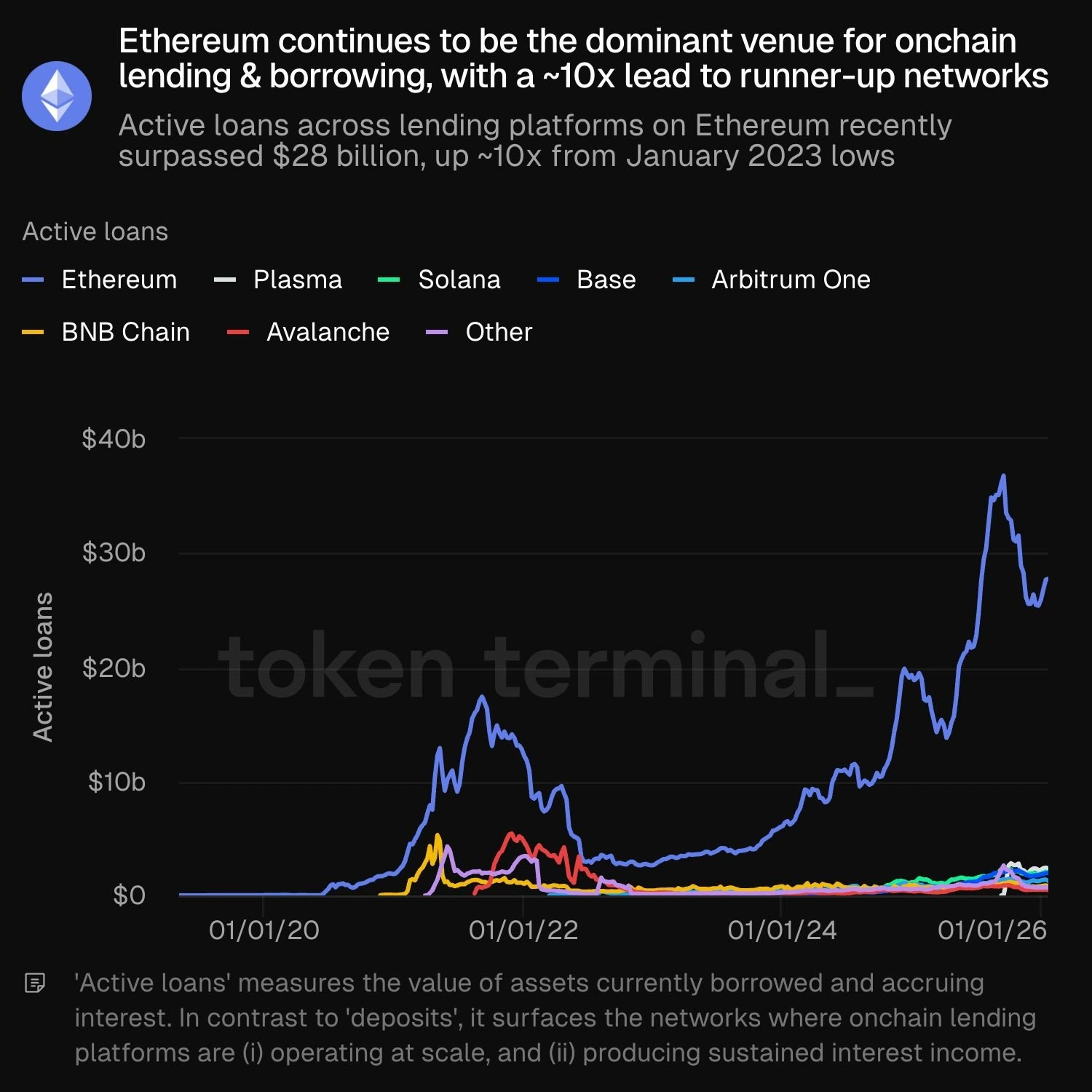

Token Terminal, a Web3 analytics platform, has reported that active loans on Ethereum-based lending protocols have surpassed $28 billion.

Active loans measure the value of assets currently borrowed and accruing interest across platforms like Aave, Compound, Morpho, and others on Ethereum.

Ethereum runs away with lending lead

According to Token Terminal, Ethereum has remained the dominant venue for onchain lending & borrowing, with its 10x lead to runner-up networks.

“Active loans across lending platforms on @ethereum recently surpassed $28 billion, up ~10x from January 2023 lows,” a Token Terminal post reads.

Unlike deposits, active loans highlight the networks where onchain lending platforms are operating at scale and producing sustained interest income.

The achievement is further proof of Ethereum’s position as the primary hub for DeFi lending, driven by deep liquidity in established protocols, high trust from users as well as institutions, and network effects from being one of the earliest and most mature DeFi ecosystems.

The figure has generated buzz on X among Ethereum diehards, who continue to praise the ecosystem for attracting users and providing utility rather than just leveraging on hype and old glory.

