A new ethereum staking report shows 2025 delivered major technical upgrades and surging institutional adoption, even as ETH prices lagged, setting the stage for structural changes to staking and market dynamics in 2026.

Paradox for Ethereum in 2025: Network Growth vs Flat ETH Prices

Ethereum’s 2025 was defined by sharp contrasts. According to the Ethereum Staking Insights & Protocol Analysis report by Everstake, the network delivered major protocol upgrades and attracted record institutional participation, yet ETH prices remained largely stagnant. The disconnect highlights how ethereum’s role is evolving faster than market valuations suggest.

Two major upgrades shaped the year. Pectra introduced EIP-7251, raising the maximum effective validator balance from 32 ETH to 2,048 ETH, while Fusaka activated PeerDAS (EIP-7594), a key title="Learn about Blockchain Layers Zero, One, Two and Three" target="_blank">Layer 2 blob throughput by up to eight times. Together, these changes improved scalability and validator efficiency, reinforcing Ethereum’s position as a global settlement layer.

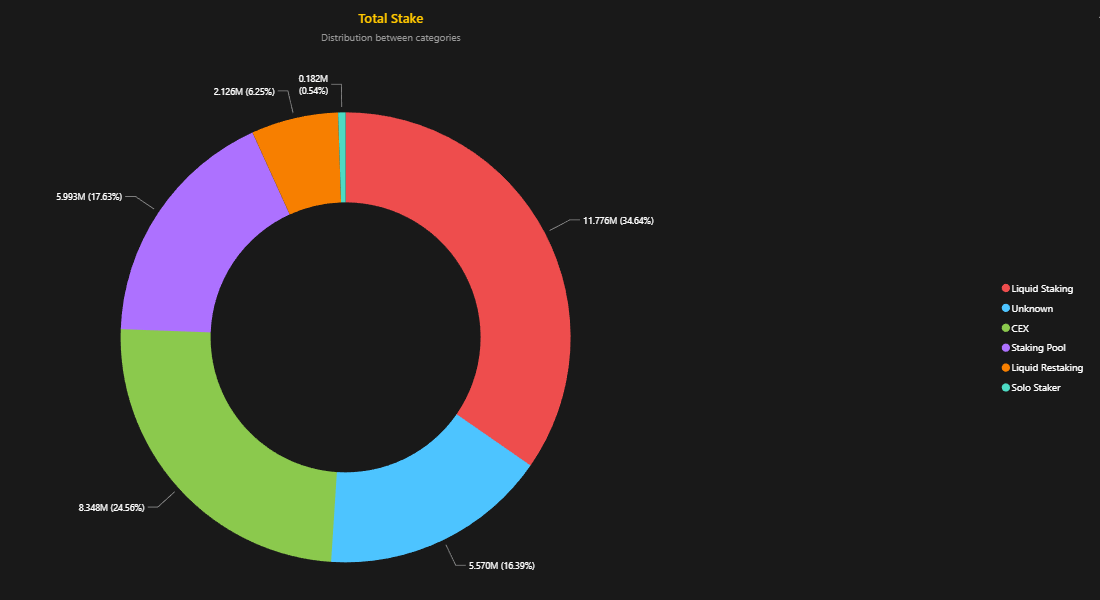

Consolidated validators grew from roughly 2% to more than 11% of total staked ETH in just six months, reflecting a shift toward operational efficiency, particularly among larger and institutional operators. By year-end, total value staked reached about 36.1 million ETH, or 29.3% of total supply, with net growth exceeding 1.8 million ETH.

Institutional demand also surged. Digital Asset Treasuries (DATs) accumulated an estimated 6.5–7 million ETH by December, representing around 5.5% of total supply. Many of these entities are staking corporate holdings to generate yield, effectively removing ETH from liquid markets and contributing to a growing supply constraint.

Bohdan Opryshko, Co-Founder and COO of Everstake commented:

In 2025, as infrastructure improved and fees fell, ETH increasingly functioned as working capital, securing networks and generating yield. In 2026, we expect institutions to move beyond passive exposure, treating ETH as a yield-bearing asset where staking becomes a baseline requirement rather than an optional add-on.

Read more: Ethereum Daily Transaction Count Hits Record High While Fees Stay Flat

On the usage side, Ethereum’s Layer 2 ecosystem surpassed 300 transactions per second, while Layer 1 activity still climbed roughly 30% year over year to 1.5–1.6 million daily transactions. Daily active addresses rose to around 450,000–500,000, driven largely by ETF-related wallets and smart accounts rather than retail transfers.

Looking ahead to 2026, the report suggests Ethereum staking is becoming more formalized and aligned with traditional finance standards. While this may attract further institutional capital, it raises fresh questions around decentralization, client diversity, and systemic risk tolerance as Ethereum continues its transformation.

FAQ🔗

-

What defined Ethereum’s performance in 2025?

Ethereum saw major network upgrades and rising institutional staking despite flat ETH prices. -

Which upgrades mattered most?

Pectra and Fusaka boosted validator efficiency and Layer 2 scalability across the network. -

How strong was institutional adoption?

Institutions staked up to 7 million ETH, tightening supply and reshaping market dynamics. -

What does this mean for 2026?

Ethereum staking is becoming more institutional and structured, setting up deeper market shifts.

cryptopotato.com

cryptopotato.com

cryptobriefing.com

cryptobriefing.com

cointelegraph.com

cointelegraph.com