Ethereum (ETH) price may be set for a further rally, with on-chain data and market activity suggesting a possible rise to $3.40.

Notably, this may happen soon, provided it holds above key support levels. Based on this outlook, analysts and market observers closely watch recent whale movements.

ETF inflows and cost-basis distribution are also observed for clues about where the price might go next.

Cost Basis Distribution Shows Strength Around $2,750

According to a recently released data by Glassnode, Ethereum broke out above $2,700. This occurred with the 200-week moving average acting as a key support level.

Per the update, the cost-basis distribution shows 1.3 million ETH held between $2.7000 and $2.740 and 800,000 ETH at $2.760.

This level has been tested since March 2025, when $1,890 was considered a critical price point.

It is essential to add that the chart also highlights that Ethereum (ETH) has experienced 53% green days in the last 30 days, with volatility measured at 2.29%.

These signals, while moderate, show that the market has leaned toward steady gains rather than sharp swings.

The resistance was near $2,832, but analysts believe that holding above $2,750 could trigger a price surge to $3,500.

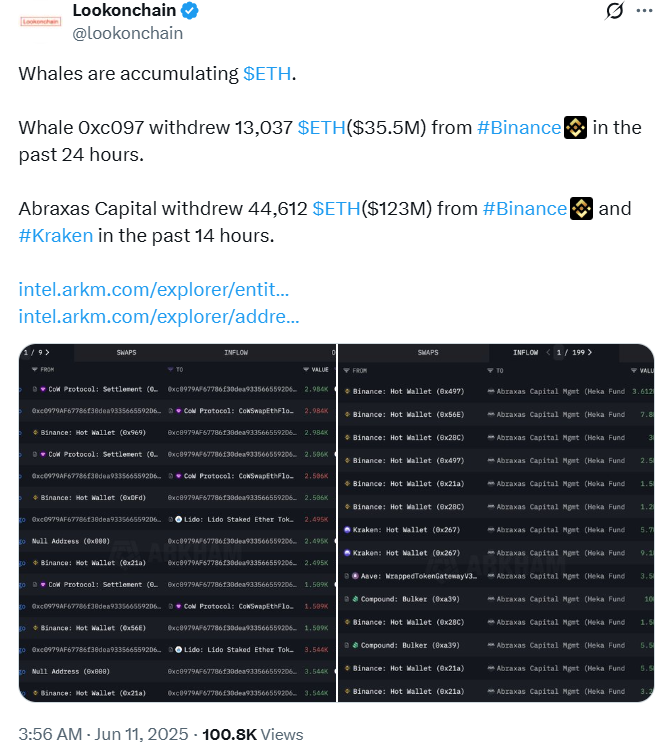

Furthermore, whale movements have also added weight to this outlook. For example, Lookonchain reports that in the last 24 hours, one wallet pulled 13,037 ETH, a fund worth about $35.5 million, all from Binance.

In a more aggressive move, Abraxas Capital collected 44,612 ETH, amounting to around $123 million, from Binance and Kraken over 14 hours.

This accumulation level suggests that larger investors believe Ethereum (ETH) has strong potential at its current price range.

Ethereum (ETH) ETF Market Logs 14 Days of Inflows

It is important to add that fresh momentum in the Ethereum ETF market is also boosting confidence.

According to Farside Investors, there has been a 14-day inflow streak into Ethereum ETFs.

Current data showed $125 million in net inflows as of June 10.

This streak has been driven mainly BlackRock’s ETHA and Fidelity’s FETH, which have accounted for over 80% of net inflows since July 2024.

Grayscale ETH and Bitwise ETH recorded $9.7 million and $8.4 million, respectively, on June 10.

These inflows are tightening supply, especially with 70 million ETH already staked following the live deployment of the Pectra upgrade earlier this quarter.

Some market participants also believe that the SEC’s recent approval of ETF options trading has contributed to the situation.

This approval has increased investor confidence, especially among institutions, making Ethereum (ETH) one of the strongest assets in terms of fund interest.

Outlook Remains Bullish, But Support Must Hold

Per the current bullish outlook, the question remains: where is the Ethereum price heading?.

Ethereum (ETH) price was trading above the 200-day exponential moving average and appears to form a bullish flag pattern.

As of this writing, market data shows that ETH price was trading at $2,770.06, up by 2.28% in 24 hours. If the price breaks above $2,870, a push toward $3,500 could follow soon.

However, traders are to monitor key levels closely, as a failure to maintain the $2,750 support could result in Ethereum retesting $2,600 or lower.

On the upside, sustained support, continued ETF interest, and large-scale accumulation could all fuel a rally to $3,400 by mid-2025.

With strong support, reduced selling pressure, and institutional inflows, Ethereum is well-positioned to make this giant price swing.

thecoinrepublic.com

thecoinrepublic.com