The crypto market is currently witnessing a significant "bloodbath" as we navigate through February 2026. Ethereum ($ETH) has seen a sharp decline, fueled by $Bitcoin losing its critical $70,000 foothold. This downward momentum has left the second-largest cryptocurrency by market cap fighting for survival at the $2,000 psychological level.

Vitalik Buterin Selling Spree Adds to Fear

Adding fuel to the bearish fire, on-chain reports from Coinpaper and other analytics platforms have confirmed that Ethereum co-founder Vitalik Buterin sold 2,972 $ETH (worth approximately $6.69 million) over the last three days. While these sales are often associated with philanthropy via the Kanro entity, the timing has intensified the "panic selling" sentiment among retail traders.

When the most prominent figure in the ecosystem moves such a volume to exchanges during a market-wide correction, it often signals a lack of immediate upward catalysts, causing investors to seek safety in hardware wallets to protect their remaining capital.

Technical Analysis: The Path to $1,550

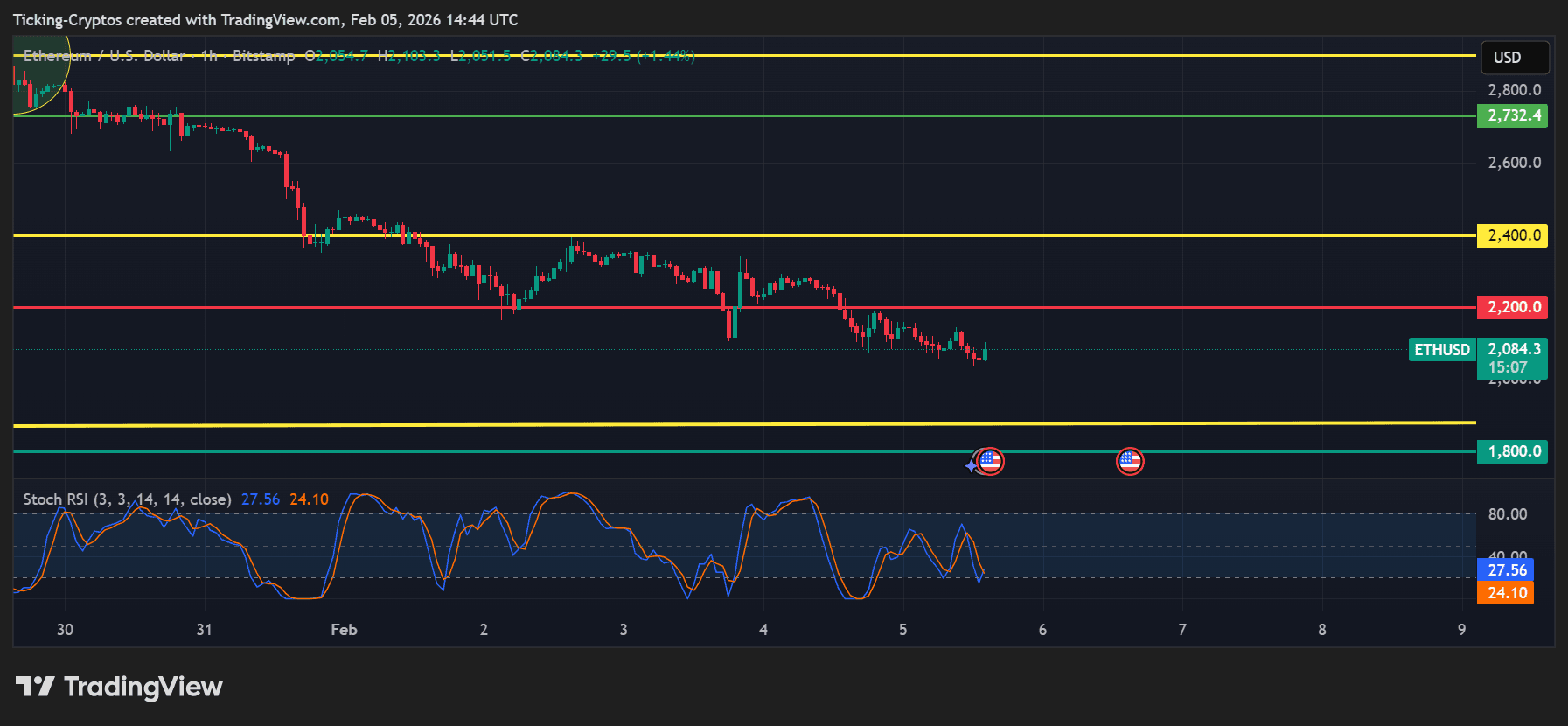

The below $ETH/USD 1-hour chart shows a textbook descending channel that has dominated the price action since early February.

- The $2,000 Brink: As of today, $ETH is trading near $2,084. The Stochastic RSI is hovering at 27.56, which is nearing the oversold zone, but the sheer volume of the sell-off suggests that the bottom is not yet in.

- Resistance Flips: The previous support at $2,200 has officially flipped into a "ceiling," making any relief bounce difficult to sustain.

- Bearish Targets: If the daily candle closes below the $2,000 mark, the next historical "demand zone" sits at $1,800. A failure there would open the door for a deeper crash toward $1,550, a level not seen since the consolidation phases of late 2025.

Market Contagion and Exchange Flows

The crash isn't happening in isolation. With Bitcoin struggling to reclaim $70,000, high-leverage positions on major crypto exchanges are being flushed out. According to Reuters, institutional interest in $ETH ETFs has also cooled, with net outflows recording millions in losses this week.

Traders should exercise extreme caution. Until Ethereum can reclaim the $2,200 level and stabilize, the trend remains firmly to the downside. The breach of $2,000 could act as a "tripwire" for a massive liquidation event.

cryptobriefing.com

cryptobriefing.com

cointelegraph.com

cointelegraph.com

coindesk.com + 1 more

coindesk.com + 1 more