nasdaq Composite closed down 0.38% at 21,098.29

- S&P/TSX Composite closed up 0.49% at 27,539.88

- S&P 40 Latin America closed up 1.02$ at 2,599.74

- U.S. 10-Year Treasury rate is unchanged at 4.332%

- E-mini S&P 500 futures are unchanged at 6,409.25

- E-mini Nasdaq-100 futures are up 0.12% at 23,481.00

- E-mini Dow Jones Industrial Average Index are unchanged at 44,808.00

Bitcoin Stats

- BTC Dominance: 61.65% (0.28%)

- Ether to bitcoin ratio: 0.03214 (-0.12%)

- Hashrate (seven-day moving average): 896 EH/s

- Hashprice (spot): $58.88

- Total Fees: 5.07 BTC / $599,372

- CME Futures Open Interest: 140,340 BTC

- BTC priced in gold: 35.5 oz

- BTC vs gold market cap: 10.04%

Technical Analysis

- Gold has put in fourth straight monthly candle with a long upper shadow (wick), marking bull failure above $3,400.

- The repeated rejection above $3,400 calls for reassessment of the bullish view and signals potential for a price pullback.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $394.66 (-2.26%), +3.03% at $406.60 in pre-market

- Coinbase Global (COIN): closed at $371.44 (-2.12%), +3.19% at $383.30

- Circle (CRCL): closed at $181.64 (-2.01%), +3.15% at $187.36

- Galaxy Digital (GLXY): closed at $26.76 (-9.59%), +9.39% at $29.27

- MARA Holdings (MARA): closed at $16.61 (-3.21%), +3.25% at $17.15

- Riot Platforms (RIOT): closed at $13.6 (-6.27%), +6.4% at $14.47

- Core Scientific (CORZ): closed at $13.19 (-4.04%), +4.32% at $13.76

- CleanSpark (CLSK): closed at $11.73 (-2.49%), +2.64% at $12.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.91 (-4.67%), +4.05% at $25.92

- Semler Scientific (SMLR): closed at $36.6 (-6.75%), +7.92% at $39.50

- Exodus Movement (EXOD): closed at $31.63 (-4.76%), +8.13% at $34.20

- SharpLink Gaming (SBET): closed at $19.08 (-8.82%), -0.1% at $19.06

ETF Flows

Spot BTC ETFs

- Daily net flows: $80 million

- Cumulative net flows: $55.03 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $218.6 million

