Key Notes

- Ether started the week above $3,000 after a sharp rise in trading activity.

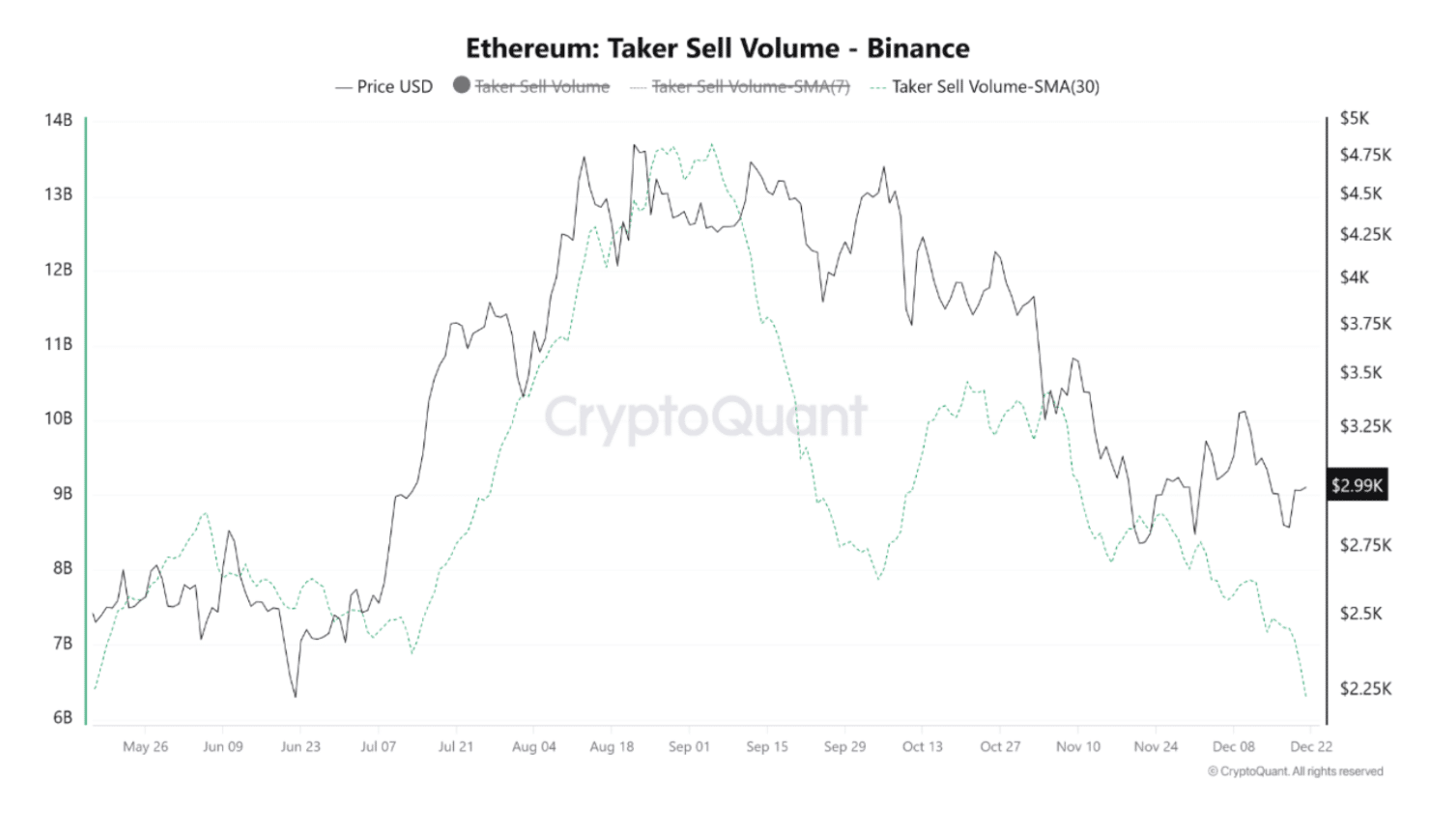

- Taker Sell Volume points to fading sell-side pressure.

- A move above $3,200 would signal takeover by the bulls, analyst says.

Ether ETH $3 047 24h volatility: 2.1% Market cap: $368.34 B Vol. 24h: $17.29 B has started the week on a positive note after a volatile stretch. On Dec. 22, the cryptocurrency reclaimed the $3,000 level as its trading volume jumped by 100%. Analysts are predicting a relief rally ahead, backed by cooling sell pressure.

Data by CryptoQuant suggests that the 30-day moving average of Ethereum Taker Sell Volume has slipped to about $6.3 billion, the lowest reading since May. This drop indicates that fewer traders are now exiting positions out of urgency or fear.

Ethereum Taker Sell Volume 30-day SMA | Source: CryptoQuant

The latest ETH purchase by Tom Lee’s Bitmine confirms the renewed buying interest. According to the data by Lookonchain, the company has acquired 13,412 ETH, worth over $40 million, on Dec. 22.

