Ethereum is trying to stabilize after weeks of heavy selling. The price is holding near the $1,950 zone, up around 6% from its recent low. At the same time, the biggest Ethereum whales have started accumulating aggressively.

But short-term sellers and derivatives traders remain cautious, creating a growing tug-of-war around the next move.

Biggest Ethereum Whales Accumulate as Bullish Divergence Stays Intact

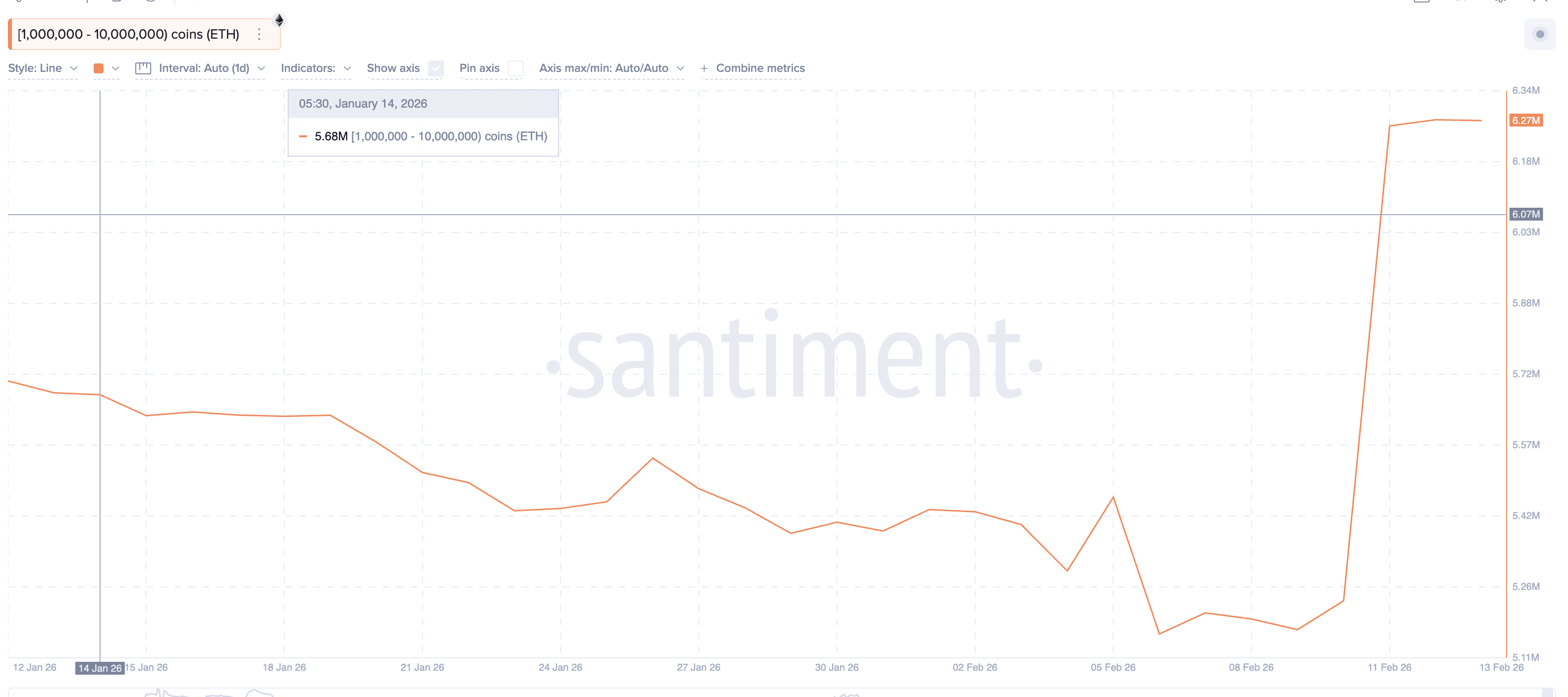

On-chain data shows that the largest Ethereum holders are positioning for a rebound. Since February 9, addresses holding between 1 million and 10 million $ETH have increased their holdings from around 5.17 million $ETH to nearly 6.27 million $ETH. That is an addition of more than 1.1 million $ETH, worth roughly $2 billion at current prices.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This accumulation aligns with a bullish technical signal on the 12-hour chart.

Between January 25 and February 12, Ethereum’s price made a lower low, while the Relative Strength Index, or RSI, formed a higher low. RSI measures momentum by comparing recent gains and losses. When price falls, but RSI rises, it often signals weakening selling pressure.

This bullish divergence suggests downside momentum is fading.

The structure remains valid as long as Ethereum holds above $1,890, as the same signal flashed even on February 11 and still seems to be holding. A breakdown below this level would invalidate the divergence for now and weaken the rebound case.

For now, whales appear to be betting that this support will hold.

Short-Term Holders Are Selling?

