Polymarket, a decentralized prediction market, predicts there is a 97.5 percent chance that the Federal Reserve will not lower interest rates during its next meeting. The forecast aligns with overall market expectations, which anticipate that the Fed may maintain its rate unchanged in the immediate future. Both investors and analysts expect the Fed to delay policy changes until September.

Markets on Edge Ahead of Key Global Decisions

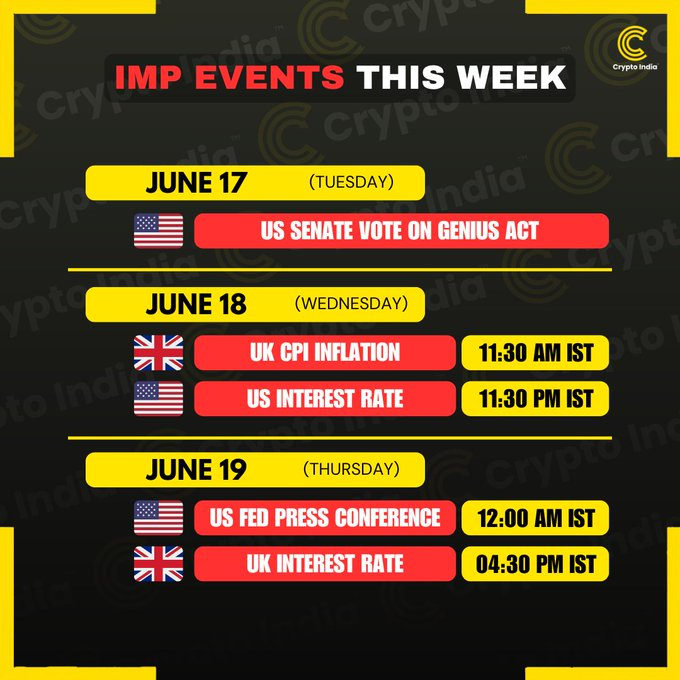

Markets are gearing up to a critical week as crucial events take place both in the US and the UK. Short-term market trends will be important for investors in this category as they are likely to be steered by political and economic developments. The U.S. Senate will vote on the GENIUS Act on Tuesday, June 17. This vote may have consequences pertaining to the policy and regulation of innovation.

On Wednesday, June 18, two major economic announcements will be made. The United Kingdom will publish its CPI inflation numbers, after which it will be followed by an interest rate decision of the U.S. Federal Reserve.

Traders are also following close attention to how the Fed will continue to deal with inflation and economic pressure. The direction provided by the central bank can dictate the rate movement in the future and influence liquidity of the globe.

The Fed will hold a press conference on Thursday. Chair Jerome Powell will update the monetary policy and give the perspective of the central bank on economic conditions. The Bank of England will declare its interest rate decision later in the same day. The decision will provide a clue on how the U.K. will combat inflation and economic growth

The Fed’s decision to hold rates will depend on key economic indicators like inflation and employment. Most analysts expect caution until the economy stabilizes. Any move could significantly impact financial markets, especially amid signs of a slowdown.

Fed at a Crossroads: Politics vs. Inflation Data

However, Trump is pressuring Fed Chair Jerome Powell to reduce rates, which is boosting the level of political scrutiny of the Fed’s decision-making process. The markets are closely watching the actions of the FOMC. Powell’s statements are also under scrutiny for any signals on potential rate changes.

The CPI data reported in May indicated that month-on-month inflation improved by 2.4% and annual inflation climbed to approximately 2.9%. These figures suggest that inflation might be brought under control, which might cause the Fed to hold off on any rate adjustments.

Markets strongly believe the Fed will not cut rates for now. Everyone is waiting to hear what Powell says and how new data will guide the next decision.

Related: Bitcoin & FOMC: What Santiment’s 4 Scenarios Mean for BTC Price

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com