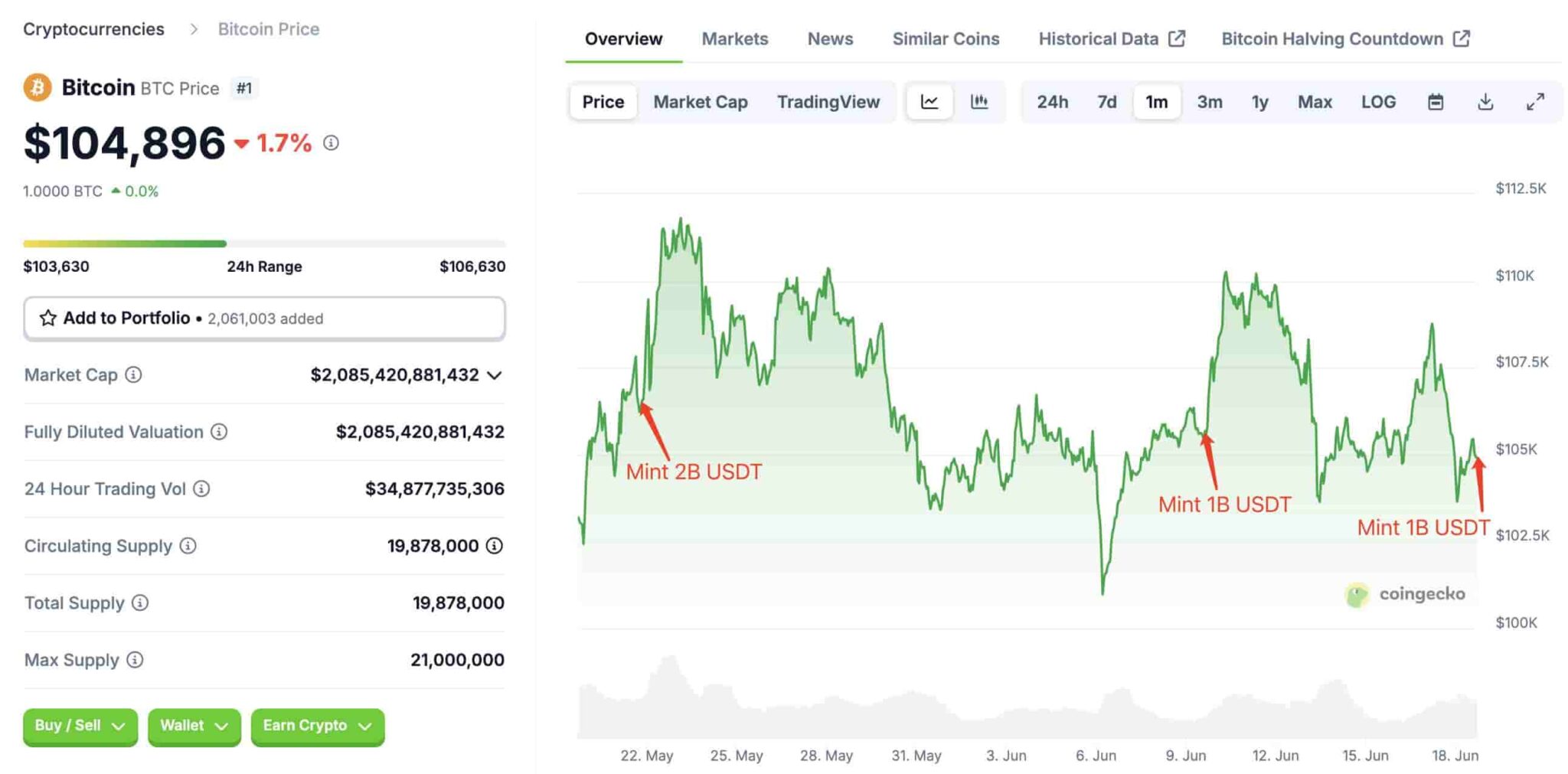

On June 18, Tether minted $1 billion worth of USDT on the Tron blockchain, according to on-chain data from Arkham Intelligence.

Historically, such minting events have coincided with short‑term surges in Bitcoin (BTC). Notably, on May 21, when Tether issued $2 billion USDT, the next day BTC broke its previous all‑time high, climbing past $111,000.

While minting alone doesn’t guarantee immediate impact, the available on-chain data reveals that major spikes in USDT supply often translate into large inflows to exchanges.

How will the mint affect Bitcoin price

Research suggests that Bitcoin often reacts positively in the short term following large Tether mints, particularly when on-chain alert accounts like Whale Alert publicly flag the transactions.

An article by Dr. Aman Saggu in Blockchain Research Lab found that Bitcoin tends to rise 0.4–0.8% within 5 to 30 minutes after a USDT mint. The response is asymmetric: mints push prices up, while burns have little to no effect.

The study, which reviewed minting and burning across Tether blockchains from 2014 to 2021, attributes the price movement to investor psychology, specifically FOMO during bullish sentiment phases.

Crucially, the effect is only observed once a mint is announced by Whale Alert or a similar service, suggesting the move is driven more by visibility and sentiment than by actual liquidity impact.

Featured image via Shutterstock.

finbold.com

finbold.com