It seems that Tom Lee(@fundstrat)'s #Bitmine just bought another 13,412 $ETH($40.61M).https://t.co/m3WT8Jwh6x pic.twitter.com/DCpdDNp0U9

— Lookonchain (@lookonchain) December 22, 2025

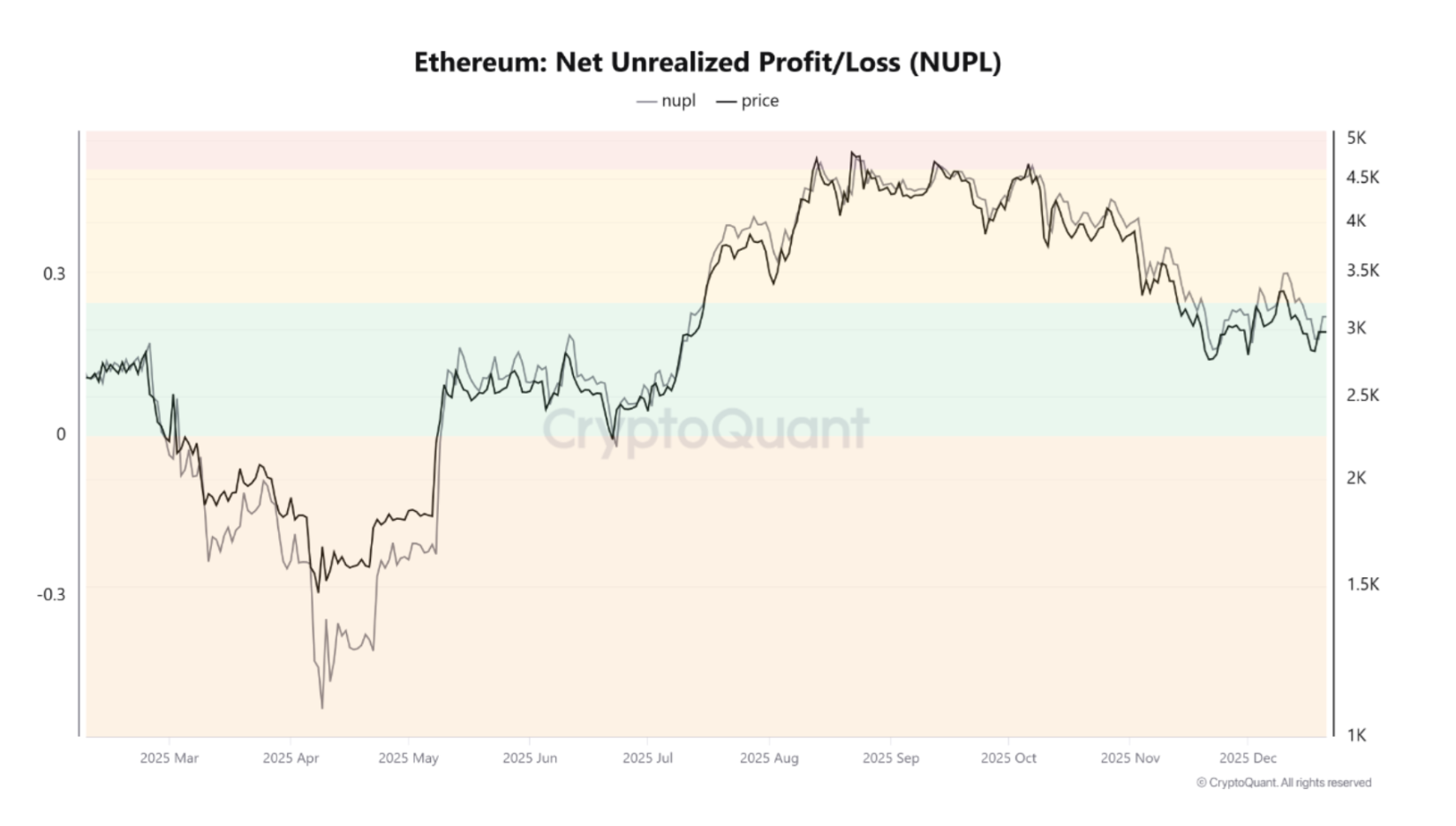

Moreover, the Net Unrealized Profit and Loss indicator (NUPL) for Ether remains in positive territory near 0.22. This level shows that the average ETH holder is still in profit, though those gains are moderate.

Ethereum NUPL | Source: CryptoQuant

Historically, this range suggests guarded confidence. It signals that the market is no longer fear-driven, but is still far from overheated conditions seen near cycle tops.

