Fireblocks, an institutional-grade crypto infrastructure company, announced on Wednesday that it will integrate Stacks, a decentralized finance (DeFi) layer for the Bitcoin protocol, to give institutional clients access to lending and yield-bearing opportunities.

The integration bypasses the 10-minute Bitcoin block time by leveraging the Stacks blockchain, which has an average block time of about 29 seconds, a Stacks spokesperson told Cointelegraph.

All Stacks transactions settle to the Bitcoin ledger for finality. Removing the 10-minute $BTC block time barrier resolves one of the most common objections for financial institutions looking to use $BTC-based DeFi applications, the Stacks spokesperson said.

The integration will go live in “early” 2026, according to Fireblocks, but no exact timeline for the rollout was announced.

The Fireblocks and Stacks integration reflects continued institutional interest in Bitcoin DeFi even amid a market downturn that has caused the price of Bitcoin ($BTC) to drop by about 40% from its all-time high above $125,000 reached in October 2025.

Related: Mercado Bitcoin expands LatAm RWA push with $20M in Rootstock private credit

Bitcoin DeFi: the future of onchain finance?

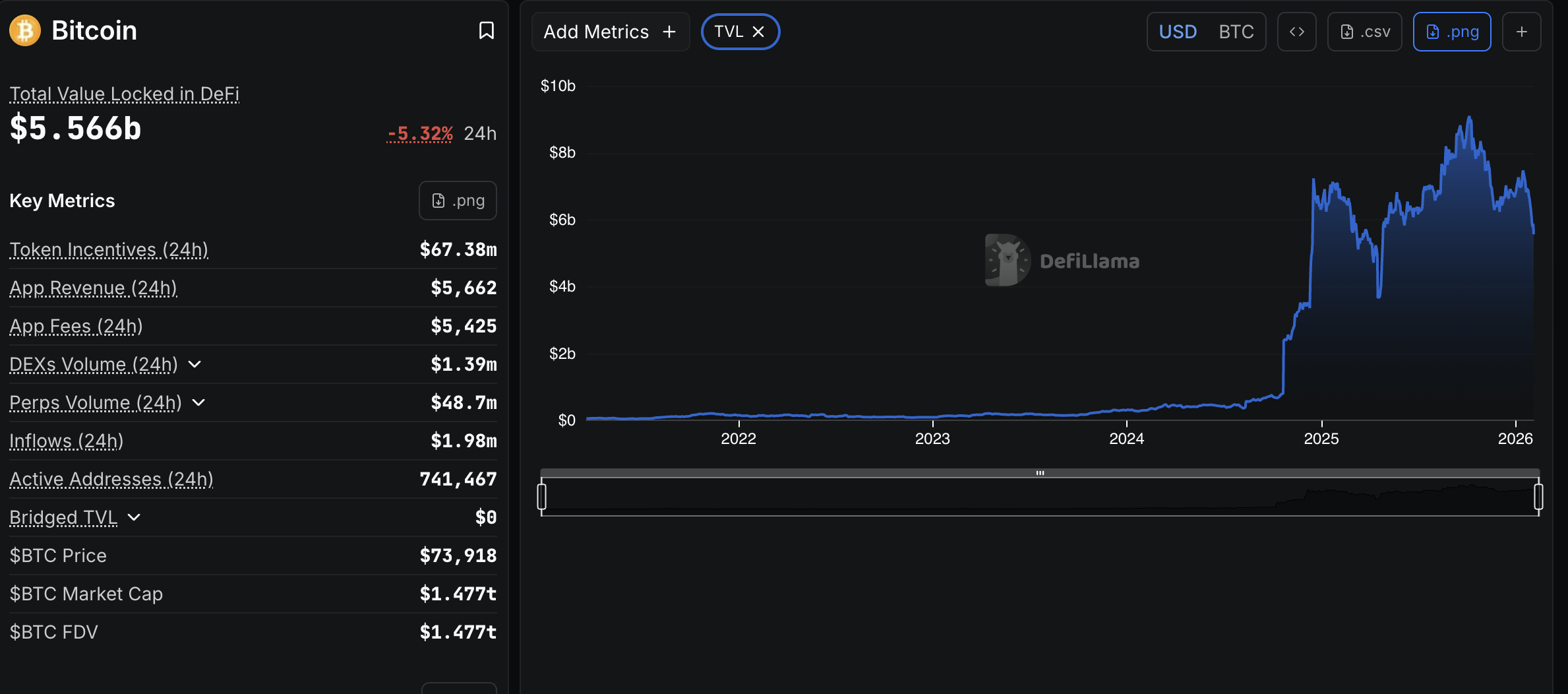

There was about $5.5 billion in total value locked (TVL) in Bitcoin-based DeFi applications at time of writing, according to DeFiLlama.

The TVL in Bitcoin DeFi applications began rising in October 2024, surging from about $704 million to over $9 billion by October 2025, before dropping back to current levels, according to DeFiLlama.

For comparison, the total value locked across the crypto ecosystem was about $103 billion at time of publication.

Proponents of Bitcoin DeFi say that applications built atop the Bitcoin protocol will eventually replace the traditional financial system, with decentralized systems that democratize access to finance.

Matt Hougan, the chief investment officer for investment company BitWise, forecast that Bitcoin DeFi could grow to become a $200 billion market.

However, the growth of second layers on Bitcoin and decentralized finance applications built on top of the protocol could threaten the base layer's decentralization, according to Markus Bopp, the CEO of crypto infrastructure company Trac Systems.

Magazine: Bitcoin’s long-term security budget problem: Impending crisis or FUD?

bsc.news

bsc.news

thecryptobasic.com

thecryptobasic.com