$Ethereum is trading around $3,030, regaining the key $3,000 psychological level after a decisive rebound from support. Renewed ETF inflows, rising whale accumulation, and improving technical momentum all contributed to the bounce. With $ETH now consolidating just below major resistance, traders are watching whether it can trigger a breakout toward higher levels.

Below is the full breakdown of why $ETH is up — and where the price could go next based on the chart.

Why Ethereum Price Is Up

1. ETF Demand Returns (Bullish Impact)

Overview

After facing $1.4B in net outflows through November, Ethereum ETFs flipped positive with $368M in inflows during the final week. This shift aligned with reduced geopolitical tension and $ETH’s prolonged underperformance compared to Bitcoin.

What This Means

Institutions appear to be rotating back into $ETH, treating it as a catch-up play. ETF inflows decrease sell pressure and act as confirmation that the $3,000 support area is fundamentally backed by institutional demand.

Watch For

Whether inflows continue into early December

If $ETH ETF demand outpaces BTC for the first time in weeks

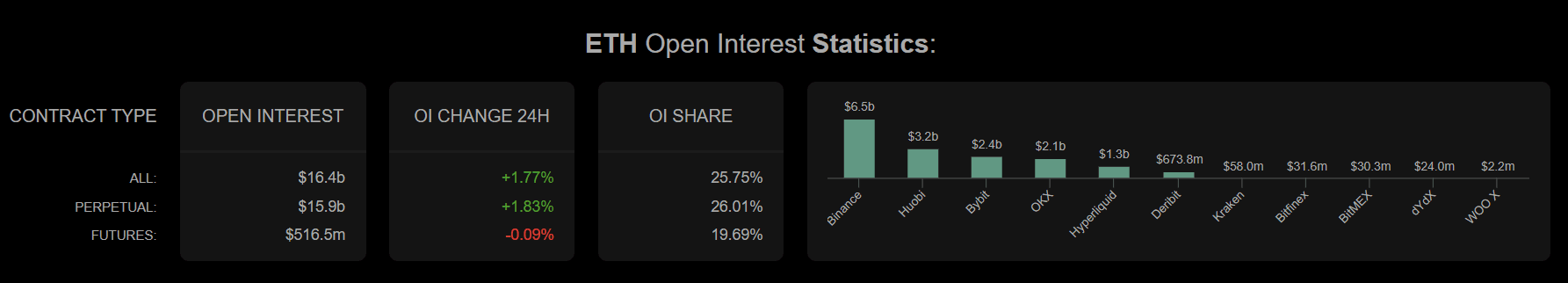

2. Whale & Derivatives Activity (Mixed Impact)

Overview

On-chain data shows whales added 14,618 $ETH (~$185M) in late November. At the same time, $ETH derivatives open interest rose $700M, with longs dominating shorts 2:1 near $2,960.

What This Means

Large players are aggressively defending the $2,960–$3,000 zone. However, rising leverage — 3.97M open contracts — introduces liquidation risks if $ETH fails to break above $3,100 resistance.

Watch For

Long liquidations if $ETH rejects at $3,100–$3,200

Leverage resets that could trigger either volatility spike

3. Technical Momentum (Bullish Short-Term)

Overview

$ETH has reclaimed the 20-day EMA ($2,968) and printed a bullish MACD crossover with a strong histogram at +37.73. The zone between $2,960 and $3,000 now acts as confirmed support.

What This Means

If $ETH maintains a daily close above $3,000, traders expect continuation toward key Fibonacci levels, especially the 38.2% retracement at $3,270. However, the 200-day MA at $3,520 remains a major resistance barrier.

