Ethereum price today trades near $2,940 after another failed attempt to reclaim short-term resistance. The market remains compressed below key moving averages as spot flows stay negative and volatility fades. At the same time, a wave of large-scale staking activity is quietly removing supply, creating tension between weak price structure and strengthening long-term positioning.

Price Trapped Below EMAs As Momentum Stalls

On the daily chart, Ethereum continues to trade below its 20, 50, 100, and 200-day EMAs. The 20-day EMA near $2,985 has capped recent rebounds, while the 50-day EMA around $3,138 remains the first meaningful upside barrier. Above that, the 100-day and 200-day EMAs clustered near $3,350 to $3,380 define the broader trend ceiling.

Price action has compressed into a narrowing range following the sharp decline earlier this quarter. The descending trendline from the October highs remains intact, and ETH has not produced a higher high since the breakdown. RSI near the mid-40s reflects that balance. Momentum is neither oversold nor constructive. It is stalled.

This type of structure typically precedes expansion. The question is whether that expansion resolves higher or lower.

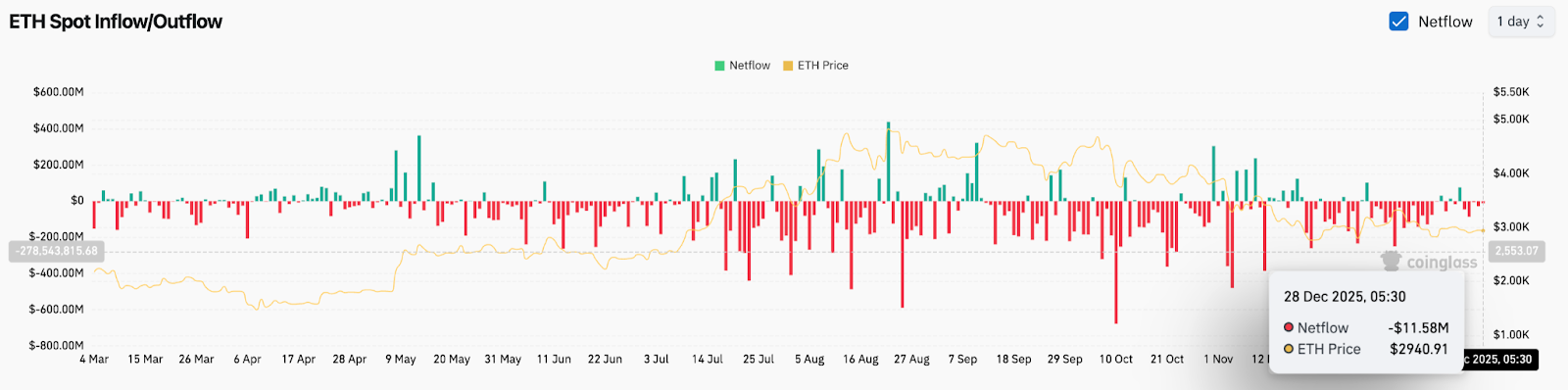

Spot Flows Stay Negative Despite Sideways Price

Exchange flow data continues to lean defensive. Recent sessions show persistent net outflows, including a $11.6 million net outflow on December 28. While the magnitude is smaller than earlier distribution waves, the direction matters. Capital is not aggressively rotating back into spot positions.

Historically, Ethereum struggles to sustain upside moves when spot flows remain negative across multiple weeks. Buyers may be present, but they are not chasing price. That behavior aligns with the muted volume visible on the chart. Participation is thinning, not building.

This keeps short-term rallies vulnerable. Without improving inflows, any push into resistance risks turning into another rejection.

Staking Activity Removes Supply At Scale

While price action looks uninspiring, on-chain behavior tells a different story. One of the largest coordinated staking inflows of the year has taken place over the past two days.

Bitmine, the Fundstrat-backed firm linked to Tom Lee, staked 342,560 ETH, roughly $1 billion at current prices. The deposits were structured, deliberate, and routed through batch contracts in repeated tranches of 28,320 ETH. This was not opportunistic yield chasing. It was operational execution.

On December 27 alone, Bitmine staked 74,880 ETH, equivalent to about $219 million. Around the same time, SharpLink Gaming redeemed 35,627 ETH, roughly $104 million. Even accounting for that redemption, staking inflows remained dominant.

This matters because staking immediately removes ETH from liquid circulation. Each token locked reduces available supply at a time when price is already coiling.

Short-Term Charts Show Capped Recovery Attempts

On the 2-hour chart, ETH remains capped by Supertrend resistance near $2,970. Parabolic SAR dots stay above price, confirming that short-term control remains with sellers. Each bounce has stalled below $3,000, reinforcing that level as a psychological ceiling.

Support continues to hold near $2,880 to $2,850. This zone has absorbed multiple sell attempts and aligns with the lower boundary of the recent range. A clean break below it would expose $2,770 next.

Until either boundary breaks, price remains locked in compression.

Outlook. Will Ethereum Go Up?

Ethereum sits at a crossroads between weak short-term structure and strengthening long-term supply dynamics.

- Bullish case: A daily close above $3,140 would reclaim the 50-day EMA and signal that buyers are regaining control. Follow-through above $3,350 opens the door for a broader trend reset.

- Bearish case: Losing $2,850 would confirm range failure and expose $2,770 and $2,650 as the next downside zones.

Staking is quietly tightening supply, but price still needs confirmation. If ETH breaks higher, the move could be sharp. If support fails, structure takes priority.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

cryptopolitan.com

cryptopolitan.com

coingape.com

coingape.com

cryptopotato.com

cryptopotato.com