Ethereum faces resistance near key levels, but the surge in active addresses signals growing network engagement and potential for recovery.

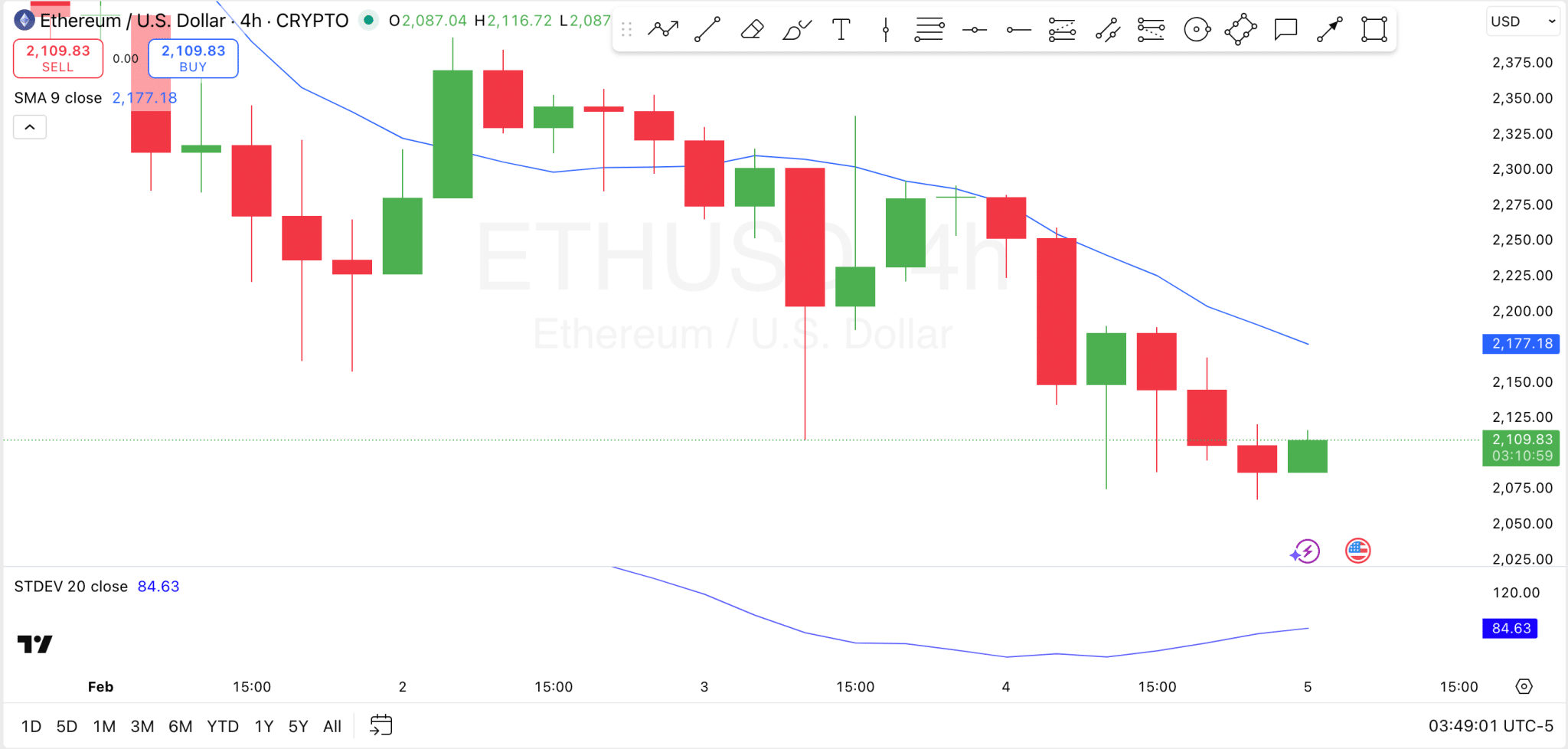

Ethereum ($ETH) is experiencing further volatility, as seen in the recent price movements. Trading at $2,113, the largest altcoin by market cap has faced a sharp decline, dropping 6.99% in the last 24 hours.

$ETH’s price has fluctuated between $2,110 and $2,230 in the past 24 hours. The token is notably down 29.67% over the past 7 days and 36.17% over the last 90 days. Year-to-date, $ETH has shed 28.74%, signaling a persistent downtrend.

Looking at the long/short ratios, Ethereum shows a slight bullish sentiment, with a ratio of 2.76 on Binance $ETH/USDT accounts. The recent performance is marked by continuous pressure from resistance levels, as Ethereum remains below key price points. Can Ethereum hold support and break key resistance zones?

Can Ethereum Hold Key Support Levels?

On technical charts, the price is currently testing key support around $2,060–$2,080, where it has seen recent buying interest. A drop below this range could signal further downside, with the next level of support around $2,025–$2,050, seen last in March 2025.

On the resistance front, Ethereum faces immediate barriers at the $2,170–$2,180 zone, aligning with the 9-period simple moving average. A breakout above this level would likely target higher resistance near $2,250–$2,300, where bears have recently sold.

Elsewhere, the standard deviation indicator stands at 84.63, indicating elevated volatility and wider price swings. However, a recovery may require Ethereum to break above the 9-SMA and show reduced volatility to confirm a shift in market sentiment.

Ethereum Active Addresses at ATH?

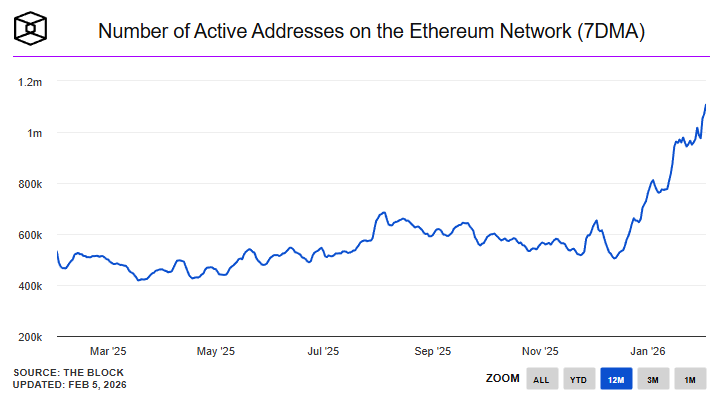

While $ETH price faces pressure, fundamentals continue to improve. According to a self-acclaimed “Ethereum narrator,” Joseph Young, $ETH’s active addresses have reached an all-time high, signaling increasing usage and network activity.

This uptick in active addresses highlights growing engagement within the Ethereum ecosystem, providing a strong foundation for the network’s long-term potential. Typically, when the number of active addresses surge, it often leads to higher transaction volumes, greater demand, and more use cases. Such an environment typically supports higher prices.

cryptopolitan.com

cryptopolitan.com

coindesk.com

coindesk.com

beincrypto.com

beincrypto.com

coinedition.com

coinedition.com