While large investors are accumulating, short-term holders are behaving very differently.

The Spent Coins Age Band for the 7-day to 30-day cohort has surged sharply. Since February 9 (the same time when the whale pickup started), this metric has risen from around 14,000 to nearly 107,000, an increase of more than 660%. This indicator tracks how many recently acquired coins are being moved. Rising values usually signal possible profit-taking and distribution.

$ETH Coins">

$ETH Coins">

In simple terms, short-term traders are exiting positions. This pattern appeared earlier in February as well. On February 5, a spike in short-term coin activity occurred near $2,140. Within one day, Ethereum dropped by around 13%.

That history shows how aggressive selling from this group can quickly reverse moves. As long as short-term holders remain active sellers, upside moves are likely to face resistance.

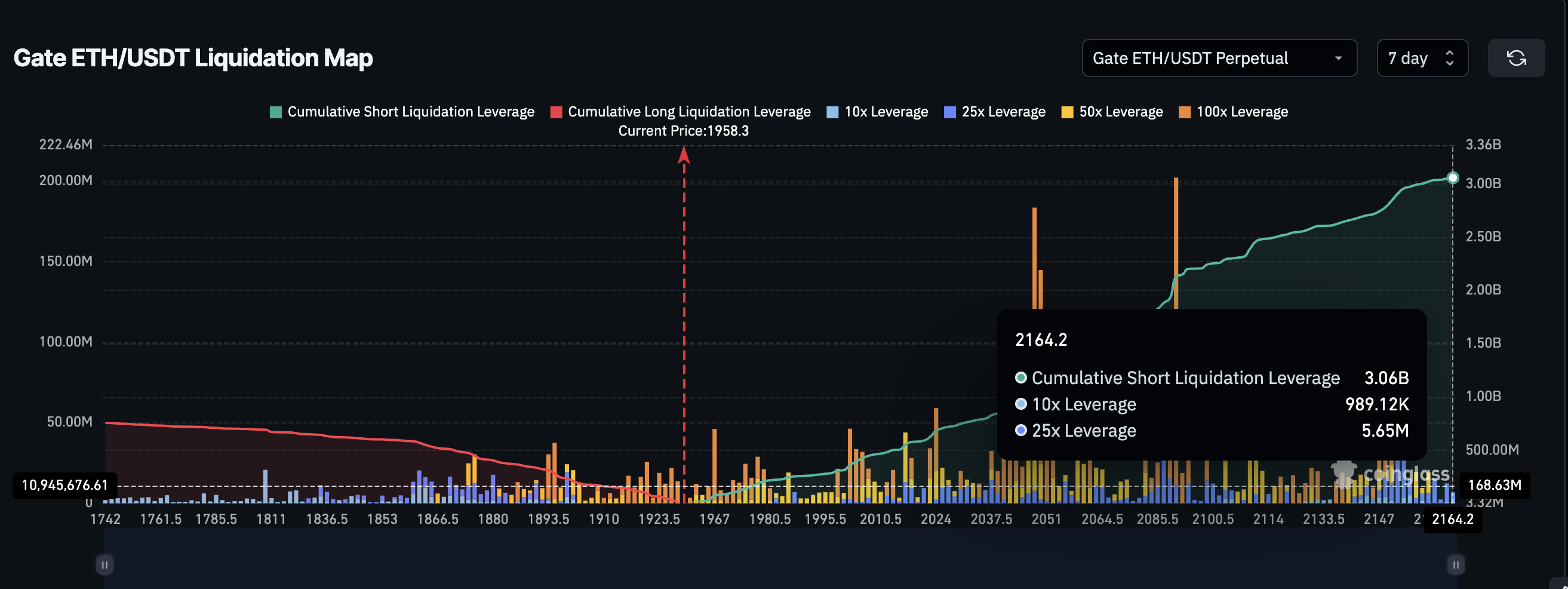

Derivatives Data Shows Heavy Bearish Positioning

Derivatives markets are reinforcing this cautious outlook. Current liquidation data shows nearly $3.06 billion in short positions stacked against only about $755 million in long leverage. This creates a heavily bearish imbalance with almost 80% of the market betting on the short side.

On one hand, this setup creates fuel for a potential short squeeze if prices rise. On the other hand, it shows that most traders still expect further weakness. This keeps momentum muted but keeps the bounce hope alive if the whale buying pushes the prices up, even a little bit, crossing past key clusters.

