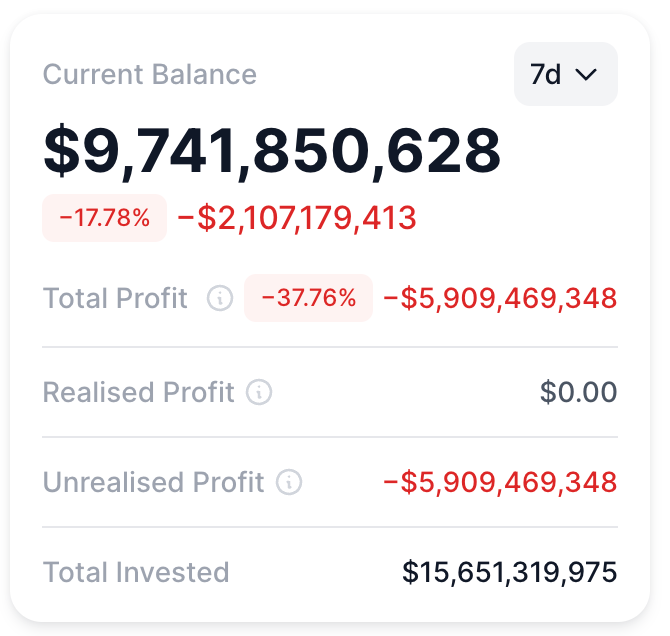

BitMine Immersion’s aggressive ether accumulation has turned sharply against it after the latest leg lower in crypto markets, leaving the company with more than $6 billion in paper losses on its $ETH holdings.

The publicly traded firm added over 40,000 ether last week, lifting its total balance to roughly 4.24 million $ETH, according to portfolio tracking data from Dropstab.

Since then, prices have fallen hard, dragging the value of BitMine’s stash to about $9.6 billion — down from nearly $14 billion at highs seen in October.

Ether slid toward the $2,300 level on Saturday as selling accelerated across major tokens.

The timing of BitMine’s latest purchases has put its balance-sheet strategy back in focus. Corporate crypto treasuries have become a prominent feature of the current cycle, but heavy exposure can amplify swings when markets turn and bids fade.

Losses have also mounted as forced selling rippled through derivatives markets, adding momentum to the decline. Liquidations across major venues picked up alongside ether’s drop, compounding pressure on spot prices.

Company chairman Tom Lee has recently struck a more cautious near-term tone.

While remaining constructive longer term, he has warned that the market is still working through deleveraging and that early 2026 could be rough before conditions stabilize.

In a recent interview, he pointed to October’s sharp sell-off — which wiped out roughly $19 billion in market value — as a break that reset positioning across crypto.

BitMine has previously said part of its ether position is staked, estimating annual staking revenue of around $164 million. That income stream, however, fluctuates with network yields and does little to offset large price swings during fast drawdowns.

u.today

u.today

cryptopolitan.com

cryptopolitan.com