As decentralized finance (DeFi) matures, users are turning to alternative platforms, such as onchain options, to generate higher yields.

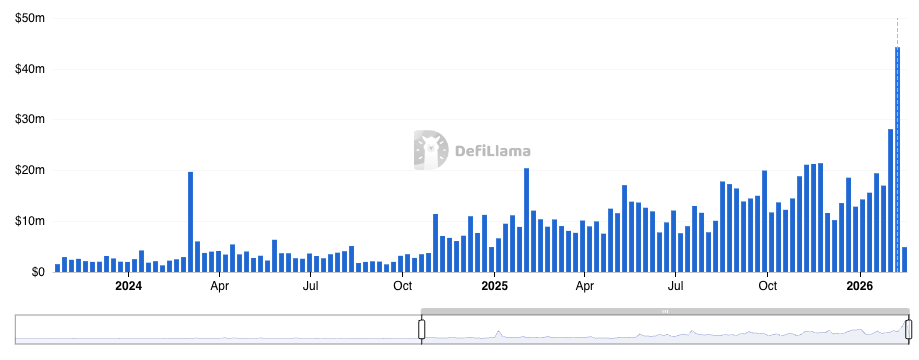

Onchain options activity reached all-time highs over the last two weeks, with $44 million of volume in the first week of February and $28 million during the last week of January.

More than 80% of the total onchain options volumes are concentrated in leading protocols, Ithaca and Derive. Over the last week, Ithaca processed $26 million in volume and Derive recorded $11 million, while the third-busiest protocol, Overtime, recorded just $2 million.

While the exact catalyst for the growth isn’t clear, it could be a combination of traditional lending platforms like Aave offering lower yields than in prior years, and also potentially some anticipation of Hyperliquid’s upcoming HIP-4 markets, which will allow users to trade binary outcomes that function similarly to options.

Just yesterday, a popular DeFi trader known as Route 2 Fi posted on X, “Where are people getting yield these days? 2% APR on USDT at Aave isn't exactly sexy.” The post gained significant traction online, indicating that many DeFi participants are also seeking new, lucrative yield sources.

cryptonews.net

cryptonews.net

en.cryptonomist.ch + 1 more

en.cryptonomist.ch + 1 more