Ethereum Chart Analysis: What Just Happened

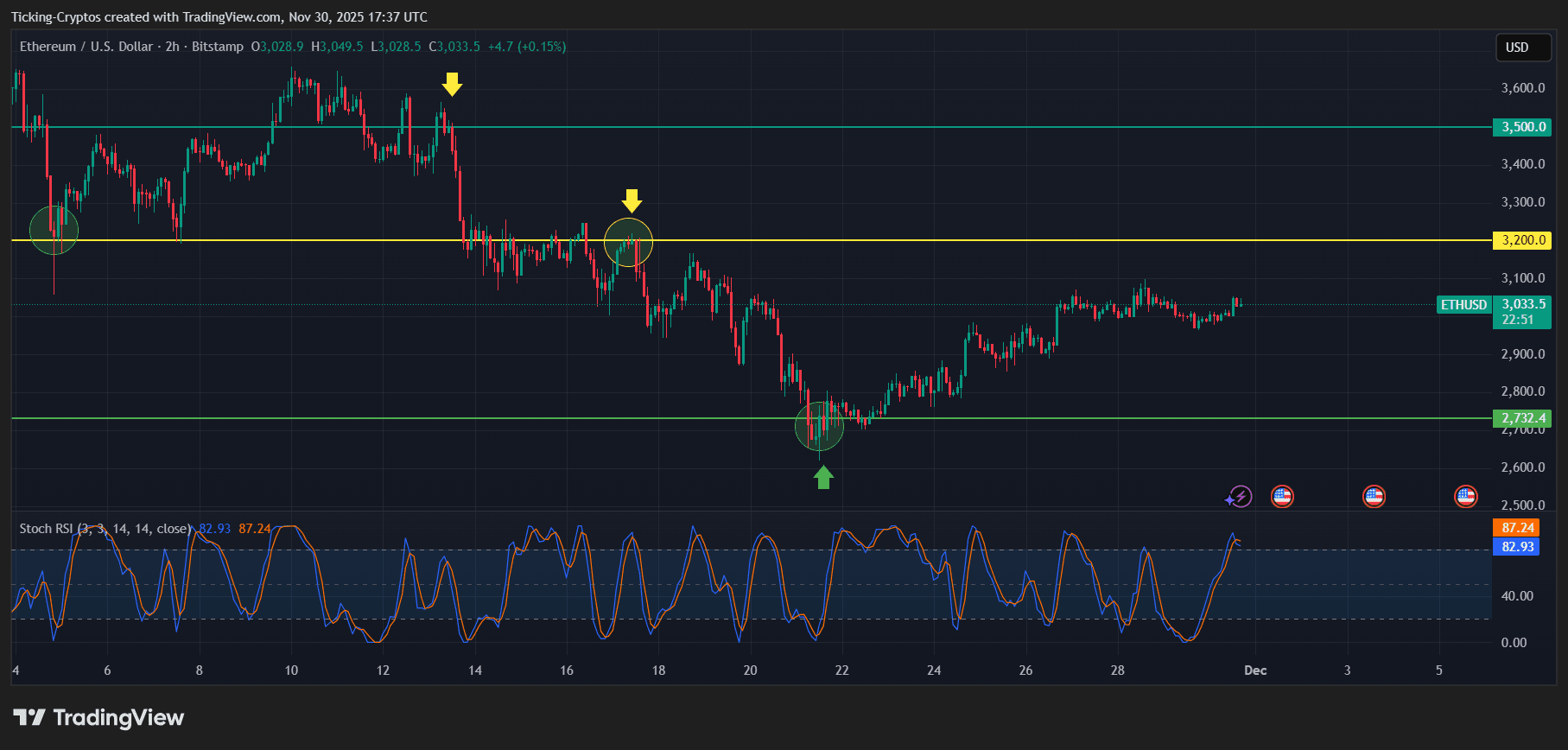

Looking at the attached chart, we notice a clear pattern.

$ETH/USD 2-hour chart - TradingView

1. $ETH Rejected Repeatedly at $3,200 (Yellow Line)

The chart shows multiple rejections at $3,200, marked by yellow arrows and circles. This zone has acted as mid-range resistance for several weeks.

2. Strong Bounce From $2,732 Support (Green Line)

$ETH bottomed perfectly at the $2,732 structural support, where a green arrow confirms a high-volume reclaim. Each historical touch at this level triggered strong reversals.

3. Current Sideways Consolidation Around $3,030

$ETH is now stabilizing in a narrow band just under resistance — which often precedes a breakout attempt.

4. Stoch RSI Shows Overbought Momentum

The Stoch RSI currently reads:

- 82.93 (blue)

- 87.24 (orange)

$ETH is short-term overbought, meaning a brief cooldown may occur before continuation.

Ethereum Coin News: Key Levels to Watch

Support Levels

- $3,000 – short-term psychological support

- $2,960 – reclaimed technical support

- $2,732 – major macro support

Resistance Levels

- $3,200 – critical resistance that rejected multiple times

- $3,500 – major upside target

- $3,520 – 200-day MA and higher-timeframe resistance

Ethereum Price Prediction: Where will Ethereum Reach Next?

Based on the current chart structure, momentum signals, and market fundamentals:

Bullish Scenario (Most likely if $ETH holds above $3,000)

$ETH pushes higher from current consolidation.

Upside Targets

- $3,200 (first major breakout zone)

- $3,270 (38.2% Fibonacci level)

- $3,500 (strong resistance)

- $3,520 (200-day MA — key trend-flip level)

If $ETH closes above $3,500–$3,520, the next macro target opens toward $3,800+.

Bearish Scenario (If $ETH fails to hold $3,000)

A rejection at $3,200 could send $ETH into a corrective move.

Downside Targets

- $2,960

- $2,850

- $2,732 (critical support zone)

A breakdown below $2,732 would shift the trend into a mid-term bearish phase.

ambcrypto.com

ambcrypto.com

newsbtc.com

newsbtc.com

cryptopotato.com

cryptopotato.com