Vitalik Sells $ETH — Big Headline, Small Transaction

Ethereum co-founder Vitalik Buterin recently sold approximately $1.94 million worth of $ETH, triggering a wave of bearish sentiment across Crypto Twitter.

On the surface, the move looks alarming. Ethereum is already under pressure, and any founder-linked sale immediately feeds into fears of insider pessimism. However, when placed in proper context, the transaction itself is not market-moving.

The sale represents a negligible fraction of Ethereum’s roughly $275 billion market capitalisation and a rounding error compared to daily $ETH trading volume. Vitalik has sold $ETH multiple times in the past for operational, tax, and donation purposes, without any consistent correlation to major price tops or crashes.

What makes this sale notable is not the size — but the timing.

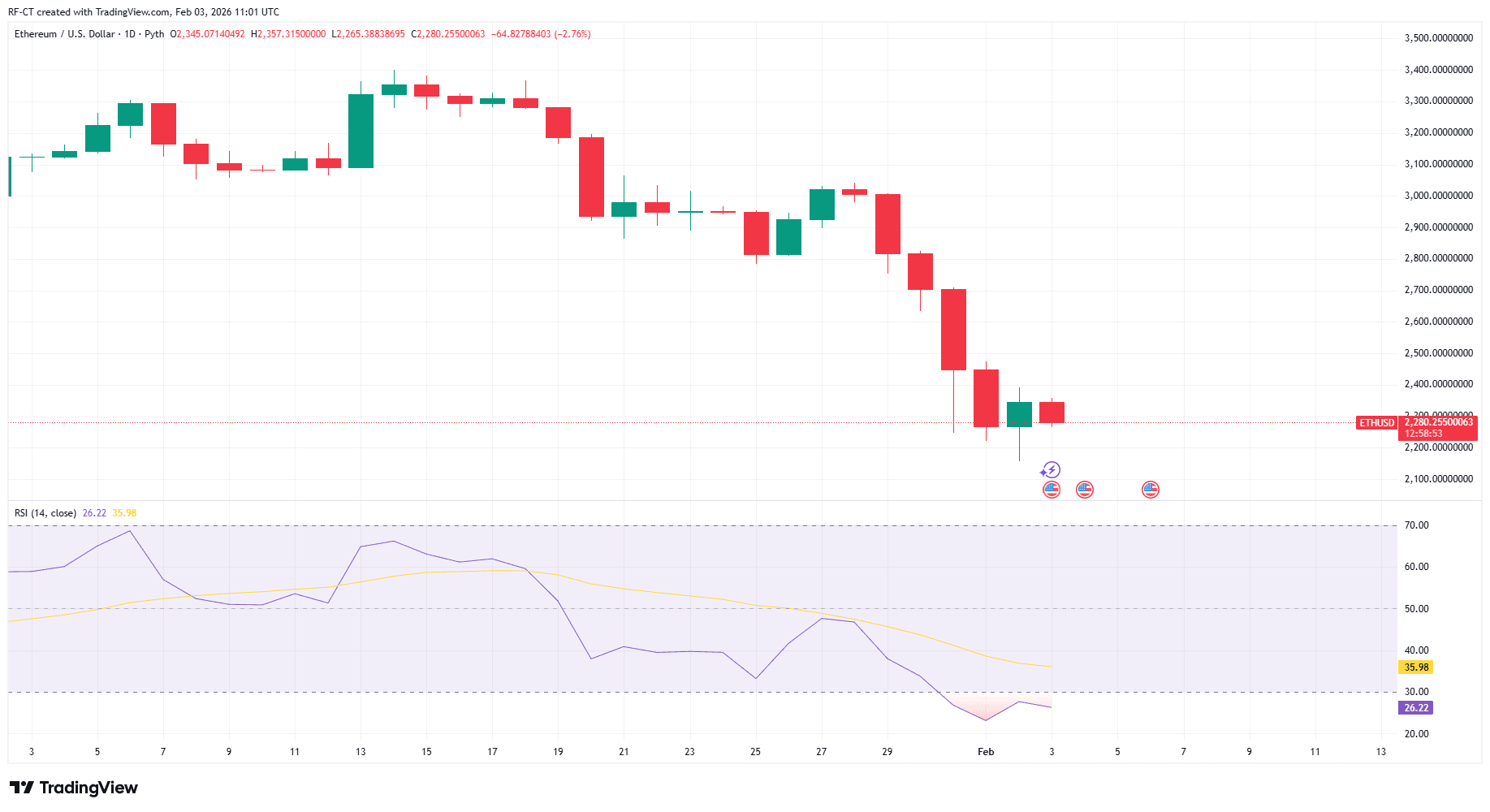

Ethereum’s Chart Confirms Structural Weakness

Ethereum’s YTD chart shows a clear deterioration in structure:

- $ETH has fallen sharply from the $3,300–$3,400 zone

- Price is now hovering near $2,280

- RSI remains deeply oversold, struggling to reclaim neutral territory

Ethereum is not collapsing — but it is failing to attract decisive demand. Rallies are being sold, momentum is weak, and $ETH continues to underperform Bitcoin on a relative basis.