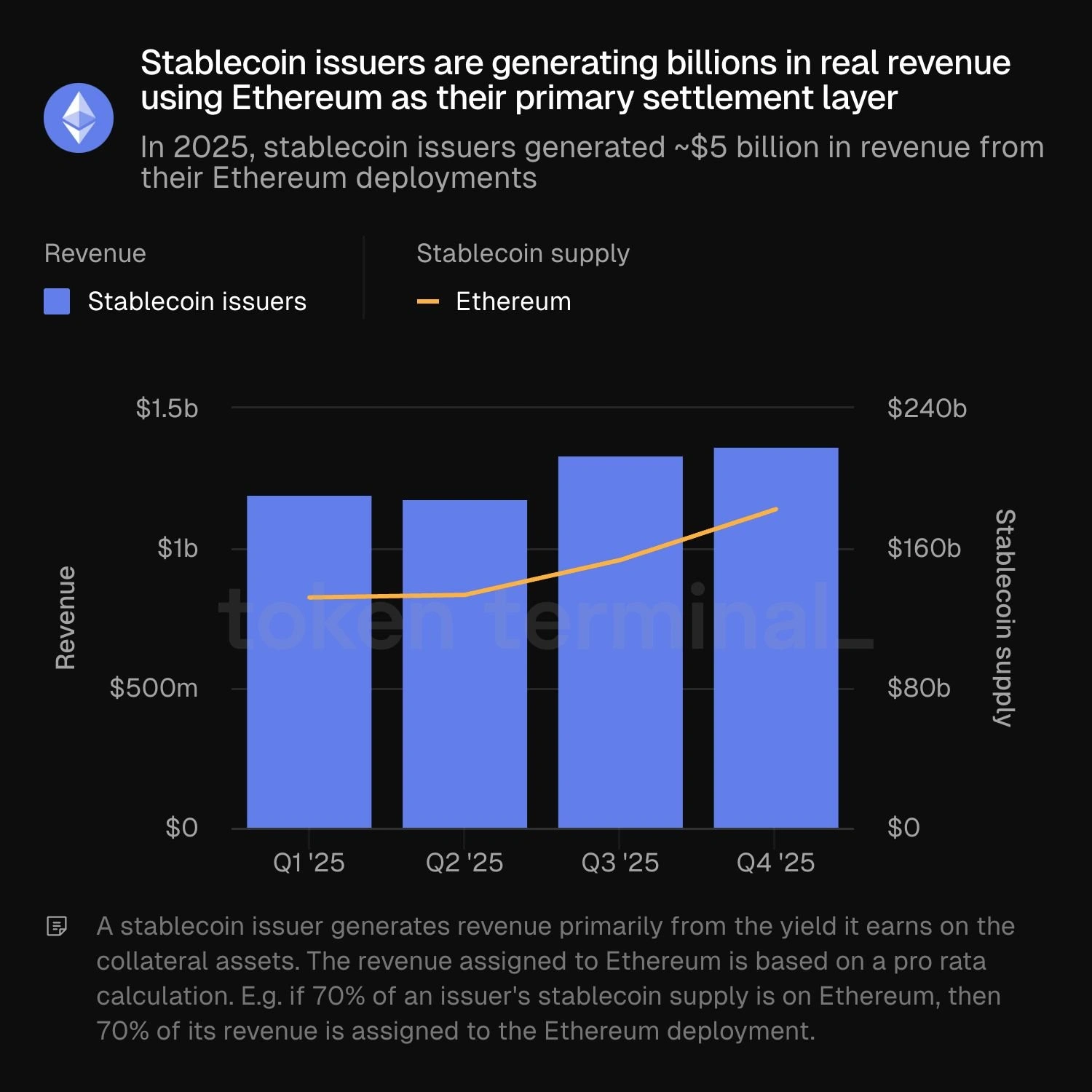

Stablecoin issuers are winning on Ethereum

The lending and borrowing part of Ethereum’s DeFi sector is bustling, but it is not the only aspect seeing real growth. Stablecoin issuers who are using Ethereum as their primary settlement layer have also been generating billions in real revenue.

Last year alone, stablecoin issuers earned approximately $5 billion in revenue attributable to stablecoin supply deployed on Ethereum. Over the year, stablecoin supply on Ethereum reportedly increased by $50 billion, and had already surpassed $180 billion by the fourth quarter.

Issuer revenue kept rising along with this growth, and had ultimately reached roughly $1.4 billion per quarter by Q4. Token Terminal noted that the revenue is driven by yield earned on reserve assets backing stablecoin supply.

“Ethereum consistently hosts the largest share of stablecoin supply for most major issuers,” Token Terminal claimed, adding that for builders, the network “functions as a neutral settlement layer that enables financial products to reach Internet scale.”

Why more institutions and users are choosing Ethereum

Ethereum has become a favorite destination for the financial sector and institutions ranging from banks to asset managers, choosing Ethereum as a layer to settle.

The biggest reason would be the fact that it has proven itself as a reliable, neutral and battle tested infrastructure for institutional-grade finance, in addition to boasting features that these institutions find attractive.

Some of those features include security, deep liquidity and network effects, programmability, L2 scaling that doesn’t happen at the cost of security, and regulatory alignment. But perhaps the most important one is that it boasts a future-proof design.

That does not sound flashy, but institutions take it very seriously. Ethereum’s modular architecture, current ongoing upgrades, and huge developer ecosystem are positioning it for decades of use.

In this way, Ethereum is playing the long game. Some of its current competitors are currently faster, or cheaper, like Solana, but they don’t have Ethereum’s depth or neutrality.

On X, people like Sassal are convinced there is a “very possible timeline where Ethereum becomes quantum resistant before the centralised financial system does.”

“Ethereum will be the global quantum-resistant settlement layer for all types of value,” Sassal wrote.

The idea of the world finally solving issues regarding quantum computing has become a topic that threatens the sovereignty of crypto so institutions are watching carefully for chains optimizing for the eventuality.

Ethereum is one of the few doing it, naming a Post-Quantum team over the weekend.

coinfomania.com

coinfomania.com

thecryptobasic.com

thecryptobasic.com

coingape.com

coingape.com