- A whale connected to ConsenSys purchased more than $422 million in ETH via Galaxy Digital OTC without transferring it to exchanges.

- Ethereum rose by 8.61% following a ceasefire agreement deal between Iran and Israel that Trump announced.

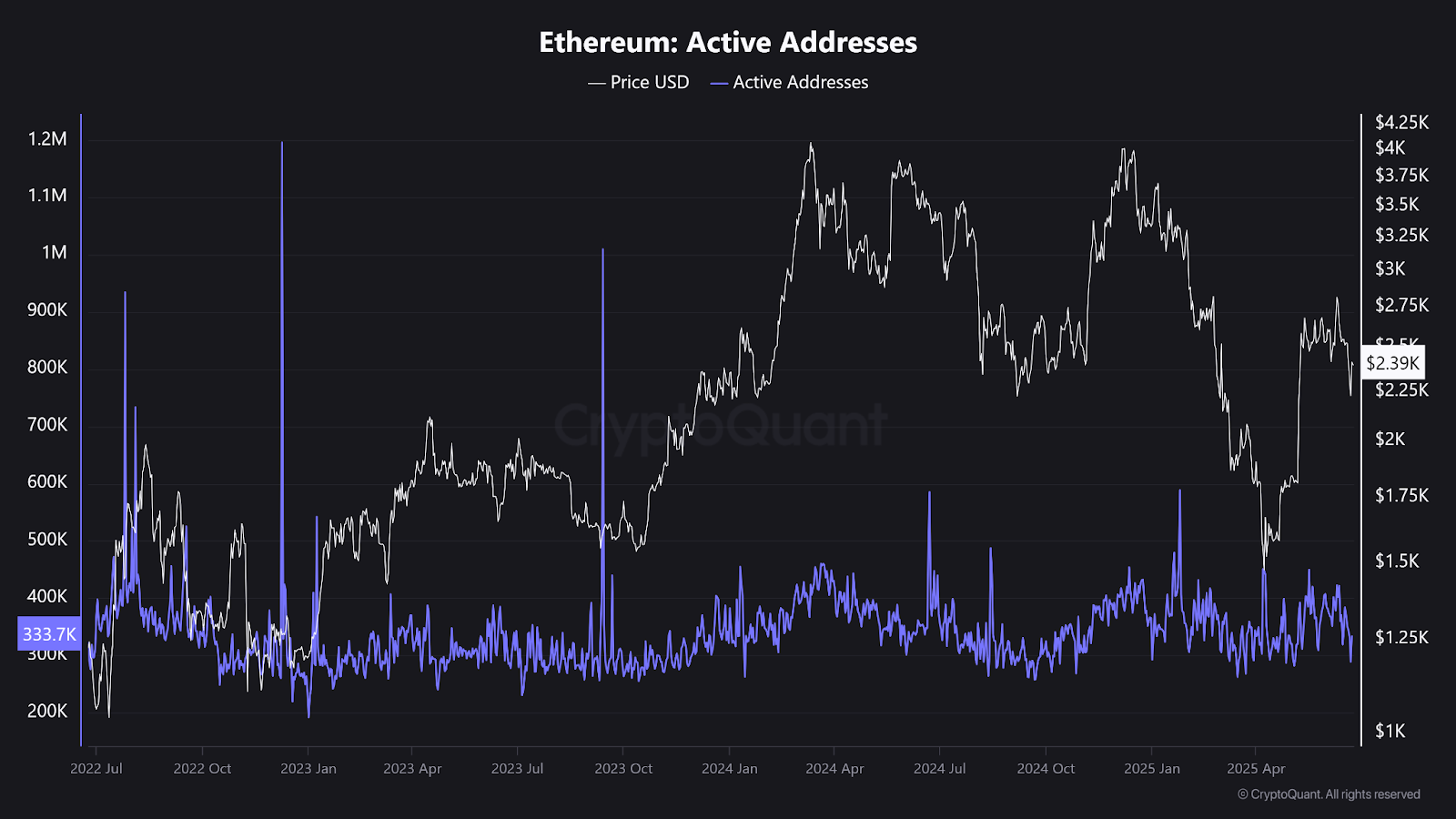

- ETH is testing $2,400 again, but analysts remain cautious because on-chain data reveals weak retail volume.

Over the last three weeks, Ethereum ($ETH) has witnessed significant institutional accumulation resulting in new OTC sales and exchange flows, divided sentiments between traders and analysts. Market data indicates more than $422 million in ETH buys flowed through Galaxy Digital, indicating potential impending sell pressure.

Blockchain analytics firm Lookonchain estimates that a whale associated with ConsenSys has purchased 161,112 ETH through the OTC desk of Galaxy Digital in the past three weeks. The most recent trade occurred 21 minutes ago and involved 3,704 ETH worth approximately $8.91 million. Earlier purchases were between 4 million and $37 million, with over $422 million in direct off-market accumulation.

The whale/institution (probably linked to ConsenSys) bought another 3,704 $ETH($8.91M) through Galaxy Digital OTC ~20 mins ago.

— Lookonchain (@lookonchain) June 24, 2025

They have bought a total of 161,112 $ETH(422M) through Galaxy Digital OTC in the past 3 weeks. https://t.co/cW8EvzSFxt pic.twitter.com/7K7o4EOXNu

These steady purchases have given Bullish sentiment to Ethereum in the medium term. It is worth noting that these transactions have lasted longer without resulting in an exchange deposit, implying a hold strategy.

CoinGlass data shows that the transfer occurred during net negative ETH exchange flows. There have been sustained outflows of Ethereum in recent days, as cumulative daily netflows dropped below negative $200 million.

Ceasefire News Triggers ETH Price Surge

Ethereum posted strong intraday gains on June 23, after U.S President Donald Trump declared a cease-fire between Iran and Israel. During writing, ETH was priced at 2,402 with an increase of 6.17% compared to the last 24 hours. The trend overcame the recent market fear associated with geopolitical tensions and suppressed the bearish mood among digital assets.

Trump said on Truth Social that the two nations agreed to a gradual ceasefire where Iran stopped hostilities for 12 hours, and Israel came in after it to end in a complete 24-hour ceasefire. He called it the resolution of a 12-day dispute that threatened to escalate into a deeper regional crisis. The news was regarded as one of the main catalysts behind the sudden price movement in high-beta cryptos such as ETH.

Ethereum Price Retests Key Levels

Technical indicators are, however, still mixed. RSI is at 47.85 and is nearly at the neutral point, and MACD momentum is negative and indicates possible downside extension.

Ethereum’s recent retest of the $2,400 area has elicited apprehension among analysts. Ted Pillows, a crypto trader, noted that reclaiming $2,350 is the key to a long bullish turnaround. After failing to maintain that level, however, he cautioned that it could fall again to previous support levels.

$ETH tested $2,100 support and bounced.

— Ted (@TedPillows) June 23, 2025

For bulls to retake control it's key to reclaim top-range.

If Ethereum rejects the previous $2,350 rangelow, we'll probably retest start impulse or go lower. pic.twitter.com/9q987utIv7

Likewise, the trader Crypto Patel highlighted the area of $2,400 as a potential trap area. He noted that a rejection would allow heading back below $2,000, and a clean break above $2,450 could trigger a rally to the highs at $3,000.

On-chain data supports caution. According to CryptoQuant, active Ethereum addresses have declined to approximately 333,700. This drop in network activity further supports the perception that there is limited retail participation in the rising prices.