- Cumulative net flows: $9.64 billion

- Total ETH holdings ~5.67 million

Source: Farside Investors

Overnight Flows

Chart of the Day

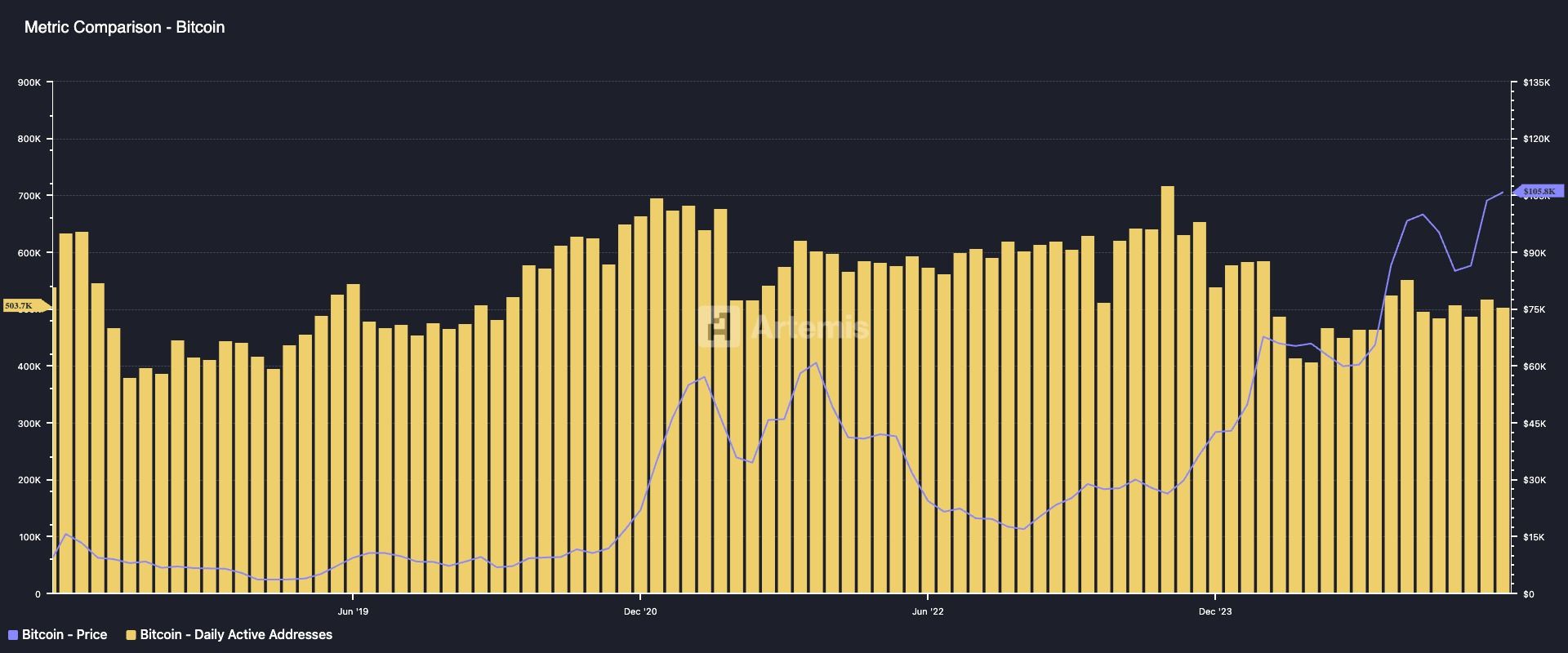

- While BTC's price hit record highs in July, active addresses held well below the peak in September.

- The discrepancy shows that the price rally is mainly driven by corporate treasury adoption and not on-chain activity.

While You Were Sleeping

- XRP Futures Volume on Kraken Eclipses Sol for 1st Time as Price Soars to Record (CoinDesk): XRP’s 40% price surge and rising U.S. derivatives activity reflect optimism after legal clarity and political shifts. Still, SOL leads in global open interest, signaling higher speculative positioning.

- Industry Experts Warn Crypto Infrastructure Is ‘Creaking’ (ComputerWeekly): A new report warns cryptographic systems are aging poorly, with near-term vulnerabilities and a looming threat from quantum computers that could break public-key encryption within 5–15 years.

- ARK Invest Buys Another $15.3M Worth of Ether Strategy Firm BitMine Immersion (CoinDesk): ARK added 477,498 shares of BitMine (BMNR) across three of its ETFs. BMNR closed Tuesday at $32, down 8.9%, extending its slide from a $135 peak earlier this month.

- Thailand and Cambodia Stepped Back From War, but Their Temple Fight Remains (The New York Times): With Thai forces blaming Cambodia for renewed clashes, officials will convene Monday alongside Malaysian observers, yet sovereignty disputes and domestic political posturing continue to endanger hopes for lasting calm.

- Strong Footsie, Strong UK? Not Necessarily (CNBC): Despite its strong 2025 performance and record highs, the FTSE 100 owes its gains to overseas exposure, a defensive sector tilt and a weak pound, not to U.K. economic strength.

- Russia Builds a New Web Around Kremlin’s Handpicked Super App (Bloomberg): Max, a new state-backed app for chat, payments and public services, is the latest step in Russia’s broader push to replace Western tech platforms with home-grown alternatives.

In the Ether

coindesk.com

coindesk.com