Ethereum price trades around $3,000, but the chart and on-chain data both indicate a pressure zone that traders cannot ignore. Momentum looks unstable, as one key holder group continues to sell.

The Ethereum price is stuck at a point where even slight shifts can alter the entire structure.

Momentum Weakens as Long-Term Sellers Step In

The $ETH price has attempted to recover over the past week, rising approximately 10%, but the broader trend remains down 23% over the last 30 days. The bounce looks healthy on the surface, yet the behavior underneath the chart tells a different story.

The RSI, or Relative Strength Index, measures momentum. A hidden bearish divergence has formed between November 18 and November 28.

The Ethereum price made a higher low, but momentum made a higher high. When this happens during a downtrend, it often signals a weak rebound and that sellers still control the trend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Who are those sellers? On-chain data gives the answer.

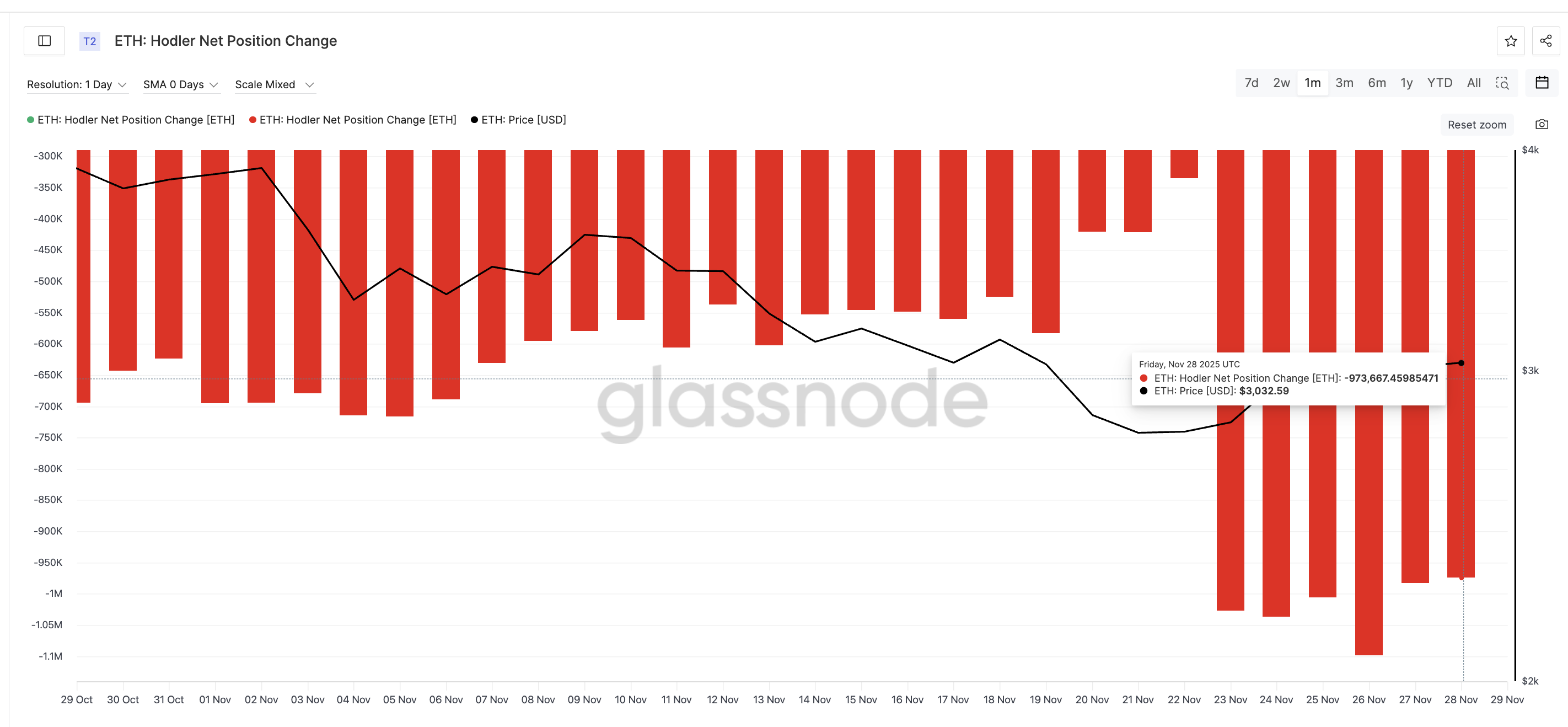

Hodler Net Position Change — which shows whether long-term holders are adding or removing $ETH — has stayed deep in red for the entire month. Red readings mean long-term wallets are sending $ETH back toward exchanges.

Over the last week, that pressure has increased sharply. On November 22, long-term holders offloaded about 334,600 $ETH, but by November 28 the figure had grown to roughly 973,000 $ETH — a rise of about 191% in six days.

There was also a local spike near 1.1 million $ETH on November 26. This steady increase in weekly outflows indicates that the cohort that typically stabilizes the market is now leaning more heavily towards the sell side.

Momentum softening and long-term selling happening together give $ETH a clear downside risk.

Ethereum Price Sits at a Tight Break Point

The Ethereum price is also closing in on the edge of a pennant structure. This can break either way.

$ETH now trades right above the $3,016 support zone, which lines up with the 0.382 Fibonacci level. If this floor breaks, the next levels sit at $2,864, a 5% dip. A deeper slide could open $2,619, especially if long-term selling continues.

To cancel the bearish setup, $ETH must push above $3,138. That level breaks the upper pennant trendline and flips the short-term bias. Without that break, the chart remains vulnerable.

Pennants can technically break either way, but the RSI setup and long-term selling tilt the Ethereum price risk toward a downside break unless buyers step in soon.

The post Ethereum Price Chart Flashes a Bearish Warning — Could This Be a ‘Long-Term’ Risk? appeared first on BeInCrypto.

ambcrypto.com

ambcrypto.com

newsbtc.com

newsbtc.com

cryptopotato.com + 1 more

cryptopotato.com + 1 more