TL;DR

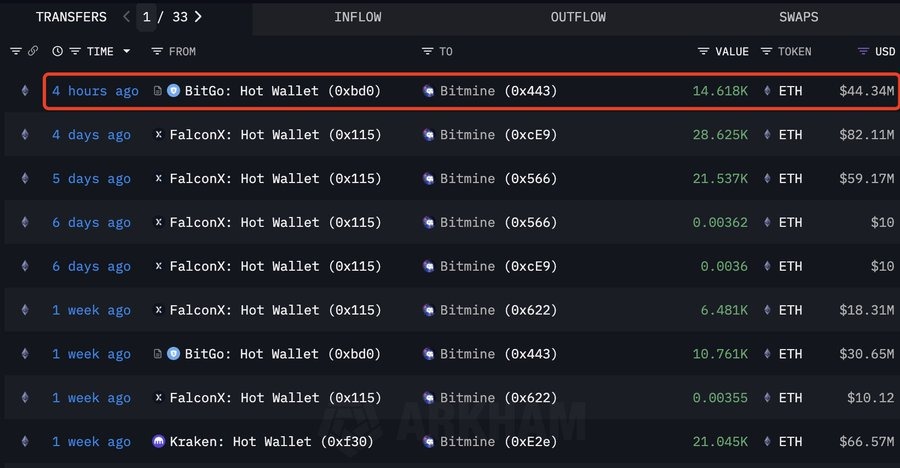

- BitMine adds 14,618 $ETH, now holding 3% of the entire Ethereum supply.

- The company aims to eventually control 5% of all $ETH in circulation.

- BitMine’s stock rose 9% on the news but is down 37% for the month.

BitMine Immersion Technologies increases its Ethereum treasury again, adding 14,618 $ETH valued at more than 44 million dollars. Led by Tom Lee, the company pushes forward with a plan to control 5% of all $ETH, a target rarely pursued in the corporate space.

BitMine now holds 3.63 million $ETH, equal to 3% of the entire supply. At an $ETH price near $3,027, the treasury reaches an estimated $10.39 billion, placing BitMine among the largest corporate holders worldwide.

Corporate buying of $ETH continues to rise. Data shows combined corporate holdings near $24.97 billion, equal to 5.01% of all $ETH, showing strong interest in staking, yields and tokenized asset activity.

BitMine Adds 14,618 $ETH While Market Liquidity Remains Weak

Data from Arkham Intelligence confirms that BitMine executed the purchase on November 28. The addition aligns with a broader plan to accumulate nearly 6 million $ETH over time.

Despite the purchase, $ETH stays near $3,030. Heavy ETF outflows and thin liquidity hold back any upward reaction. Even aggressive buying fails to create momentum in the current environment.

Broader market pressure also limits volatility, keeping $ETH near the same trading range for days.

BitMine Stock Rises 9%, Yet Remains Under Monthly Pressure

Shares of BitMine (BMNR) react strongly to the news. The price climbs 9% to roughly $31.74, outpacing $ETH during the same period.

Monthly performance tells another story. BMNR falls about 37% in the past thirty days due to its close link with broader crypto market behavior. With crypto down nearly 22%, BitMine stock absorbs similar selling pressure.

BitMine maintains its approach: increase long-term $ETH exposure during weak market phases and continue building a large treasury position in preparation for stronger liquidity and higher institutional demand.

Ethereum ($ETH) Technical Analysis – November 28, 2025

As of November 28, 2025, the price of Ethereum ($ETH) stands at approximately $3,057.96 USD, showing a +2.01% increase over the past 24 hours, with a daily trading range between $2,995 and $3,065 USD. The market capitalization is valued at $369 billion, with a 24-hour trading volume of $16.1 billion, reflecting strong market activity and sustained buying pressure.

From a technical standpoint, Ethereum remains in a moderately bullish trend, trading above the 50-day moving average near $2,880 USD and maintaining strong support around $2,950 USD. The next short-term bullish target lies at $3,150 USD, a level that coincides with a key resistance area observed in previous sessions. A breakout above this zone could open the path toward $3,350 USD, where the October local high and the 200-day moving average intersect.

Conversely, if $ETH loses support below $2,950 USD, a correction toward $2,780 USD could occur — a region where historical buying pressure has reappeared multiple times.

cryptobriefing.com

cryptobriefing.com

coindesk.com

coindesk.com

coincodex.com

coincodex.com