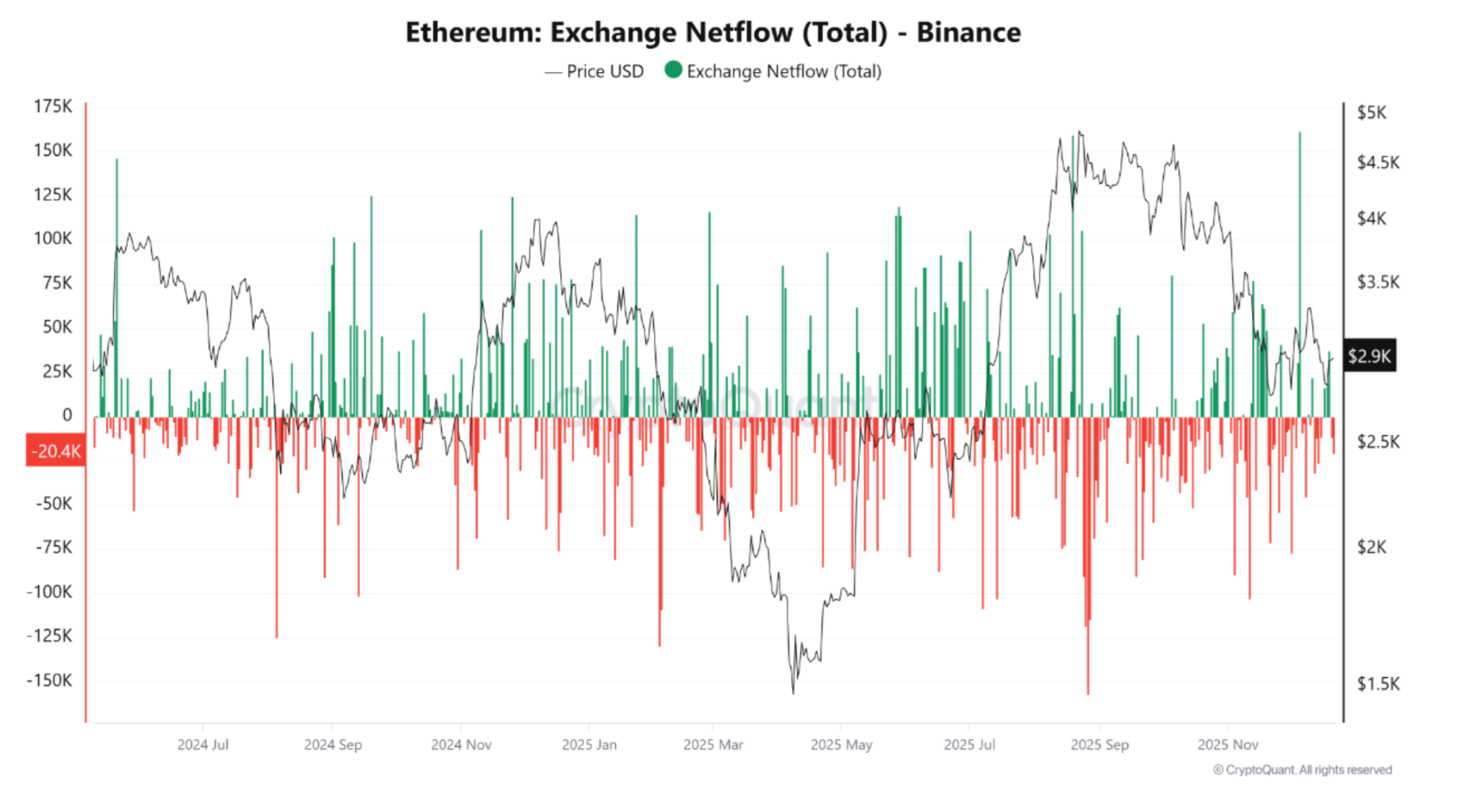

Meanwhile, Binance has recorded large net outflows of ETH, which means near-term selling risk is lower. Importantly, these exchange exits are despite moderate unrealized gains, suggesting holders are not rushing to lock in profits.

Ethereum netflow on Binance | Source: CryptoQuant

Recent Ether Price Weakness Still Suggests Caution

This easing in selling pressure comes after a difficult week for Ethereum, when the price slipped below $2,800. Last week, spot ETH ETFs saw a combined net outflow of $644 million, with none of the nine funds posting inflows.

Popular crypto analyst CyrilXBT noted on X that while ETH is bouncing, it is still under key resistance levels. He explained that the $2,700-$3,000 area acts as a fragile support for the top altcoin, and further weakness can result in a “quick downside acceleration.”

However, he added that ETH could look “healthy” if it manages to cross the $3,200-$3,400 level.

$ETH

ETH is basically stuck in the same story: bouncing, but still under key overhead levels.

The orange band ($2.7–3.0k) is the battlefield. It’s support until it isn’t.

Above that, ETH needs to reclaim $3.2–3.4k to look “healthy” again.

Expectation: hold $2.7–3.0k = chop +… pic.twitter.com/8Lby8IOw6Q— CyrilXBT (@cyrilXBT) December 22, 2025

At the time of writing, ETH is trading near $3,031, up by around 2% in the past day. But, it remains 38% below its August peak of $4,953.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

bitcoinworld.co.in

bitcoinworld.co.in

cryptoticker.io

cryptoticker.io

coinedition.com

coinedition.com

coinfomania.com + 1 more

coinfomania.com + 1 more

newsbtc.com

newsbtc.com