Ethereum price today: $2,460

- Ethereum registered a 1% decline over the past 24 hours as bulls ease buying pressure.

- Bitcoin miner, Bit Digital, announced plans to switch to an ETH treasury strategy.

- ETH must recover the $2,500 level to prevent the validation of a bearish flag pattern.

Ethereum (ETH) is down 1% over the past 24 hours following Bitcoin (BTC) miner Bit Digital's (BTBT) announcement on Wednesday that it's pivoting toward an ETH staking and treasury strategy.

ETH loses steam despite Bit Digital's pivot to an Ethereum treasury strategy

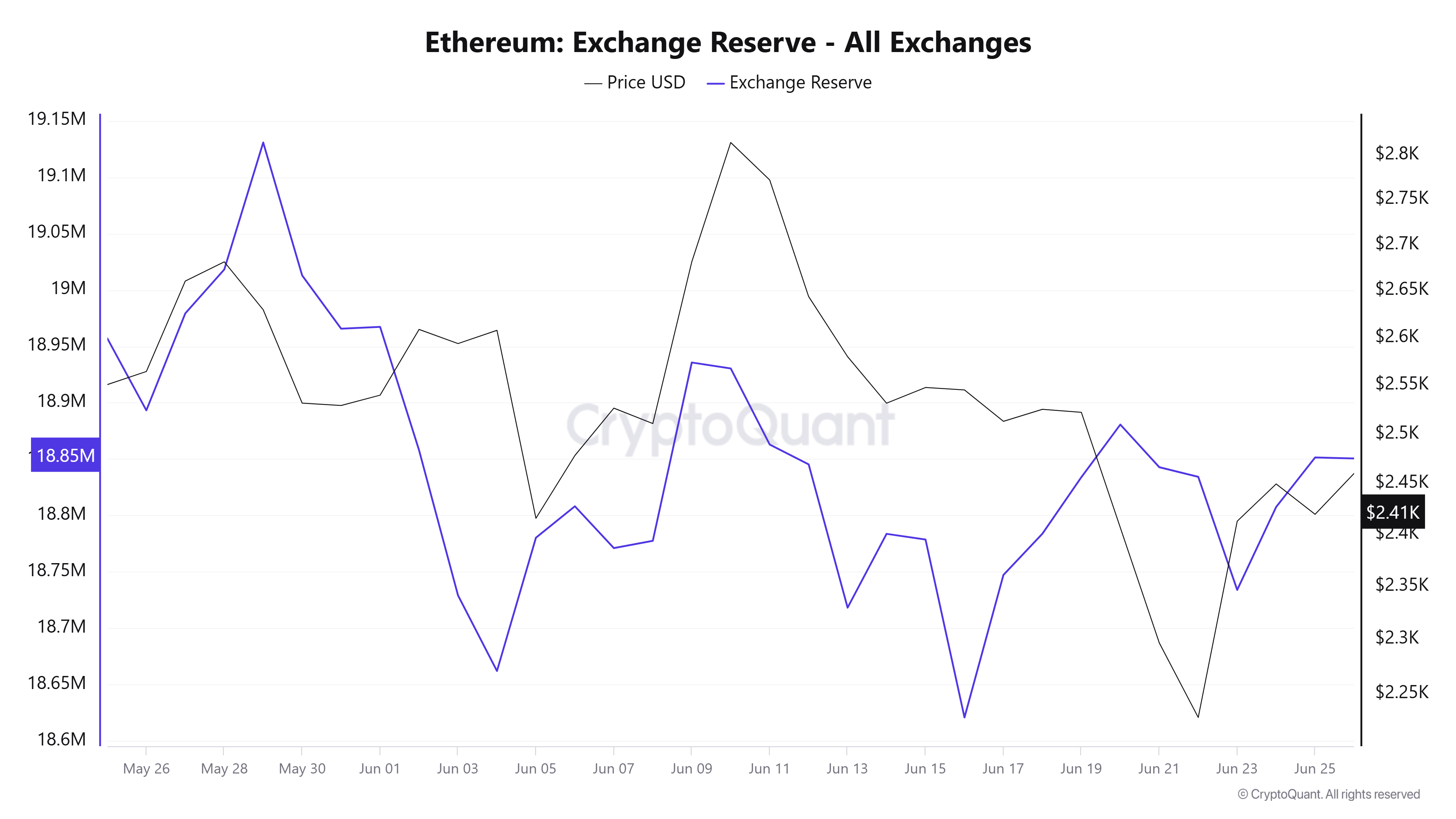

After two consecutive days of recording gains following the Israel-Iran ceasefire, bulls have lost steam, as Ethereum registered a 1% decline. The decline was spurred by a rise in Ethereum's exchange reserve, indicating low demand and a modest increase in the sell-side pressure.

ETH Exchange Reserve. Source: CryptoQuant

Despite the calmness, corporate entities continue to allocate funds toward ETH, as Nasdaq-listed Bitcoin miner Bit Digital revealed a decisive shift to become an ETH staking and treasury-focused company, according to apress release on Wednesday.

The firm announced plans to wind down its Bitcoin mining operations, redirecting the proceeds to expand its Ethereum staking activities. Bit Digital claimed it began building its Ethereum position and staking infrastructure in 2022 and has gradually expanded its ETH holdings.

Bit Digital alsoannounced the launch of an underwritten public offering of its ordinary shares, with all shares to be issued and sold directly by the company. The firm said that proceeds from the sale will be used to expand its Ethereum holdings, reinforcing its strategic shift toward becoming an ETH treasury and staking platform. However, the size or timing of the offering was not disclosed.

Bit Digital revealed that it held 24,434.2 ETH and 417.6 BTC as of March 31.

The move aligns with a growing trend among crypto firms to adopt treasury models that provide exposure to Ethereum and other cryptocurrencies. This includes SharpLink Gaming (SBET), which holds the largest Ethereum treasury among public companies. The firm holds a total of 188,478 ETH, worth approximately $457 million based on current prices.

Nasdaq-listed BTCS also acquired 1000 ETH last Friday, boosting its treasury holdings to 14,600 ETH.

Ethereum Price Forecast: ETH must recover $2,500 to prevent bearish flag validation

Ethereum experienced $49.49 million in futures liquidations in the past 24 hours, according to Coinglass data. The total amount of long and short liquidations is $30.09 million and $19.40 million, respectively.

Ethereum briefly broke above the upper boundary of a descending channel and the 50-day Exponential Moving Average (EMA) over the past 24 hours before seeing a rejection just below the $2,500 key level.

ETH/USDT daily chart

If ETH fails to recover the $2,500 level and loses the channel's upper boundary support, it will validate a bearish flag pattern. Such a move could send its price below $2,100 if it fails to hold the lower boundary support of a symmetrical triangle pattern.

On the upside, ETH must clear the $2,500 and 200-day Simple Moving Average (SMA) resistance to test the symmetrical triangle's upper boundary and potentially the $2,850 key level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their neutral levels. A rejection could trigger the resumption of bearish momentum, but a crossover will accelerate bullish pressure.

Related news

- Ethereum Price Forecast: ETH defies Powell’s hawkish tone as Israel-Iran ceasefire fuels bullish sentiment

- Ethereum Price Forecast: ETH eyes recovery as Israel-Iran conflict spills into US military base

- Coinbase eyes record close as analysts raise price target to $510, call company 'Amazon of crypto'

fxstreet.com

fxstreet.com