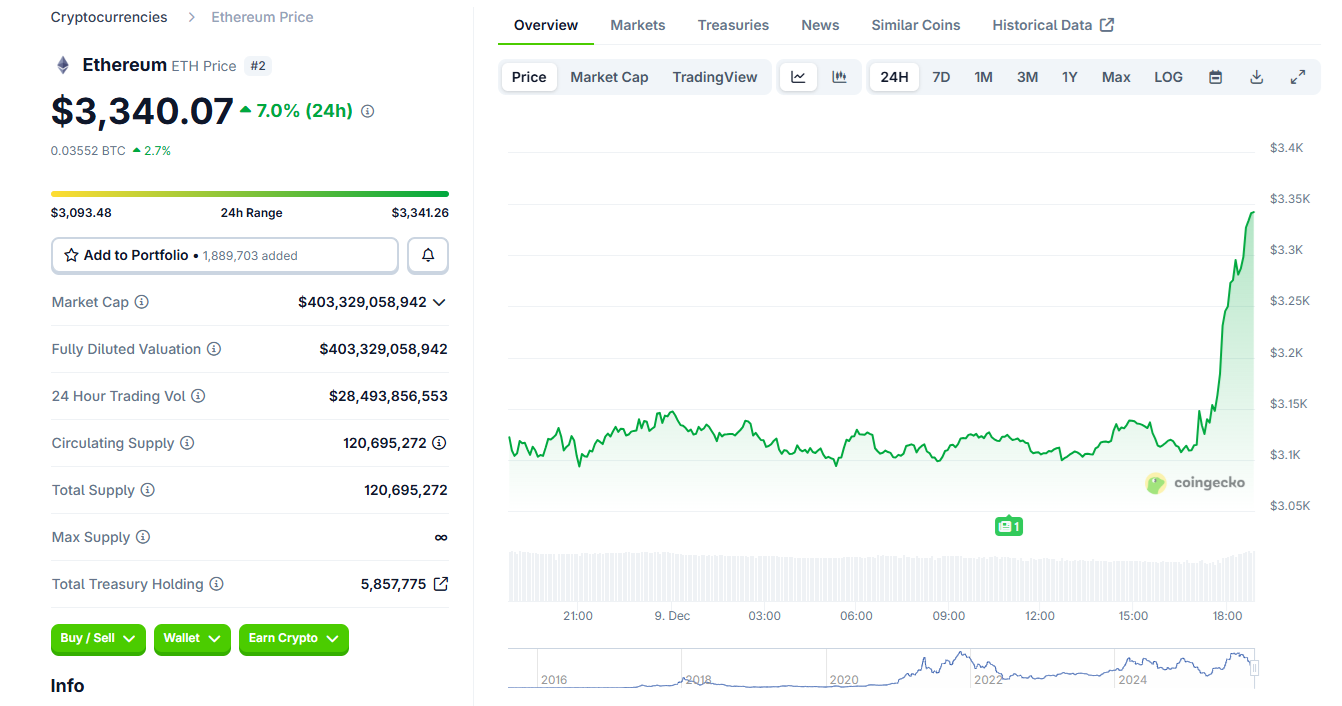

$ETH rallied above $3,300 after a mostly positive day for the crypto market. The token kept seeing inflows from whales, as well as another big purchase from Bitmine.

$ETH continues to see interest from large-scale players, including whales, in both spot and derivative markets.

$ETH recovered above $3,200 after a short squeeze, following a day of rebuilding short liquidity. The token continued its expansion to $3,342.21. The last price move caused $36.3M in long liquidations for the past 24 hours, of which close to 50% were on Binance.

The latest price moves showed a quick return to speculation, as traders opened new positions just as the token showed signs of a directional move. Open interest spiked within a short timespan, from $17.6B to $18.5B. However, traders opened new positions on the short side, suggesting the rally may be short-lived.

Bitmine has $1B to buy more $ETH

Bitmine revealed it had been buying more $ETH in the past week, expanding its treasury to $12.05B.

The treasury company has $1B remaining to make more purchases, after last week’s addition of over $138K $ETH. Bitmine expanded its treasury by 13.8% in the past month, resuming more frequent purchases in December.

Treasury companies have slowed down their buying, but still added more $ETH to their balance in December. BMNR shares responded by bouncing off their lows, rising to $38.60, around the middle of their range for the past few months. BMNR has secured its financing and is one of the predictable buyers of $ETH.

Hyperliquid whales go long on $ETH

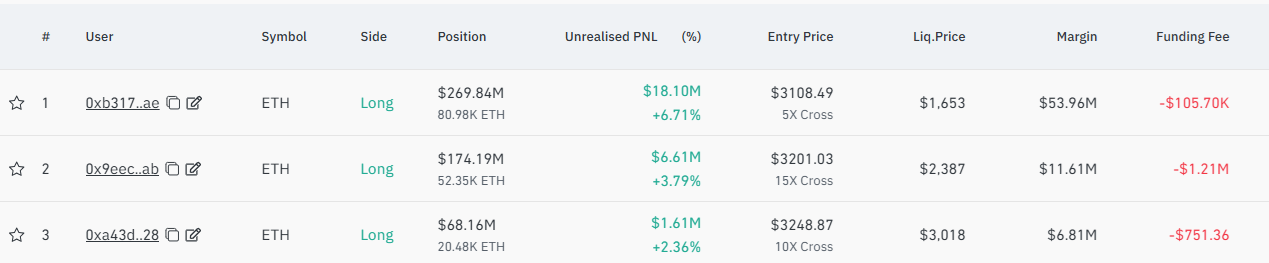

Hyperliquid whales also took high-profile positions in $ETH, currently sitting on outsized unrealized gains.

The 1011 whale, who was known for shorting BTC just before the October drop, expanded the unrealized gains from $3M to over $18M. The whale keeps paying fees of over $100,000 to retain the position, and has not closed to take profits.

On-chain data shows whale currently holds the biggest long position on Hyperliquid, with a notional value of $269M.

The second position was built by the ‘Anti-CZ’ whale, and is valued at $174M, with unrealized gains of over $6M. In the third spot is an older whale that quickly aped into $ETH, with $1.6M in unrealized gains. Machi Big Brother, another notorious Hyperliquid trader, also increased his $ETH long position.

The latest climb erased most of the available $ETH short liquidity, with few positions remaining up to $3,400. The short squeeze may be followed by a reversal, as $ETH has accumulated long positions just above $3,000. At the current price range, $ETH retains the support level at $3,000, in addition to the $2,800 range, which is the cost basis of multiple whales.

The ETh fear and greed index rallied from 51 points to 66 points within a few hours, signaling a rapid shift in sentiment.

Join a premium crypto trading community free for 30 days - normally $100/mo.

coindesk.com

coindesk.com

thecryptobasic.com

thecryptobasic.com

invezz.com

invezz.com

coinedition.com

coinedition.com