In this environment, any negative narrative — even a small founder sale — hits harder than it otherwise would.

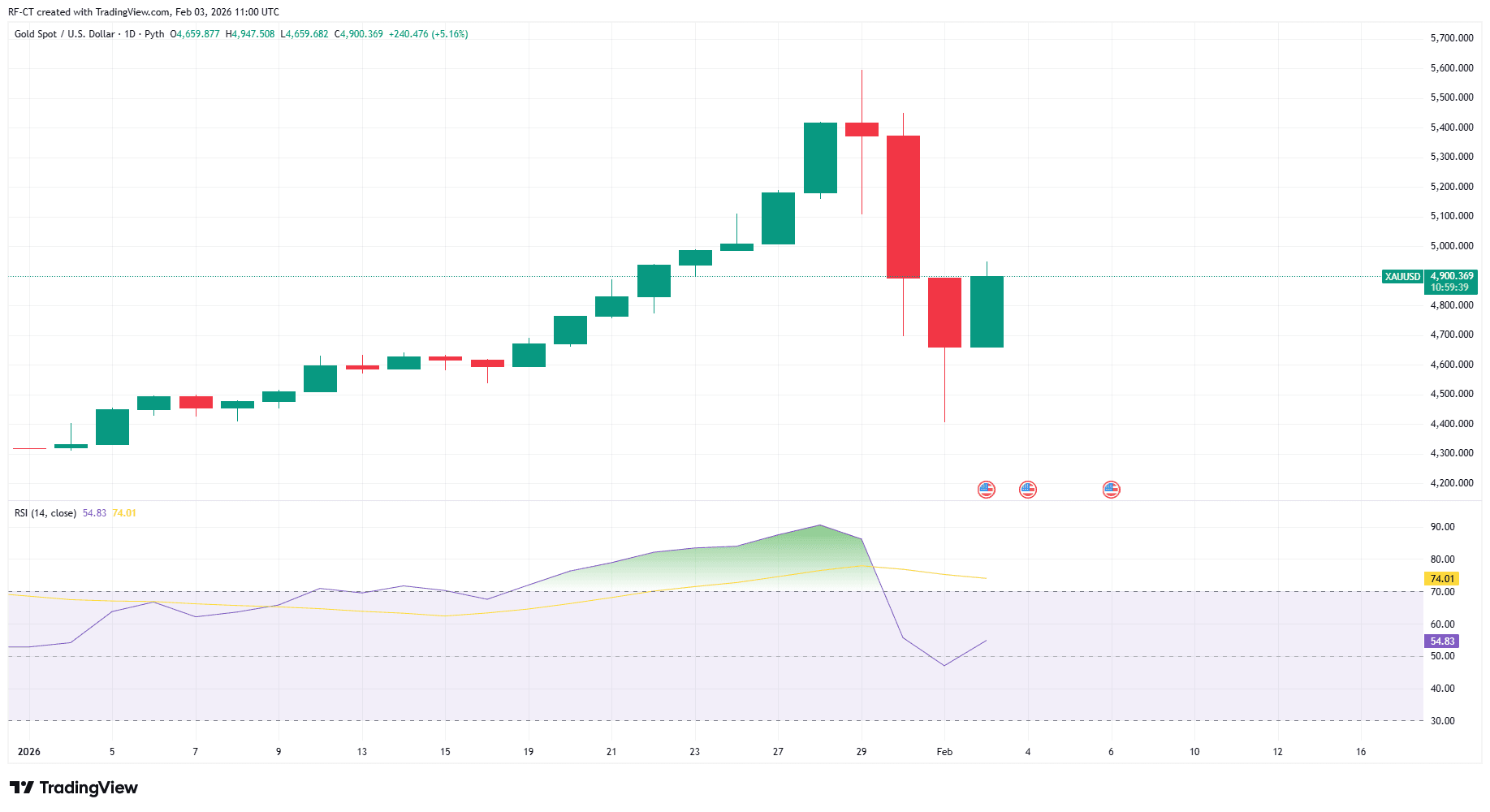

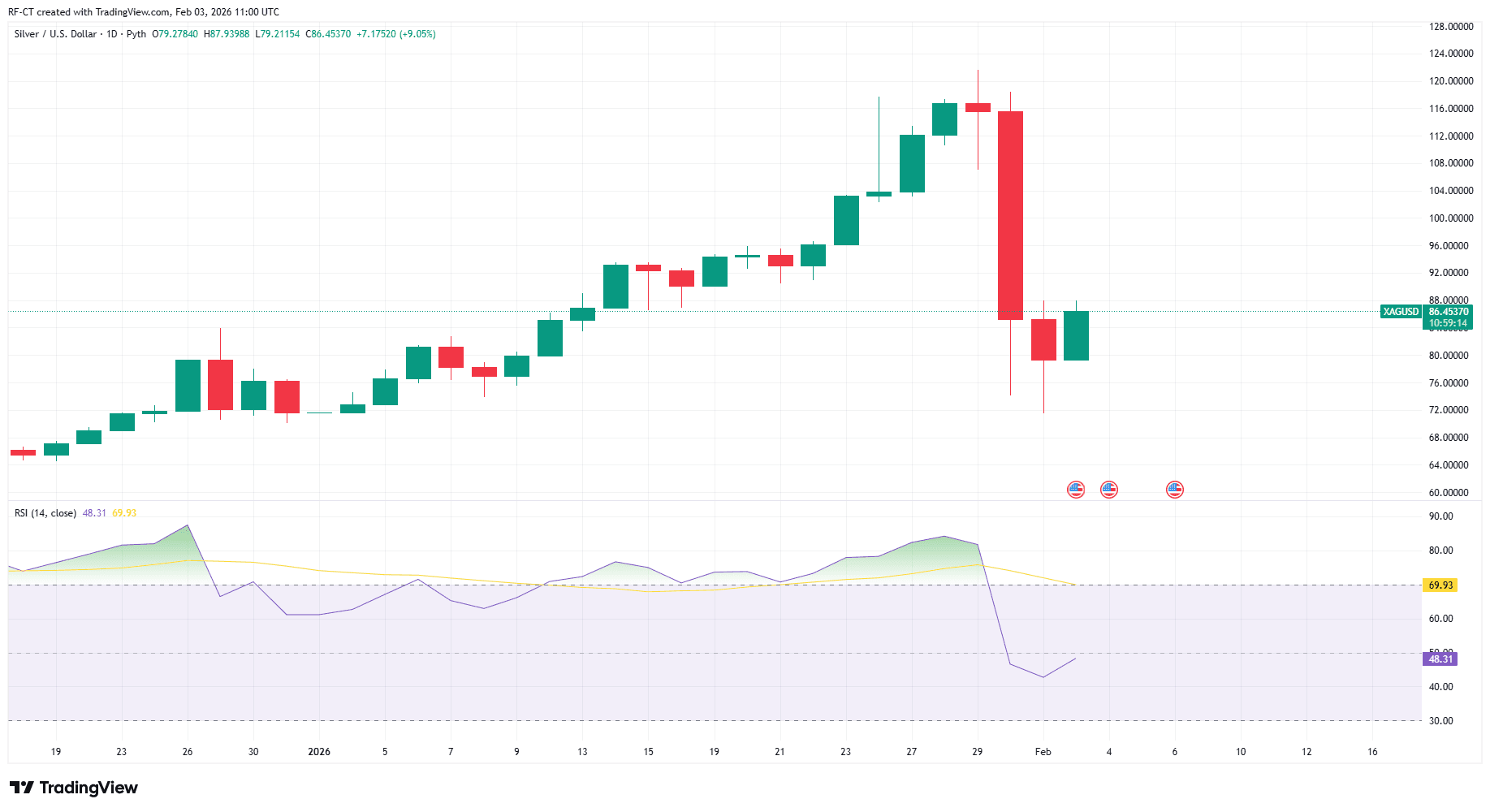

Meanwhile, Gold and Silver Are Exploding Higher

While crypto debates sentiment, hard assets are making decisive moves.

- Gold surged above $4,900, adding trillions in market value in days

- Silver spiked above $85, posting near-vertical gains

- Both assets remain strong YTD outperformers

This is not retail speculation. The speed, scale, and consistency of the move strongly point to institutional and macro capital rotation.

Notably, gold and silver surged before crypto reacted — a classic signal that traditional macro hedges are being accumulated first.

This Is Not an $ETH Story — It’s a Capital Rotation Story

The real takeaway is not “Vitalik is bearish.”

It’s this:

Capital is moving toward assets with clear macro narratives and away from assets stuck in narrative limbo.

Right now:

- Gold and silver are benefiting from inflation hedging, monetary credibility concerns, and geopolitical risk

- Bitcoin is increasingly treated as digital macro collateral

- Ethereum lacks a dominant, urgent narrative to pull capital back in

$ETH is not being abandoned — it’s being temporarily deprioritised.

Why Vitalik’s Sale Matters Psychologically — Not Structurally

If Ethereum were in a strong uptrend, this sale would barely register.

Instead, it:

- Reinforces existing bearish bias

- Highlights $ETH’s lack of momentum

- Acts as a sentiment accelerant, not a catalyst

The market is reacting emotionally, not analytically.

What to Watch Next

For Ethereum to regain strength, markets will likely need:

- Bitcoin to stabilise and break higher

- Metals to cool without collapsing

- A renewed $ETH-specific catalyst (ETF flows, scaling narrative revival, or $ETH/BTC reversal)

Until then, Ethereum remains vulnerable to headline-driven pressure, even when the fundamentals behind those headlines are thin.

Bottom Line

Vitalik selling $ETH is not a bearish signal by itself.

But it arrives at a moment when capital is clearly favouring hard assets and macro hedges over narrative-dependent crypto assets.

Ethereum isn’t breaking — it’s waiting.

Gold and silver, for now, are leading.

coindesk.com

coindesk.com

u.today

u.today

coinedition.com

coinedition.com