Fundstrat head of research Tom Lee argues Ether's recent slump should be seen as “attractive” as its fundamentals remain strong, and that it has only fallen due to a lack of leverage and a flight to precious metals.

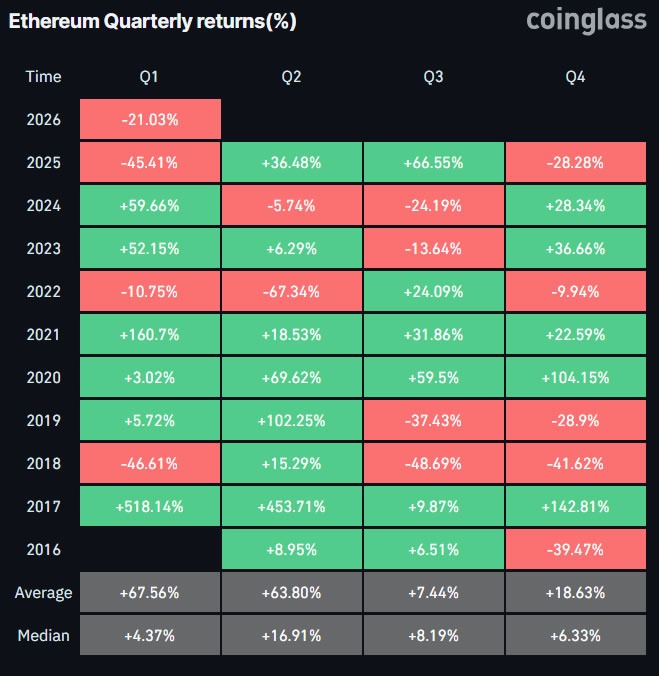

The first quarter of 2026 is shaping up to be Ether’s ($ETH) third-worst Q1 in history, with the asset down 21% so far this year, according to CoinGlass.

However, Lee said the price drop has come at a time when network on-chain activity and fundamentals have continued to grow.

Ethereum daily transactions hit an all-time high of 2.8 million on Jan. 15, and active addresses in 2026 soared to a peak of 1 million per day, he said.

During the crypto winters of 2018 and 2022, Ethereum transaction activity and active wallets declined, “which is counter to what we have seen in the past 12 months,” said Lee.

“Thus, non-fundamental factors are arguably more the factors explaining the weakness in $ETH prices.”

Lee said two factors are keeping Ether prices suppressed. Leverage has not returned to crypto since the Oct. 10 crash, while the surge in precious metal prices has “acted as a ‘vortex’ sucking away risk appetite from crypto.”

BitMine buys dip after $ETH drops 25% in a week

Lee’s Ethereum treasury firm appears to be betting on a recovery. In the past week, BitMine acquired a further 41,788 $ETH.

“BitMine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals,” he said.

“In our view, the price of $ETH is not reflective of the high utility of $ETH and its role as the future of finance.”

BitMine now holds 4.28 million $ETH tokens, or 3.55% of the total supply, and is 70% of the way toward its target of 5%. Around 2.87 million $ETH has been staked.

However, the digital asset treasury neared $7 billion in unrealized losses as Ether prices melted down.

Most of the price slump has come over the past week alone, with $ETH tanking more than 25% from around $3,000 to a bear market low of $2,200 on Monday, before a minor recovery.

newsbtc.com

newsbtc.com

bitcoinworld.co.in

bitcoinworld.co.in