After weeks of choppy price action, Ethereum is back in focus as volatility brews across the crypto market. While ETH has maintained key levels recently, the growing divergence between price movement and futures open interest is raising eyebrows.

With macro uncertainty easing and altcoin narratives slowly rotating back into the spotlight, ETH is setting up for a potential directional move—but it remains to be seen whether that’s to the upside or downside.

Technical Analysis

By ShayanMarkets

The Daily Chart

Ethereum continues to consolidate just below the $2,800 resistance zone after reclaiming the 200-day moving average yesterday. The price has been hovering within a narrow range, caught between the key resistance area around $2,800 and the $2,500 demand zone.

It has also been creating a tight ascending channel pattern below $2,800, which is usually a reversal pattern if broken to the downside. However, a bullish breakout from this pattern could invalidate the reversal and add fuel to a potential rally higher.

The RSI also chart remains stable around the 60 level, indicating there’s still room for upward movement before the asset enters overbought territory. But without a convincing break above $2,800, the move could still be classified as a range rather than a trend continuation.

If $2,500 gives way, and the channel is broken to the downside, a deeper pullback into the $2,100-$2,200 imbalance zone becomes increasingly likely, especially as resting liquidity remains uncollected there.

The 4-Hour Chart

Zooming in on the 4H timeframe, ETH’s price action inside the ascending channel becomes clear. This pattern has formed after an almost vertical impulse move from the $1,800 region, which left behind noticeable imbalances that are yet to be filled. There is also a Fair Value Gap formed around the $2,600 level, which is now acting as short-term support.

This area is key for the buyers to defend if they want to preserve the current market structure. So far, the asset has attacked the higher trendline of the channel multiple times, but each retest is coming with decreasing bullish momentum.

Moreover, the RSI is printing lower highs while the price holds steady, suggesting a potential bearish divergence is forming. If confirmed, this could lead to a drop back to the lower boundary of the channel and even a potential breakdown, sending ETH toward the $2,350 liquidity pool or even deeper into the imbalance zone around $2,000. For a bullish breakout, ETH must clear $2,800 with strength and continuation, ideally backed by volume and liquidation flow to fuel the rally.

Sentiment Analysis

By ShayanMarkets

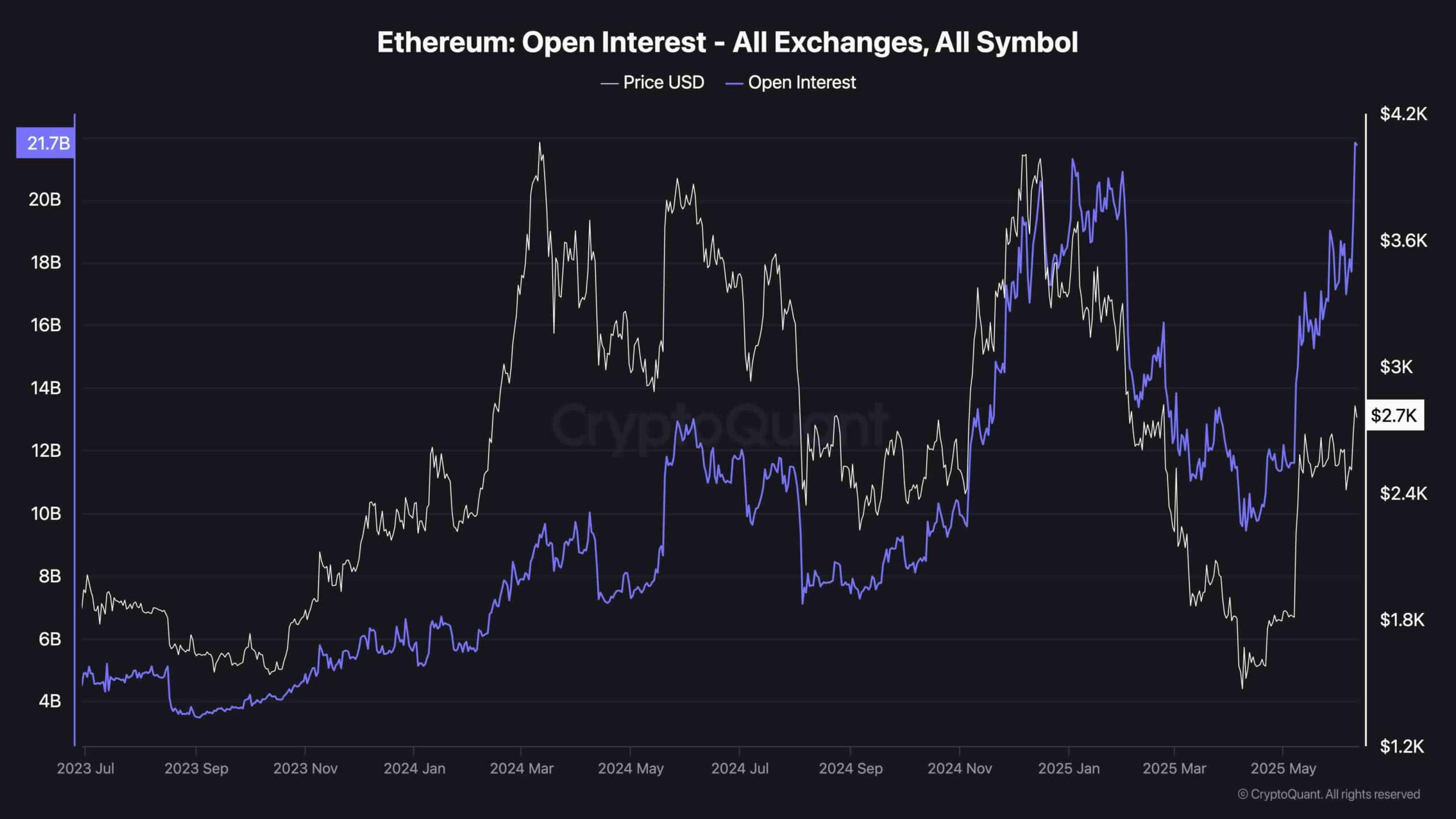

One of the most notable shifts in recent days has been in Ethereum’s open interest (OI). As shown in the chart, the metric has hit a new high of over $21.7B across all exchanges, despite the ETH price still sitting below recent highs.

This creates a clear divergence: OI is climbing aggressively while price remains relatively muted. This kind of divergence often precedes sharp volatility, either in the form of a liquidation flush or a breakout squeeze. Simply put, the market is heavily positioned, but the price isn’t validating the buildup.

This scenario can lead to two outcomes. If ETH breaks above key resistance, the heavy open interest could fuel a rapid short squeeze and continuation rally. On the flip side, if the price fails to reclaim $2,800 soon and loses $2,500 support, a cascade of long liquidations could kick in, potentially wiping out recent bullish leverage.

Traders should prepare for an expansion move soon, as compression between rising OI and flat price is rarely sustainable. It’s a volatility trap waiting to spring. Timing it right will be critical for short-term positioning.

cryptopotato.com

cryptopotato.com