Ethereum remains under pressure as strong downside momentum puts bears in control, leaving traders focused on whether key support zones can stabilize price.

Ethereum ($ETH) has come under sharp selling pressure, dropping nearly 10% over the past 24 hours. The altcoin market leader is now trading around $2,207 after failing to hold above recent intraday highs near $2,435.

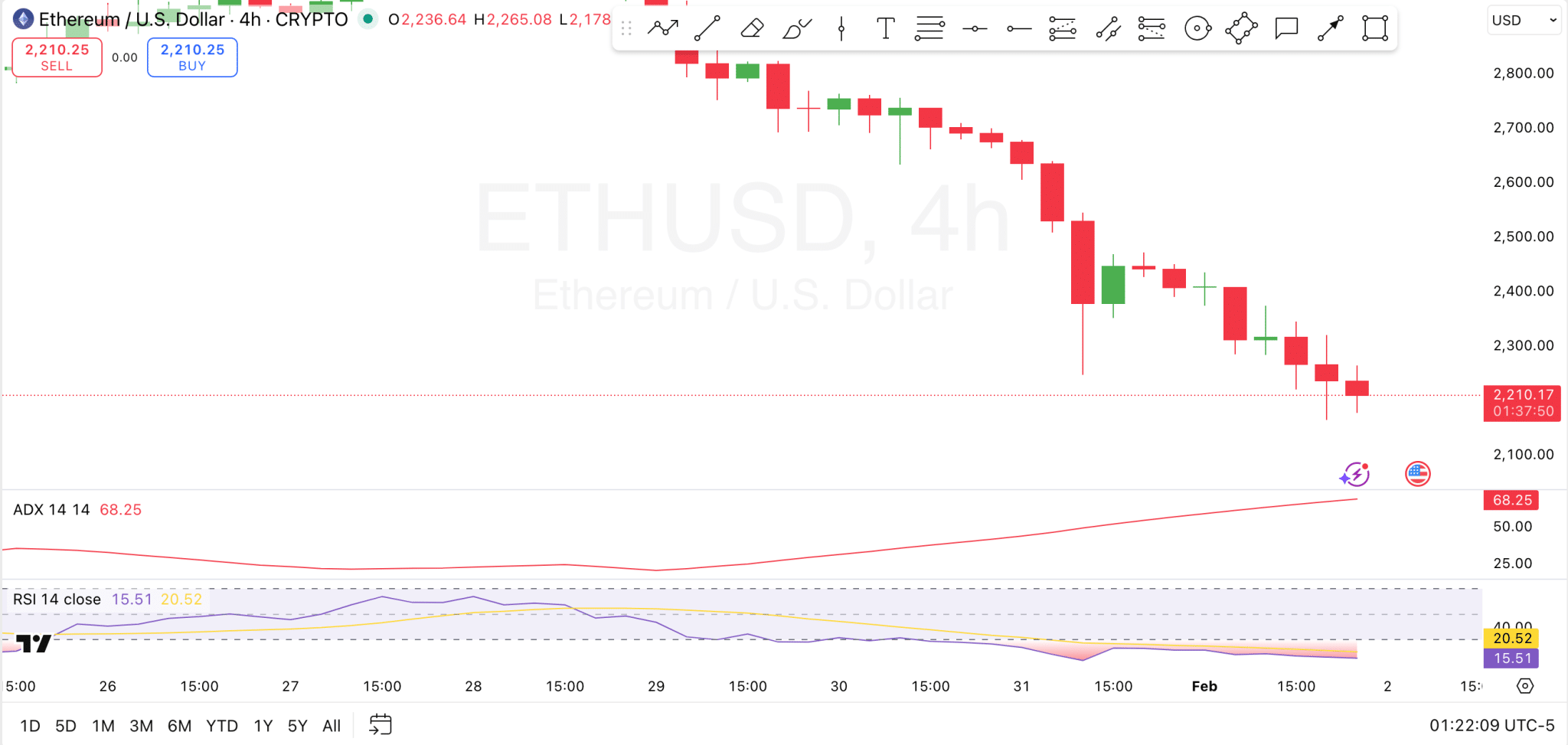

The chart shows a steady downward grind punctuated by sharp sell-offs, reflecting weakening short-term sentiment as $ETH also slid roughly 23% over the past week and more than 31% over the last 14 days. Despite elevated trading volume near $51.9 billion, buyers have struggled to stabilize price, leaving Ethereum underperforming both the broader market and Bitcoin over 24 hours.

Ethereum Price Analysis

Ethereum’s price action on the 4-hour chart shows continued downside pressure, with $ETH now consolidating just above the $2,200 area after a sharp sell-off. This zone is acting as immediate support. A clean break below this level would expose Ethereum to further weakness toward the next psychological support around $2,100, where buyers may attempt a short-term defense.

On the upside, former consolidation zones have turned into clear resistance. Specifically, the $2,300–$2,350 region stands out as the first major resistance area, aligning with prior breakdown levels and recent failed rebound attempts. Above that, the $2,450–$2,500 zone represents a stronger ceiling, where sellers previously stepped in aggressively.

Moreover, momentum indicators reinforce the bearish structure. The Relative Strength Index is deeply oversold, hovering around 15, which signals extreme selling pressure. However, it also raises the possibility of a short-term relief bounce if selling exhausts.

Meanwhile, the Average Directional Index is elevated above 65, confirming that the current trend is strong and well-established to the downside. This combination suggests Ethereum remains firmly in a bearish trend until signs of a reversal appear.

Ethereum Reversal to $6,000 Incoming?

In social media commentary, analyst Crypto GVR outlined both a potential reversal zone and upside targets for Ethereum. The analyst noted that $ETH could begin forming a base between the $1,800 and $2,200 range, an area viewed as a critical demand zone after the recent sell-off.

If price stabilizes and confirms a reversal from this region, Crypto GVR expects a broader recovery phase to follow. He sets upside targets in the $4,000 to $6,000 range over the coming period.

coinedition.com

coinedition.com

coinfomania.com

coinfomania.com

invezz.com

invezz.com

cryptopolitan.com

cryptopolitan.com