Ethereum ($ETH) extended its downward trend today, leading to widespread liquidations and millions in losses for crypto traders.

This comes amid a broader decline in the crypto market. Major cryptocurrencies are continuing to suffer losses, and today is no exception.

Ethereum’s Market Correction Hits Traders Hard

BeInCrypto Markets data showed that $ETH has slipped 7.3% since the beginning of the week. This dip follows the second-largest cryptocurrency’s rise to multi-year highs.

Ethereum’s value has decreased 1.54% over the past day alone. At the time of writing, it was trading at $4,166.

While corrections are typical, they proved costly for those who wagered on the market moving upwards. CoinGlass data revealed total liquidations reached $486.6 million over the past 24 hours.

This figure reflected the liquidation of 136,855 traders. Ethereum bore the brunt of the market drop, with $196.8 million in positions liquidated. Of this, $155.15 million came from long positions.

Lookonchain, a blockchain analytics firm, recently spotlighted a trader who profited millions by going long on Ethereum, only to see nearly all those gains wiped out within two days.

The trader began with a $125,000 deposit into Hyperliquid four months ago. He strategically entered long positions on $ETH across two accounts. The trader used his profits to boost his position to 66,749 $ETH.

With this strategy, his total equity surged from $125,000 to an impressive $29.6 million. Furthermore, earlier this week, this trader closed all 66,749 $ETH long positions, securing a profit of $6.86 million.

However, amid the recent market crash, the trader re-entered the $ETH market but was ultimately liquidated, losing $6.22 million in the process.

“Starting with just $125,000, he grew his accounts to $6.99 million (peaking $43 million+). Now only $771,000 remains—4 months of gains nearly wiped out in just 2 days,” Lookonchain noted.

James Wynn, a high-risk leverage trader, also experienced partial liquidation. Lookonchain reported that Wynn opened a 25x leveraged long on $ETH after claiming 19,206.72 $USDC ($USDC) in referral rewards. Nonetheless, as the market went south, his position was partially liquidated.

“James Wynn’s $ETH long was partially liquidated, leaving him with a long position of 71.6 $ETH ($300,000),” the post read.

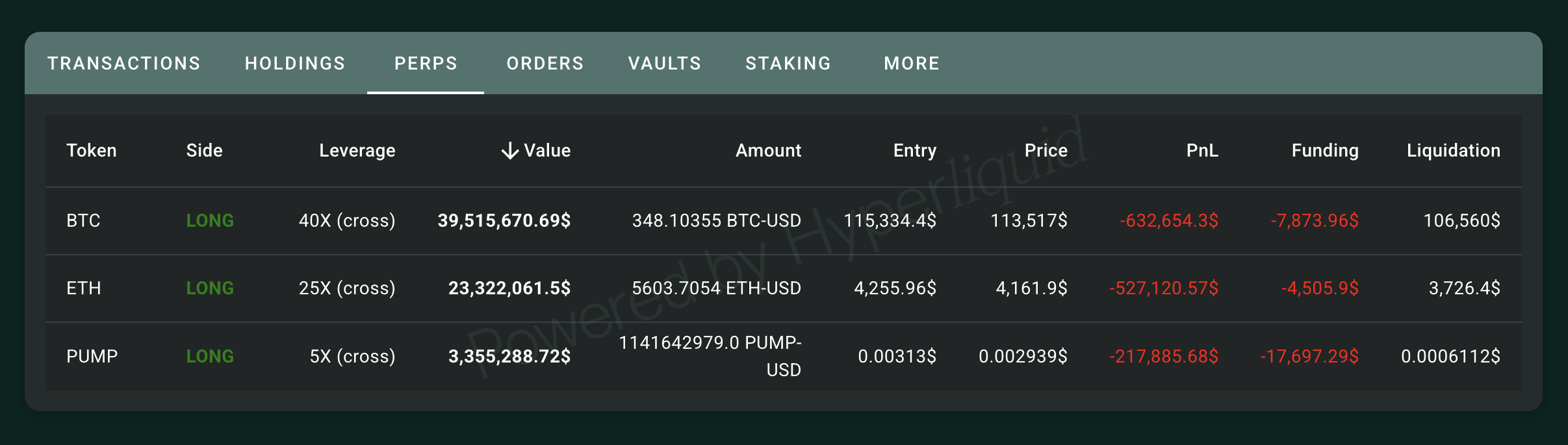

In addition, the blockchain analytics firm noted that a trader made a 1 million $USDC deposit into Hyperliquid yesterday. The funds were used to open maximum-leverage long positions on $ETH, Bitcoin (BTC), and Pump.fun (PUMP).

Nonetheless, the latest data from HypurrScan showed that the trader now faces unrealized losses exceeding $1 million.

Institutional Investors Are Buying The Dip

Amid the widespread liquidations, institutional investors are capitalizing on the $ETH dip. Bitmine Immersion, the largest publicly traded $ETH holder, acquired 52,475 $ETH, pushing its total $ETH holdings to 1,575,848 $ETH worth nearly $6.6 billion.

“SharpLink bought 143,593 $ETH($667 million) at $4,648 last week and currently holds 740,760 $ETH ($3.19 billion). Together with Bitmine, they bought 516,703 $ETH($2.22 billion) last week,” Lookonchain wrote.

Additionally, two institution-linked wallets, 0x50A5 and 0x9bdB, received 9,044 $ETH, valued at approximately $38 million, from FalconX. Besides buying, panic-selling was also prevalent.

Whales are panic-selling $ETH as the market plummets!

— Lookonchain (@lookonchain) August 19, 2025

0x1D8d deposited 17,972 $ETH($77.4M) to #Coinbase an hour ago.

0x5A8E deposited 13,521 $ETH($57.72M) to #Binance in the past 12 minutes.

0x3684 deposited 3,003 $ETH($12.89M) to #Binance 20 minutes ago.… pic.twitter.com/oxKPQsl9Nv

This highlights the diverse strategies investors are employing in response to market conditions. Still, institutional buying does signal strong confidence in Ethereum’s long-term potential.

The post Ethereum Dip Triggers Million-Dollar Losses for Traders appeared first on BeInCrypto.

cryptopotato.com

cryptopotato.com

coindesk.com

coindesk.com

thecryptobasic.com

thecryptobasic.com

invezz.com

invezz.com