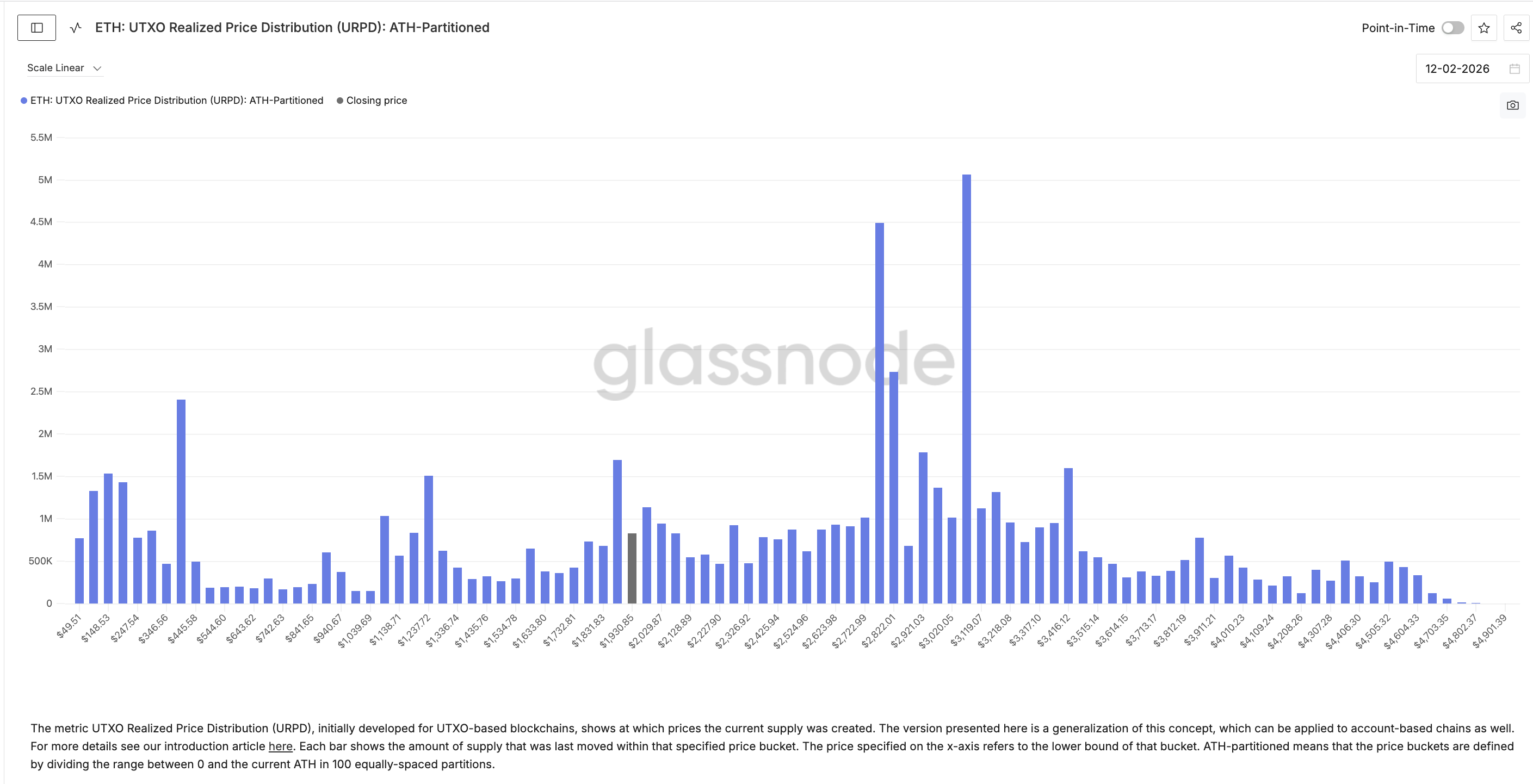

On-chain cost basis data helps explain why Ethereum struggles to break higher. Around $1,980, roughly 1.58% of the circulating supply, was acquired. Near $2,020, another 1.23% of supply sits at breakeven. These zones represent large groups of holders waiting to exit without losses.

When price approaches these levels, selling pressure increases as investors try to recover capital. This has repeatedly capped recent bounces. Only a strong leverage-driven move or short squeeze would likely be powerful enough to push through these supply clusters.

Until then, these zones remain major barriers.

Key Ethereum Price Levels To Track Now

With whales buying and sellers resisting, Ethereum price levels now matter more than narratives.

On the upside, the first major resistance sits near $2,010. A clean 12-hour close above this level would increase the probability of short liquidations. And it sits near the key supply cluster.

If that happens, Ethereum could target $2,140 next, a strong resistance zone with multiple touchpoints. It also sits around 10% from the current levels. On the downside, $1,890 remains the critical support. A break below this level would invalidate the bullish divergence and signal renewed downside pressure. Below that, the next major support sits near $1,740.

As long as Ethereum holds above $1,890 and continues testing $2,010, the rebound structure remains intact. A sustained breakdown below support would cancel the current recovery attempt.

The post Can Ethereum Price Attempt a 10% Bounce as the Biggest Whales Add $2 Billion? appeared first on BeInCrypto.

coindesk.com

coindesk.com